Be part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s (BLOK) Bitcoin ETP (exchange-traded product) has began buying and selling on the London Inventory Change at the moment after the UK’s Monetary Conduct Authority (FCA) lifted its ban on sure Bitcoin-based ETPs.

That’s the first such product supplied by the asset administration large within the UK. In its first hour of buying and selling, the IB1T ETP noticed buying and selling volumes of 1,000 shares on the London Inventory Change.

London Inventory Change Launch Builds On European Presence

The iShares Bitcoin ETP began buying and selling on the London Inventory Change underneath the ticker “IB1T,” and permits buyers within the UK to realize publicity to Bitcoin via a regulated market while not having to carry the crypto immediately.

BlackRock’s product was already accessible to some European buyers. That is after it listed on Xetra, Euronext Amsterdam and Euronext Paris in direction of the tip of March this yr, in line with BlackRock’s web site.

The London Inventory Change itemizing comes after the FCA opened up entry to crypto ETPs for retail buyers. This rule change had come into impact on Oct. 8.

Previous to that rule change, the FCA had barred retail entry to crypto ETPs in 2021 as a consequence of issues round investor protections.

One of many necessities for retail buyers within the UK to purchase into crypto ETPs is that the merchandise should be listed on acknowledged, FCA-approved UK-based exchanges. Merchandise may even need to comply with monetary promotion guidelines to stop deceptive promoting and inappropriate incentives.

BlackRock Seems To Cement Its Dominance In The Bitcoin ETF Market

BlackRock manages over $13 trillion in belongings globally, and has seen sturdy progress in its crypto-focused merchandise.

Its flagship US spot Bitcoin ETF, IBIT, was launched in January final yr and has recorded probably the most cumulative inflows of the entire US merchandise since their inception.

Knowledge from Farside Buyers reveals that IBIT has seen $64.981 billion in cumulative inflows to date. That is considerably greater than the second-biggest cumulative inflows of $12.554 billion that Constancy’s FBTC has seen because it launched.

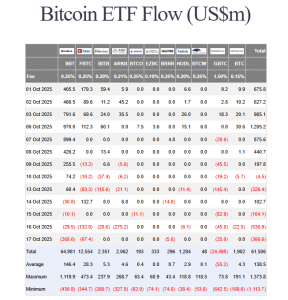

US spot BTC flows (Supply: Farside Buyers)

IBIT has, nonetheless, been in a multi-day outflows streak, which it prolonged within the newest buying and selling session.

The product noticed $268.6 million depart its reserves on Oct. 17, which was the best damaging flows seen on the day. Different funds, like Constancy’s FBTC, Valkyrie’s BRRR, and Grayscale’s GBTC noticed $67.4 million, $5.6 million, and $25 million outflows, respectively, on the identical day.

IBIT’s newest outflows got here after the product noticed $29.5 million outflows the day earlier than. On Oct. 15 and Oct. 14, the funding product noticed respective outflows of $10.1 million and $30.8 million as nicely.

Regardless of the current outflows, IBIT has been one of many high performers in each the US spot Bitcoin ETF market and amongst BlackRock’s different ETFs.

Simply 374 days after launch, IBIT crossed $80 billion in belongings underneath administration, changing into the quickest ETF in historical past to attain this milestone.

Its AUM then continued to develop at first of October, and got here inside attain of $100 billion, in line with Bloomberg ETF analyst Eric Balchunas. Nevertheless, its AUM has since dropped to round $85.78 billion after a broader crypto market pullback, the fund’s web page reveals.

$IBIT a hair away from $100 billion, is now probably the most worthwhile ETF for BlackRock by a very good quantity now primarily based on present aum. Take a look at the ages of the remainder of the High 10. Absurd. pic.twitter.com/E8ZMI2wynx

— Eric Balchunas (@EricBalchunas) October 6, 2025

IBIT has additionally outperformed BlackRock’s well-liked S&P 500 fund when it comes to annual charges to change into the asset supervisor’s most worthwhile ETF.

BlackRock’s CEO Has A Change In Stance In the direction of Crypto

A lot of BlackRock’s enlargement into the digital asset house has to do with its CEO, Larry Fink’s, change in stance.

In 2018, Fink described Bitcoin as a “speculative” asset and questioned why it “has a lot fascination for the press.”

In 2021, he then mentioned that BlackRock was finding out cryptos like Bitcoin, however nonetheless argued that it was too early again then to say whether or not cryptos have been greater than speculative buying and selling instruments.

In October this yr, nonetheless, Fink mentioned that Bitcoin has an analogous function to gold as a portfolio diversifier, and admitted that he was mistaken about his earlier anti-Bitcoin feedback.

CEO of world’s largest asset supervisor…

“We’re simply in the beginning of the tokenization of all belongings.”

Sure, contains ETFs.

Larry Fink on his positively evolving angle in direction of crypto: “I develop & study.”

Good lesson right here.

And a few of you *nonetheless* suppose crypto is a rip-off. pic.twitter.com/GJ8oxWF3vK

— Nate Geraci (@NateGeraci) October 15, 2025

Whereas his stance might have shifted, Fink did nonetheless warning towards buyers making Bitcoin a big element of their portfolios.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection