Briefly

- Meeting Invoice 9138, launched Friday within the New York State Meeting, would tax proof-of-work miners based mostly on electrical energy consumption, with charges starting from 2 to five cents per kilowatt-hour.

- The companion invoice to Senate Invoice 8518 would funnel collected taxes into New York’s Power Affordability Packages for low- to moderate-income households.

- Mining operations utilizing renewable vitality and working off-grid could be exempt from the tax, which takes impact January 1, 2027.

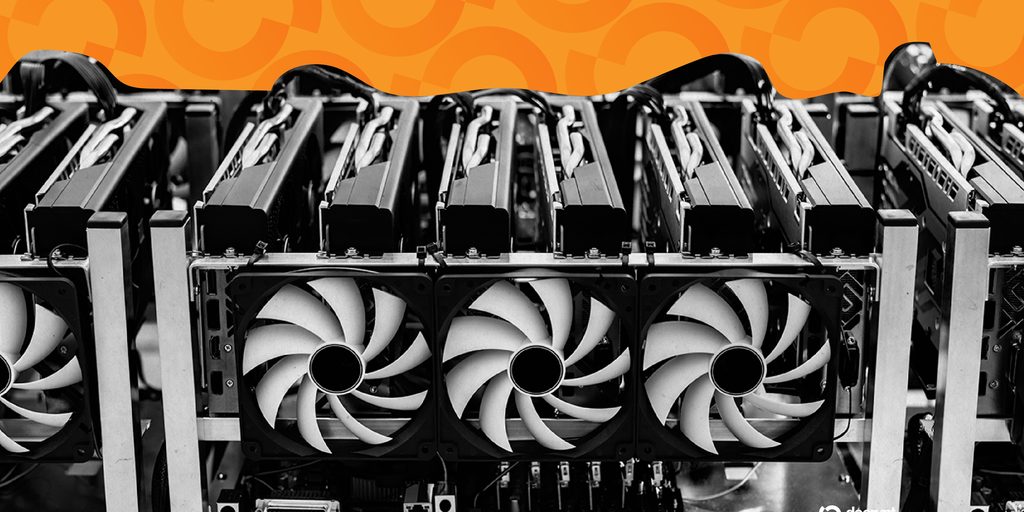

New York lawmakers launched a legislative strike towards crypto mining Friday, introducing companion laws to a Senate invoice that might drive proof-of-work miners to pay excessive taxes based mostly on their electrical energy consumption.

On Friday, Meeting Invoice A9138 was launched within the New York State Meeting by Democratic Meeting member Anna Kelles and referred to the Methods & Means Committee.

The invoice would impose an excise tax on electrical energy utilized by companies engaged in digital-asset mining beneath proof-of-work authentication strategies.

This measure is a companion to the S8518 Invoice, launched earlier this month by State Senator Liz Krueger, Chair of the Senate Finance Committee, within the New York State Senate.

Each payments pursue equivalent objectives as they require crypto mining firms to pay into New York’s Power Affordability Packages based mostly on their electrical energy consumption.

Operations consuming as much as 2.25 million kilowatt-hours yearly would pay nothing, in response to the invoice.

The speed jumps to 2 cents per kWh for consumption over 2.25 million to five million kWh per 12 months, 3 cents per kWh for over 5 million to 10 million kWh, 4 cents per kWh for over 10 million to twenty million kWh, and maxes out at 5 cents per kWh for consumption exceeding 20 million kWh yearly.

“The invoice ensures that the businesses driving up New Yorkers’ electrical energy charges pay their fair proportion, whereas offering direct reduction to households fighting rising utility prices,” Senator Krueger mentioned in a press release when S8518 was launched.

Mining amenities powered totally by renewable vitality methods and working off-grid would dodge the tax, a provision designed to encourage sustainable practices inside the digital asset sector, as per A9138.

All collected taxes, curiosity, and penalties would move on to vitality affordability packages administered by the Division of Public Service in session with the Power Affordability Coverage Working Group.

Making mining “unviable”

If handed, the tax would take impact January 1, 2027, making use of to all taxable years thereafter. Each the Senate and Meeting variations stay in committee.

The transfer resembles these made by Northern European nations like Norway or Sweden, Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, instructed Decrypt. Whereas these weren’t express bans, he mentioned, “the elimination of earlier benefits basically made mining unviable.”

“We could also be seeing the identical factor enjoying out right here, and the end result would be the similar,” Puckrin added. “The irony is that strikes like these do not are inclined to result in cleaner practices; they simply push mining operations out of state.”

Requested whether or not mining operations would merely relocate to extra crypto-friendly states, Puckrin mentioned it might be “the plain reply,” as shifting will likely be simpler and cheaper than “attempting to adjust to punitive laws, and there are nonetheless loads of a lot friendlier choices inside the U.S.”

Each day Debrief E-newsletter

Begin day-after-day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.