- Solana (SOL) eyes a breakout above $204 as hidden bullish indicators type regardless of volatility.

- Chainlink (LINK) exhibits quiet accumulation by whales, with restoration targets between $21 and $27.

- Stellar (XLM) dangers bearish crossovers however might shock with a brief squeeze if market sentiment flips.

As U.S. markets put together for a giant week — with CPI information on the best way, a possible Fed charge lower looming, and Jerome Powell’s feedback anticipated to sway world sentiment — crypto merchants are on edge, watching how digital belongings will react to altering coverage winds. Amongst them, a number of “Made in USA” cash like Solana (SOL), Chainlink (LINK), and Stellar (XLM) are exhibiting blended however intriguing setups that would outline how the following few weeks play out.

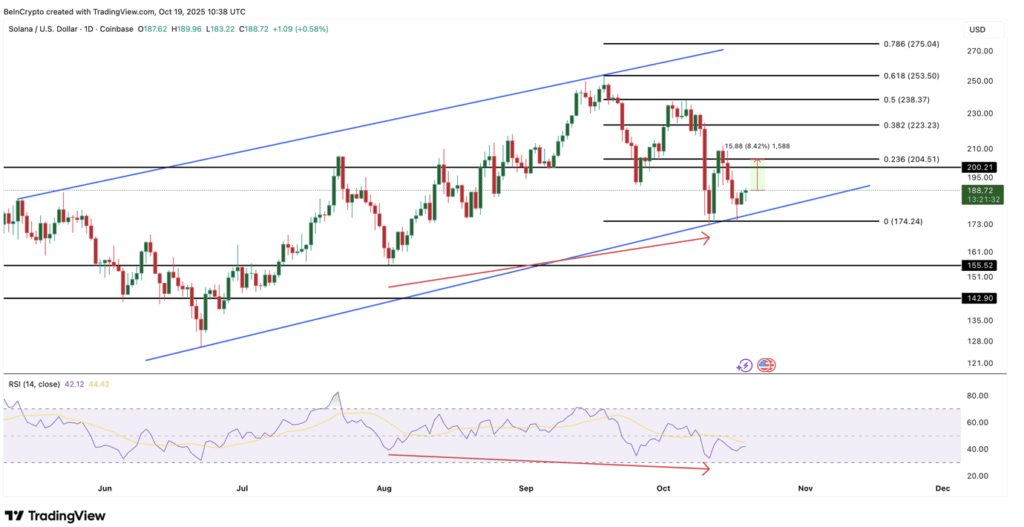

Solana (SOL) Hints at Restoration Amid Volatility

Solana has managed to remain one of many stronger performers regardless of a rocky month. After dropping about 23% since early October’s “Black Friday” crash, the token is slowly regaining floor, up greater than 2% this week.

Technically, SOL remains to be buying and selling inside an ascending channel sample that’s been intact since Could — a bullish setup that sometimes helps continuation developments. Proper now, the important thing degree to beat sits at $204. If Solana breaks by way of cleanly, it might open a transfer towards $223–$238, and a decisive shut above $253 would possibly even set the stage for brand spanking new highs within the brief to mid-term.

The RSI helps this case — between August 7 and October 11, value made larger lows whereas RSI made decrease ones, forming a hidden bullish divergence. That’s often a sign that the general uptrend stays alive, even when value appears to be like shaky brief time period.

Nonetheless, merchants are cautious. A every day shut beneath $174 might flip the sample bearish and push the token down towards $155–$142, quickly breaking construction for one of many strongest altcoins this quarter.

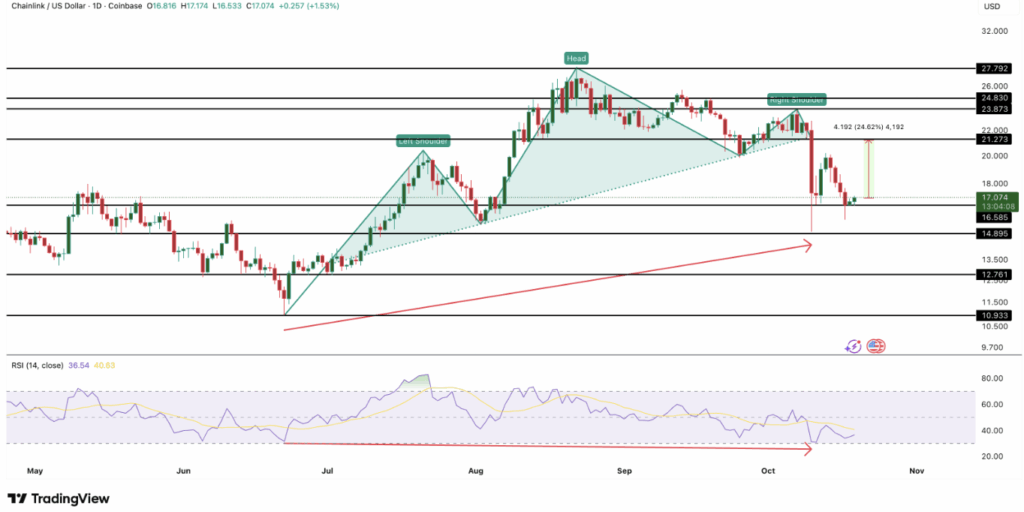

Chainlink (LINK) Holds Its Floor After Correction

Chainlink has additionally taken a success just lately, down about 30% during the last month, however indicators of restoration are rising. Previously 24 hours, LINK closed within the inexperienced, signaling that consumers is perhaps stepping again in.

Knowledge from Whaler Discuss exhibits that roughly 270,000 LINK tokens (value round $4.6 million) have been pulled out of Binance wallets just lately — a touch that whales are accumulating once more.

From a technical perspective, LINK broke beneath a head-and-shoulders sample earlier this month, with the neckline at $21, resulting in a pointy correction towards $14. Since then, it’s discovered assist at $16, which now acts as the bottom for a possible rebound.

Between June and early October, LINK’s value made larger lows whereas RSI fell — one other hidden bullish divergencesuggesting the larger uptrend remains to be alive. If LINK manages to shut above $21, a transfer to $24–$27 might observe. But when it slips again beneath $16, bears might drag it again towards $14 and even $12 earlier than stability returns.

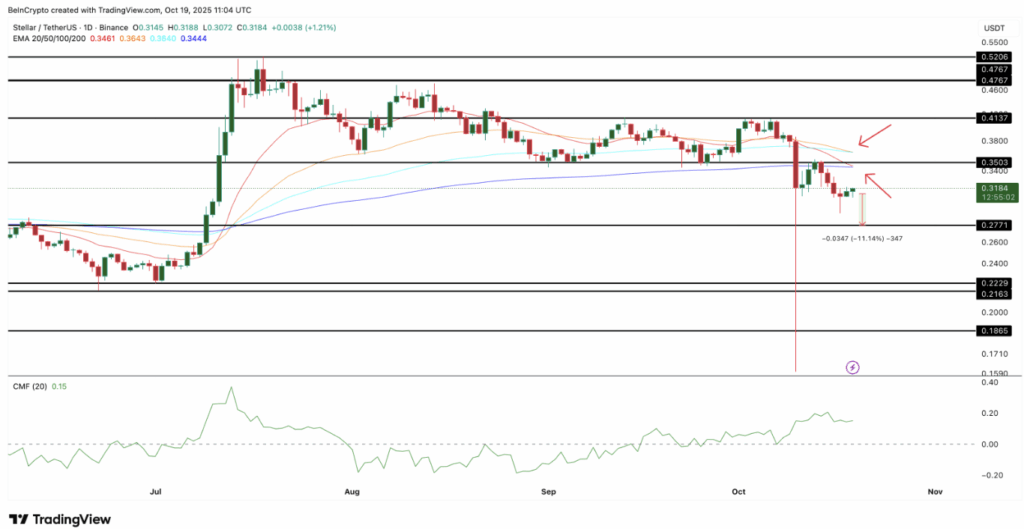

Stellar (XLM) Balances Between Confidence and Collapse

Stellar is proving to be one of many trickier belongings to learn. The token is buying and selling round $0.31, supported by regular whale inflows. The Chaikin Cash Circulate (CMF) has stayed above zero since October 7, exhibiting that enormous traders are nonetheless shopping for dips.

Nonetheless, technical indicators are turning tense. The 20-day EMA is about to cross beneath the 200-day EMA, and the 50-day EMA is closing in on a cross beneath the 100-day EMA — each often called demise crosses, which regularly level to rising bearish momentum. If these crossovers affirm, XLM might drop towards $0.27, with deeper helps close to $0.22–$0.18.

Nonetheless, there’s a twist. Derivatives information from Bybit exhibits about $4.7 million in brief leverage on XLM, in comparison with $2.6 million in longs. If costs dip barely, these lengthy positions would possibly get liquidated — but when the alternative occurs and shorts begin closing, a pointy brief squeeze might ship XLM larger quick.

For now, Stellar stays the wildcard of the “Made in USA” group — strolling a superb line between misplaced optimism and a sudden rebound pushed by panic liquidations.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.