Be a part of Our Telegram channel to remain updated on breaking information protection

Most institutional buyers are bullish on Bitcoin heading into 2026 amid a robust macro backdrop and digital asset regulatory progress within the US, in line with a report by Coinbase Institutional.

In a report titled, “Navigating Uncertainty,” Coinbase Institutional head of analysis David Duong stated that “most respondents are bullish on Bitcoin.”

Buyers Stay Bullish Regardless of Divide Over Present Market Stage

Coinbase Institutional carried out a current survey of institutional buyers with 124 respondents. 67% of the respondents stated that they’re nonetheless bullish on Bitcoin for the subsequent three to 6 months.

Nonetheless, the report famous that there was a “significant divergence” of opinion on the subject of what stage of the cycle the market is in. In keeping with the report, 45% of establishments consider the market is within the late phases of the bull run, whereas solely 27% of non-institutions share the identical view.

Digital Asset Treasury Corporations Have Had A Main Influence On The Market This Yr

Duong then stated that digital asset treasury (DAT) companies gave the crypto market a serious enhance this yr.

“Wanting on the provide/demand image, it’s arduous to overstate the affect that digital asset treasury corporations have had on markets this yr,” wrote Duong within the report.

The report follows the document $20 billion liquidations within the crypto market on Oct. 10, which analysts have labeled as a much-needed “de-leveraging.”

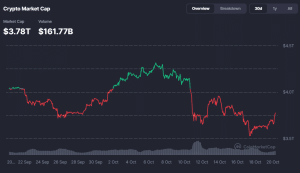

Throughout that flash crash, the crypto market cap dropped under $4 trillion, and has not managed to get well since, information from CoinMarketCap exhibits.

Crypto market cap (Supply: CoinMarketCap)

Market leaders Bitcoin and Ethereum have additionally struggled to get well their losses from the market-wide pullback. BTC continues to be greater than 3% within the crimson on the weekly time-frame, whereas ETH is over 1% down over the previous week.

Zooming out to the month-to-month time-frame exhibits that BTC has slid greater than 3% over the previous thirty days, whereas Ethereum is down greater than 8% over the identical interval.

Technique and BitMine, that are the biggest Bitcoin treasury and largest Ethereum treasury corporations, respectively, stepped in to purchase the current dip and supply the crypto market with some assist.

After buying 220 BTC on Oct. 13, Michael Saylor lately hinted at a recent BTC purchase by his agency with a cryptic submit on X.

A very powerful orange dot is at all times the subsequent. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

In the meantime, BitMine purchased the newest dip by buying over 379K ETH price practically $1.5 billion for the reason that flash crash.

Bitcoin Nonetheless Has Room To Run

Duong stated within the report that the Bitcoin value nonetheless “has room to run.” Nonetheless, the analyst is extra cautious now following the current crypto market flash crash.

“We nonetheless see resilient liquidity situations, a robust macro backdrop, and supportive regulatory dynamics,” the analyst stated within the report.

From a macro perspective, Duong stated that the “labor market seems to be cooling,” including that “fears of a pointy contraction within the financial system look overblown.”

Along with that, there are additionally two extra anticipated Federal Reserve rate of interest cuts and huge money-market funds sitting on the sidelines, which Duong stated might drive the markets within the fourth quarter.

“Extra price cuts from the Fed, in addition to higher fiscal and financial stimulus in China, might incentivize extra buyers to return off the sidelines,” the analyst stated within the report.

On the regulatory entrance, Duong stated that crypto regulation “is heading in the right direction.” The analyst highlighted the signed GENIUS Act and the CLARITY Act as indicators that the regulatory panorama is shifting in the suitable course.

Duong additionally famous that infrastructure for US spot Bitcoin and Ethereum ETFs (exchange-traded funds) continues to deepen, which improves entry for conventional market gamers and provides to market depth. These funding merchandise, Duong argues, present rails for the crypto market that maintain utilization and liquidity flowing via volatility.

Coinbase Favors Bitcoin, Says Buyers Want To Be Cautious Round Alts

Duong then went on to say that Coinbase Institutional favors crypto market chief Bitcoin for its “digital gold” narrative, particularly as doubts round fiscal and financial self-discipline persist. The analyst added that Coinbase is extra cautious in terms of altcoins.

Regardless of the cautious stance in direction of altcoins, Coinbase did say that Ethereum seems constructive.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection