On-chain knowledge exhibits that Bitcoin traders’ profit-taking has noticed an enormous decline since final month’s prime, an indication that could possibly be optimistic for BTC.

Bitcoin Realized Revenue To Exchanges Now Down To $277 Million Per Day

Based on knowledge from the on-chain analytics agency Glassnode, dealer profit-taking within the Bitcoin market has cooled off considerably over the last couple of weeks.

For the aim of monitoring profit-taking, the analytics agency has made use of the “Realized Revenue to Exchanges” indicator. This metric, as its title suggests, measures the whole quantity of revenue that the traders are harvesting or ‘realizing’ via transactions to centralized exchanges.

Revenue is alleged to be realized on the blockchain when a token with a earlier transaction worth lower than the present spot worth is moved. Not all transfers on the community correspond to a commerce, nevertheless, which is why Glassnode has particularly restricted the metric to trade influx transfers.

Holders usually switch their cash to those platforms once they wish to take part in selling-related actions, so the quantity of revenue realized by trade inflows is extra probably to offer an correct image of the profit-taking state of affairs within the sector.

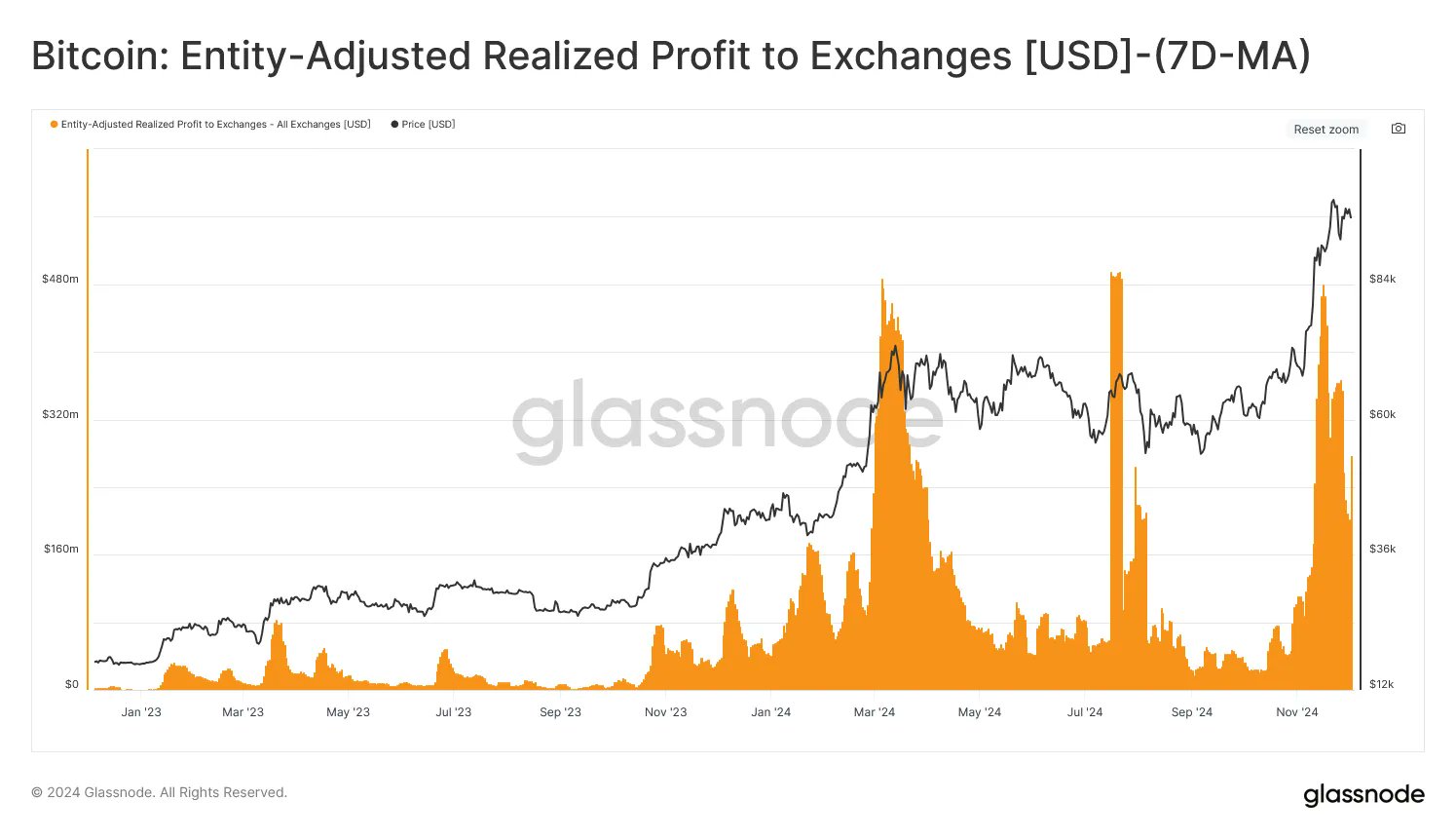

Now, right here is the chart for the indicator shared by the analytics agency that exhibits the pattern within the 7-day shifting common (MA) of the Bitcoin Realized Revenue to Exchanges during the last couple of years:

The 7-day MA worth of the metric seems to have seen a decline in current days | Supply: Glassnode on X

As displayed within the above graph, the 7-day MA Bitcoin Realized Revenue to Exchanges registered a pointy surge final month as BTC exploded to new highs. This means that the traders have been harvesting a considerable amount of earnings on the rally highs.

Be aware that the model of the indicator used right here is the “Entity-Adjusted” one, that means that it solely tracks transactions occurring between two entities. An ‘entity’ refers to a cluster of addresses that Glassnode has decided to belong to the identical investor.

Since BTC has achieved a peak above $99,000, its worth has been caught in a part of consolidation. From the chart, it’s obvious that this slowdown within the bull run has led to a notable drop in profit-taking out there.

“Each day realized earnings to exchanges have cooled off considerably, now at $277M/day,” notes the analytics agency. “This represents a 42% drop from the height of $481M/day on Nov 16.”

This 12 months, Bitcoin additionally noticed two different mass profit-taking occasions of comparable scale, with each of them resulting in tops within the cryptocurrency market. As such, the truth that revenue realization has calmed down for the asset lately regardless of the value persevering with to maintain at comparatively excessive ranges could possibly be a optimistic signal for this rally to go on.

BTC Value

Bitcoin is presently proper in the course of its current consolidation vary, as its worth is floating round $95,900.

Appears like the value of the coin has taken to a sideways trajectory lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com