- Ripple plans to boost $1B to purchase XRP regardless of having escrow reserves.

- The pre-allocation concept suggests some escrowed XRP is already dedicated to companions.

- Ripple’s determination could goal to guard liquidity and value stability amid rising hypothesis.

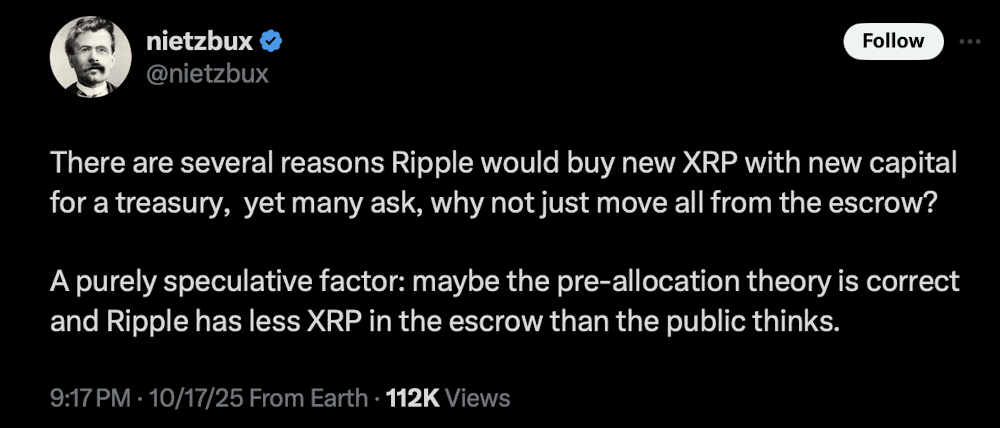

A latest submit by well-known XRP group member Nietzbux (@nietzbux) has stirred dialog after questioning why Ripple would select to purchase new XRP with contemporary capital as a substitute of tapping into its large escrow reserves. The query sounds easy—however the reasoning behind it won’t be.

Ripple’s plan to boost $1 billion for XRP purchases caught many abruptly. In response to Nietzbux, there could possibly be “a number of causes Ripple would purchase new XRP for its treasury,” but the group can’t assist however marvel—why not simply use the tokens already sitting in escrow?

The Pre-Allocation Concept

Right here’s the place it will get fascinating. Nietzbux floated a speculative thought, one which touches on a long-standing rumor inside XRP circles: “Possibly the pre-allocation concept is right, and Ripple has much less XRP in escrow than the general public thinks.”

The speculation means that among the XRP held in escrow could already be spoken for—maybe tied up in personal offers or commitments with establishments. That may imply Ripple’s “accessible” stability is smaller than it seems, despite the fact that the blockchain exhibits billions of tokens locked up.

If true, this might partly clarify why Ripple continues shopping for XRP from the open market somewhat than dipping into escrow. It won’t be about optics or advertising and marketing—it could possibly be necessity. A smaller liquid provide may even have bullish implications for XRP’s long-term value, since tighter circulation tends to extend shortage.

Transparency, Possession, and Interpretation

Naturally, the idea drew skepticism. Some group members identified that Ripple’s escrow holdings are public data, absolutely seen on-chain. Nietzbux agreed however made a delicate distinction: whereas the escrow stability itself is public, the possession or contractual commitments tied to these tokens aren’t.

Ripple can’t simply dump escrowed XRP at any time when it desires. These tokens are launched regularly and observe set situations. However as Nietzbux highlighted, it’s potential that sure quantities are already pre-allocated—primarily promised to companions or establishments earlier than being absolutely launched.

One other consumer jumped in asking if “pre-allocation” referred to XRP being reserved for Ripple’s banking and monetary companions. Nietzbux confirmed this interpretation, explaining that in such a case, the tokens could already be bought or assigned, solely ready for scheduled launch from escrow.

Ripple’s Lengthy Recreation

If this concept holds any weight, Ripple’s determination to buy XRP immediately from the market could possibly be a part of a broader technique. It’d assist preserve liquidity, handle value volatility, and sign continued dedication to XRP’s ecosystem well being.

For buyers, this concept reframes Ripple’s monetary habits—it’s not only a buyback; it’s a calculated transfer to protect market stability and long-term confidence.

Whereas none of that is confirmed, the dialogue reveals a captivating layer beneath the floor. Whether or not pre-allocation is actual or not, it highlights how Ripple’s complicated treasury administration continues to gasoline debate about who actually controls XRP’s future—and the way a lot of it’s actually in play.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.