Crypto costs stay pretty secure on Sunday as Bitcoin and Ethereum commerce inside ranges close to break-even, a scenario welcomed by merchants after over $1 billion of liquidations rattled the market once more on Friday, and a historic $19 billion liquidation triggered upheaval the Friday earlier than.

At press time, Bitcoin is buying and selling at $106,400, whereas Ethereum is at $3,800. Bitcoin’s worth has fallen by 8.8% over the previous month, and Ethereum’s by 14%. Nonetheless, with the market showing to stabilize, is a bullish reversal on the horizon, or will there be extra ache first?

Bitcoin worth predictions counsel that bulls might quickly take cost, with liquidity zones and on-chain exercise signalling that promoting is slowing, and brief merchants are vulnerable to being worn out.

Ethereum’s outlook can also be shiny, with SEC chair Paul Atkis lately acknowledging its ERC-3643 commonplace, a framework that encodes regulatory compliance straight into tokens. In the meantime, a brand new Bitcoin Layer 2, Bitcoin Hyper, has simply exceeded $24 million in funding in its presale, signaling that one other main participant may very well be rising.

Bitcoin Worth Prediction: $113K Inbound on Sturdy Accumulation, Overheated Shorts

Bitcoin fell to $104,000 on Friday, which was a four-month low for the market-leading asset. Nonetheless, buyers rapidly swooped in and took benefit of the low cost.

Glassnode posted on X that small Bitcoin holders (between 1 and 1000 BTC) “stepped up” to purchase BTC on the dip, whereas giant holders slowed their promoting. In line with the information analytics agency, this means “renewed confidence regardless of the latest shakeout.”

Smaller $BTC holders are stepping up.

Sturdy accumulation is underway amongst small to mid-sized cohorts (1–1000 BTC), whereas giant holders have slowed distribution, signaling renewed confidence regardless of the latest shakeout. pic.twitter.com/LYFeGjrc3k— glassnode (@glassnode) October 16, 2025

Including to this outlook, knowledge from the Glassnode platform exhibits a robust liquidation cluster of brief positions above $113,000, with over $400 million set to be worn out at $113,718 – $113,842 – and that’s simply on the Binance alternate alone.

Usually, the worth strikes into zones with probably the most liquidity, indicating that $113,000 may very well be the subsequent goal for BTC. Nonetheless, some analysts consider the BTC uptrend will increase effectively past $113,000, with Friedrich noting that it’s at present rebounding on a key long-term assist stage and that this might propel it to $135,000 within the weeks forward.

SEC Chair Backs Ethereum’s ERC-3643 for Compliant Tokens

In a latest speech, Securities and Alternate Fee Chair Paul Atkins mentioned how compliance necessities may very well be encoded into sensible contracts, utilizing ERC-3643 for instance. This marks a delicate but vital trace about how regulators view blockchain requirements as a method to make sure on-chain compliance in a usually permissionless surroundings.

“These circumstances could embrace, for instance, a dedication to make periodic experiences to the Fee, incorporate whitelisting or “verified pool” performance, and limit tokenized securities that don’t adhere to a token commonplace that includes compliance options, reminiscent of ERC3643,” he stated.

With Ethereum’s ERC-3643 token commonplace, compliance turns into programmable – token issuers can embed regulatory-adherent code on-chain, permitting solely verified and licensed wallets to carry or switch the asset. This could guarantee alignment with KYC, AML, and securities legal guidelines with out counting on intermediaries. If circumstances aren’t met, the transaction doesn’t proceed.

Coinlaw knowledge estimates that the worth of tokenized real-world property will attain $5.5 trillion by 2029, representing a 43% compound annual development charge (CAGR) from the time the forecast was made. Ethereum’s ERC-3643 commonplace and its assist from regulators might make it a serious beneficiary of this development.

Historically, Bitcoin has been excluded from such discussions as a consequence of its lack of programmability. Nonetheless, initiatives like Bitcoin Hyper goal to alter that with sensible contract-enabled Layer 2 networks.

Bitcoin Hyper Funding Hits $24M as Bitcoin L2 Growth Advances

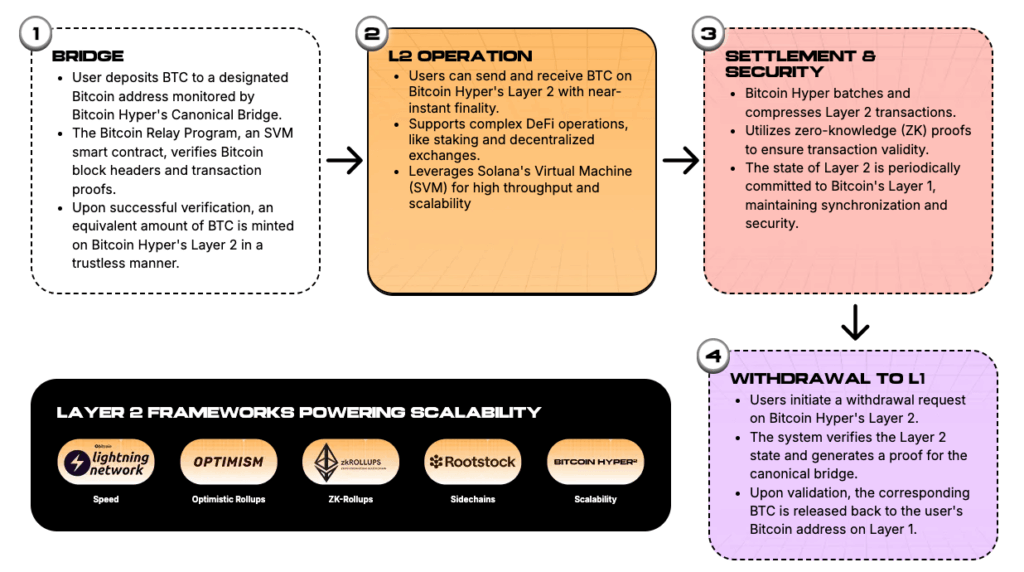

Bitcoin Hyper is creating the world’s first ZK-rollup-based Bitcoin Layer 2, advancing past earlier Bitcoin scaling options that used sidechains or federated bridges – and so don’t totally inherit Bitcoin’s base-layer safety.

The venture runs on the Solana Digital Machine (SVM) for execution, enabling sensible contract assist and the power to deal with 1000’s of transactions per second. It can periodically ship its state again to the Bitcoin Layer 1, the place transactions are saved, making Bitcoin Hyper as immutable and impartial as Bitcoin itself.

There’s additionally a trustless canonical bridge that enables BTC transfers to and from the Bitcoin Hyper Layer 2, offering seamless entry for Bitcoin holders.

At the moment in a presale to fund improvement, Bitcoin Hyper lately exceeded $24 million raised, marking an necessary milestone that exhibits sturdy group assist and big potential for demand as soon as it lists on the open market.

This has attracted consideration from high crypto analysts, with RJ from Cryptonews describing HYPER as “the subsequent 100x venture when the market recovers.”

With Bitcoin anticipated to rebound and Ethereum strengthening its place within the RWA area, crypto prospects look shiny, so Bitcoin Hyper may very well be launching at simply the correct time.

The present HYPER presale worth is $0.013135, however this gained’t final lengthy as worth will increase are scheduled to happen all through the marketing campaign, and the subsequent is in underneath at some point.