Bitcoin is displaying indicators of restoration after a number of days marked by promoting strain, volatility, and concern throughout the crypto market. Following the sharp flash crash on October 10, when BTC briefly plunged to round $103,000, the worth has since rebounded and is now testing provide close to the $111,000 stage. This transfer has introduced a short lived sense of aid to merchants, however on-chain knowledge means that the market continues to be below stress.

In line with CryptoQuant, Quick-Time period Holders (STHs) — buyers who sometimes maintain Bitcoin for lower than 155 days — at the moment are promoting under their price foundation, a transparent signal of capitulation. Traditionally, such capitulation occasions have typically marked late levels of a correction, as weak fingers exit the market whereas stronger gamers accumulate.

Whereas this might sign that Bitcoin is nearing a neighborhood backside, uncertainty stays excessive. The approaching days will decide whether or not this rebound has the power to maintain — or if the market will face renewed draw back strain as world threat sentiment stays fragile.

Quick-Time period Holders Sign Capitulation

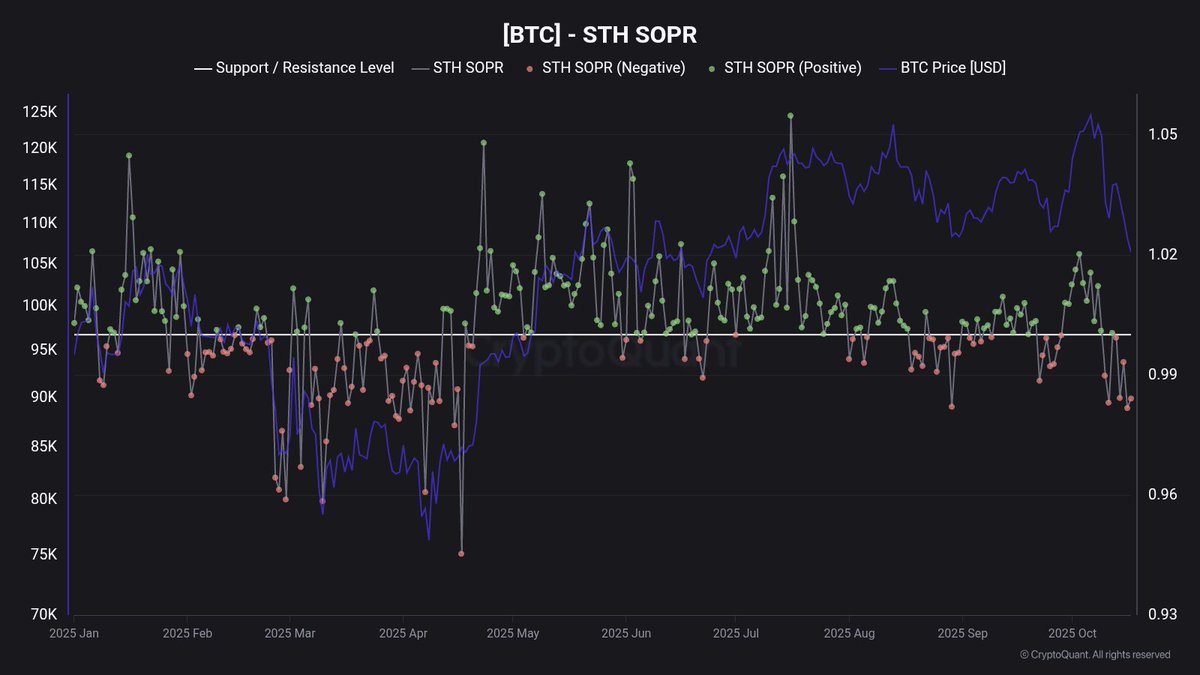

In line with CryptoQuant analyst Maartunn, the Quick-Time period Holder (STH) Spent Output Revenue Ratio (SOPR) has dropped to 0.98, marking its lowest stage since April 2025. This studying helps the development that STHs at the moment are promoting at a loss, an indication of capitulation inside probably the most reactive section of the market.

Traditionally, such declines in STH SOPR have aligned with late-stage corrections or market bottoms, as weaker fingers are flushed out and cash switch to stronger holders. Throughout comparable phases in 2023, 2024, and early 2025, this metric has acted as a contrarian sign, typically previous main rebounds. Nonetheless, Maartunn cautions that whereas capitulation is unfolding, affirmation of a restoration nonetheless is determined by whether or not Bitcoin can maintain above its realized worth ranges and key transferring averages.

The market now finds itself at a important juncture. Bitcoin has rebounded from the $103,000 flash crash low to hover round $111,000, however momentum stays fragile. A sustained shut above the $111,500–$113,000 zone might reinforce short-term bullish construction, whereas failure to carry present help could open the door to deeper corrections towards $100,000 or under.

If the SOPR stabilizes and begins to rise once more, it might affirm a shift from capitulation to re-accumulation — the early stage of a brand new upward development. But when promoting strain persists and sentiment weakens additional, the market dangers getting into a chronic consolidation part earlier than the following bullish leg begins. For now, Bitcoin stays on edge, caught between restoration hopes and macro-driven uncertainty.

Bitcoin Makes an attempt Quick-Time period Restoration, However Resistance Looms Forward

Bitcoin is displaying early indicators of a short-term rebound, recovering from the October 10 crash that despatched costs under $104,000. On the 4-hour chart, BTC is presently buying and selling close to $111,200, trying to reclaim short-term transferring averages (50 and 100 SMA) after a number of days of bearish momentum. This bounce displays a shift in intraday sentiment, however the market stays cautious.

The subsequent key resistance lies round $113,000–$114,000, the place the 200 SMA aligns with earlier help turned resistance. A breakout above this zone might open the door to a check of $117,500, a serious liquidity space that capped rallies earlier this month. Nonetheless, if Bitcoin fails to clear this stage, it dangers falling again towards $107,000–$106,000, the place robust demand beforehand emerged.

Momentum indicators are bettering however not but convincing. Quantity stays subdued, and funding charges proceed to hover in unfavourable territory — suggesting merchants nonetheless lean bearish. This setup typically precedes bigger quick squeezes, however affirmation continues to be missing.

Bitcoin’s short-term construction favors cautious optimism. Holding above $110,000 would help the restoration narrative, whereas rejection at greater ranges might shortly set off one other retest of the latest lows. The subsequent few periods shall be decisive for confirming development path.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.