Be part of Our Telegram channel to remain updated on breaking information protection

Coinbase has purchased the UpOnly NFT for $25 million, giving it the facility to make crypto dealer Cobie “carry out like a monkey” in a shock revival of the eponymous podcast.

Coinbase CEO Brian Armstrong confirmed the acquisition in a submit on X, saying it would mark the podcast’s long-awaited return. In response to the NFT’s fantastic print, the token’s holder “can compel Cobie and Ledger Standing into performing, like monkeys, 8 episodes of UpOnlyTV.”

The rumors are true, we purchased the NFT. @UpOnlyTV is coming again. pic.twitter.com/kbGNzjLoJQ

— Brian Armstrong (@brian_armstrong) October 20, 2025

Cobie reacted with disbelief, telling Armstrong in a submit on X that whoever accepted the choice must be ”fired.”

”I’m too outdated to have a crypto podcast,” he stated in one other submit that’s acquired greater than 258k view. ”It has been 3 years since up solely ended. I used to be in my 20s when it began, now I’ve gray hair. We’ll rename it Unc Solely and I’ll spend $25m on beauty surgical procedure. See ya quickly.”

The transfer fulfills a problem Cobie set earlier this 12 months, when he minted the NFT and declared the present would solely return if the token’s proprietor burned it. Coinbase’s determination to purchase it indicators the change’s curiosity in reviving one in all crypto’s most recognizable media manufacturers.

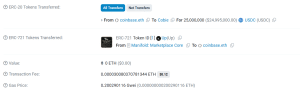

Transaction particulars for the acquisition (Supply: Etherscan)

Cobie’s Problem

The NFT originated from the podcast UpOnly, which was hosted by the dealer together with Ledger earlier than it’s demise after the crypto winter.

In Could, Cobie created a problem that if somebody burns the NFT, this system would return for one more season.

“OK I’m not the choice maker on if UpOnly returns,” the dealer wrote in an X submit on the time. “The ability is now saved inside this NFT that I simply minted. When the NFT is burned, the podcast will restart. Till then, please depart me alone.”

Coinbase Urges Treasury To Scrap Outdated AML Guidelines

Even because it embraces crypto tradition, Coinbase can be lobbying the US Treasury to overtake outdated anti-money-laundering necessities to replicate advances in blockchain and AI know-how.

Coinbase’s chief authorized officer (CLO) Paul Grewal argued in a letter dated Oct. 17 that cash laundering schemes have change into more and more subtle by the usage of superior applied sciences.

He added that the “sheer quantity and pace of economic transactions processed day by day” has compounded present challenges.

Grewal then went on to pitch an innovation-driven resolution that mixes new applied sciences, together with blockchain, to counter the rising dangers.

That was in response to the Treasury’s Division’s request for touch upon methods to deter illicit exercise in crypto.

“Good Guys Want Innovation To Maintain Tempo,” Says Coinbase’s CLO

Grewal posted the important thing factors of Coinbase’s letter on X yesterday.

“When dangerous guys innovate in monetary crime, good guys want innovation to maintain tempo,” he stated.

When dangerous guys innovate in monetary crime, good guys want innovation to maintain tempo. @coinbase filed a response to @USTreasury‘s Request for Touch upon “Modern Strategies to Detect Illicit Exercise Involving Digital Belongings” to underscore this actuality and 4 explicit reforms UST…

— paulgrewal.eth (@iampaulgrewal) October 20, 2025

Grewal listed 4 steps that the Treasury must take to fight illicit exercise in crypto.

The primary is to “set up a regulatory safe-harbor underneath the Financial institution Secrecy Act for corporations who responsibly deploy AI to enhance AML compliance applications.”

He argued that this safe-harbor ought to then concentrate on governance and outcomes as a substitute of “forcing a one-sized-fits-all-model.”

Grewal additionally stated that the Treasury Division ought to challenge steerage that “clearly acknowledges and defines regulatory expectations for API-driven AML compliance applied sciences.” This proposed steerage ought to define “acceptable use circumstances, knowledge privateness necessities, and requirements for interoperability,” Grewal stated.

The following step, in accordance with the Coinbase CLO, is to amend the Financial institution Secrecy Act’s buyer identification necessities “to incorporate decentralized identification and zero-knowledge proofs as a part of an accepted identification verification course of.“

Lastly, Grewal stated that the Treasury also needs to publish steerage that “acknowledges and incentivizes the usage of Know-You-Transaction screening” together with blockchain analytics clustering. This, he argued, can be a “simpler” approach for firms to keep up AML compliance.

This isn’t the primary time that Coinbase has pushed for higher crypto regulation and monitoring within the US. The change has additionally spent $2.13 million lobbying within the US so far.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection