- Gold’s 5–6% drop reopens threat urge for food, fueling Bitcoin’s rebound.

- Coinbase acquires Echo for $375M, pushing into token issuance.

- Coinbase buys Cobie’s $25M UpOnly NFT, hinting at a podcast comeback.

Crypto traded with a spring in its step over the past 24 hours. A violent reversal in gold eased the “flee-to-metals” commerce, spot-ETF flows steadied after a uneven begin to the week, and one headline stole the tradition cycle: Coinbase simply spent $25 million on Cobie’s UpOnly NFT—organising a probable return of the podcast that outlined the final bull. Listed here are the three greatest tales driving timelines right now.

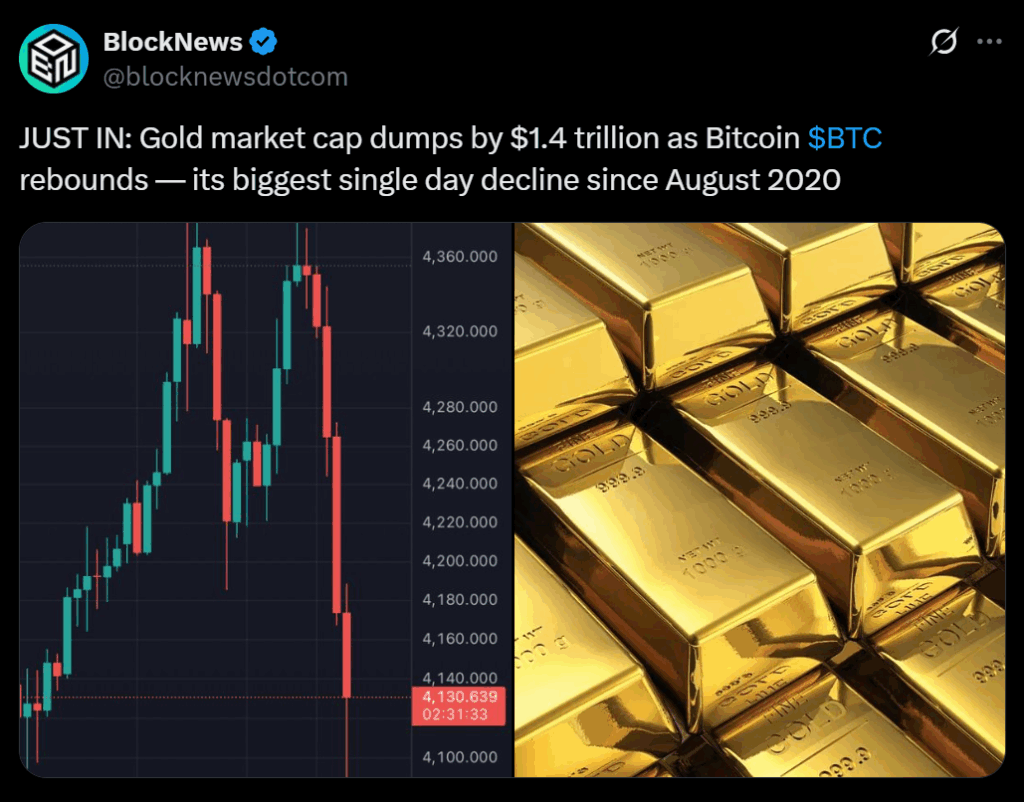

1) Gold’s greatest drop in years takes stress off crypto threat

After racing to recent data early within the week, gold snapped arduous—falling roughly 5%–6% intraday in its steepest single-day decline since 2020. The transfer unwound a two-month melt-up that had pushed bullion above $4,380/oz, earlier than sellers yanked it again towards the low $4,100s by U.S. afternoon commerce. Revenue-taking, a firmer greenback, and barely calmer U.S.–China headlines all confirmed up within the tape, flipping some cross-asset flows again towards threat.

Why it issues for crypto: the “metals over every thing” consensus that’s been draining consideration (and a few capital) from digital belongings simply blinked. When gold is screaming increased, crypto usually struggles to seize the hedge bid; when that commerce cools, the liquidity hunt rotates. Right now’s bullion washout coincided with firmer crypto breadth and sooner dip-buying throughout giant caps—precisely what you’d count on when the safe-haven magnet weakens.

2) Coinbase’s $375M Echo Purchase Indicators a Main-Markets Push

Coinbase agreed to amass Echo—an on-chain capital-formation platform—for about $375 million in money and inventory. Echo (based by Jordan “Cobie” Fish) runs non-public and public token raises and not too long ago shipped Sonar for open gross sales; it’s facilitated $200M+ in mission funding since launch. For Coinbase, it’s acquisition #8 in 2025, extending a technique to personal extra of the lifecycle—from fundraising to itemizing to derivatives—simply months after its Deribit deal. Reuters+2Wall Road Journal+2

Merchants learn the transfer as each product and distribution: fold Echo’s rails into Coinbase’s person base, then route liquidity throughout spot, perps, and Base-native apps. Even with shares little modified intraday, the message is evident—major issuance is coming on-chain at scale, and Coinbase desires to be the entrance door for retail and establishments alike. Anticipate tighter integration of token launches and potential RWA issuance as soon as the deal closes.

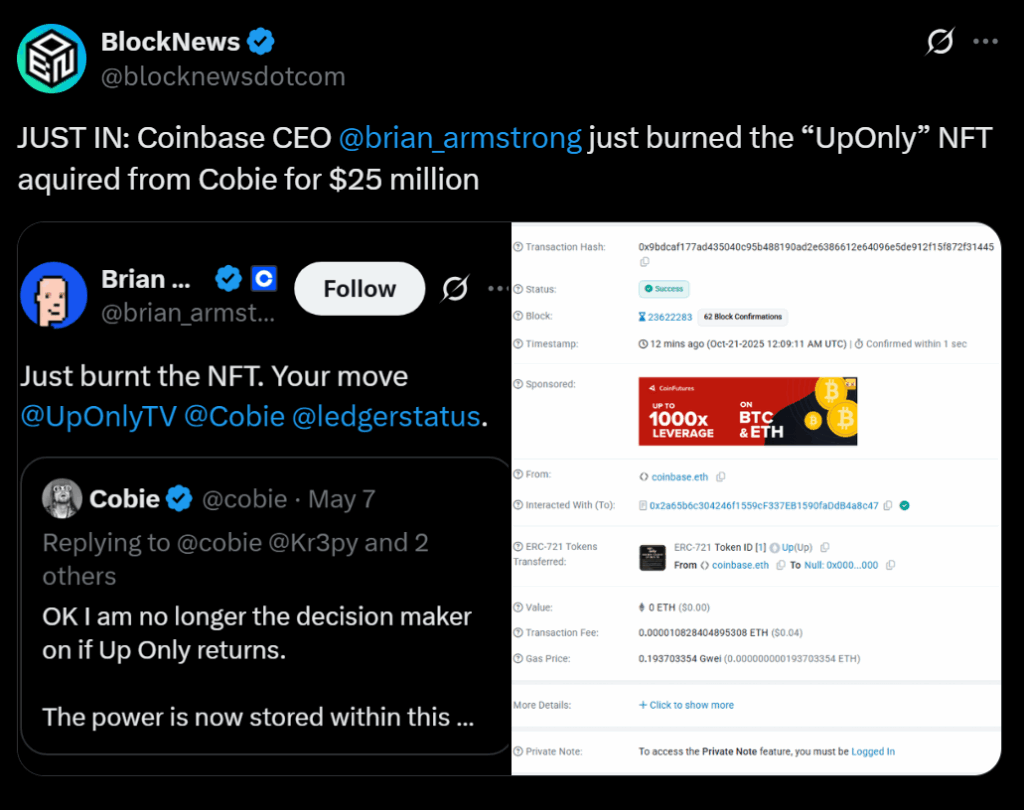

3) Coinbase buys Cobie’s UpOnly NFT for $25M USDC—podcast revival inbound

Tradition bomb: Coinbase bought the UpOnly NFT from Cobie (Jordan Fish) for $25,000,000 in USDC—a token whose metadata features a burn clause compelling manufacturing of a brand new UpOnlyTV season. On-chain trackers flagged the 25M USDC switch from a Coinbase-linked pockets, and Brian Armstrong amplified the information, signaling the present’s comeback after a multi-year pause. The deal immediately dominated crypto Twitter and pushed “UpOnly” to the highest of social mentions.

Why it issues: past nostalgia, it’s an announcement about programmable media rights. An NFT used as a binding content material lever—funded by a high U.S. alternate—blurs business IP, group governance, and on-chain enforcement. Anticipate a recent season timeline (the burn situation factors to a ~3-month window post-trigger), model tie-ins, and a halo impact for creator-centric NFTs. It’s additionally a shot of oxygen for crypto’s tradition loop proper as costs attempt to re-gather momentum.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.