Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor has hinted that Technique, the most important Bitcoin treasury agency globally, will announce one other BTC purchase in the present day.

“Crucial orange dot is all the time the following,” Saylor wrote in a latest X put up, which included a screenshot of the SaylorTracker chart. Previously, posts like these by Saylor have been adopted with bulletins of latest Bitcoin purchases. This has led to hypothesis that one other Technique BTC purchase might be introduced quickly.

The continued Bitcoin accumulation by Technique comes at the same time as the web asset values (NAVs) for digital asset treasury (DAT) companies collapse.

Technique Holds Extra Bitcoin Than The Prime 15 BTC Treasury Companies

The chart in Saylor’s put up reveals that there have been 82 purchases by Technique, with the agency’s whole holdings standing at 640,250 BTC, value round $69 billion at present costs. The corporate has additionally achieved an unrealized achieve of 48.99% after buying the BTC at a median value of $74K per coin.

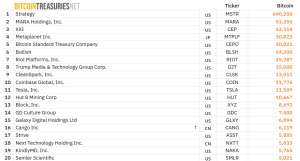

Prime 20 company BTC holders (Supply: Bitcoin Treasuries)

Technique holds practically 2.5% of BTC’s whole provide of 21 million cash, greater than the mixed reserves of the highest 15 public miners and company treasuries. The Bitcoin Treasuries information reveals that these high 15 public corporations collectively maintain greater than 900K BTC.

Crypto miner MARA Holdings is the second-biggest holder with 53,250 BTC on its steadiness sheet. Coming in at third is XXI with 43,514 BTC.

In the meantime, Japan-based Metaplanet, which is the most important company Bitcoin treasury in Asia, is the fourth-biggest BTC treasury on the earth with 30,823 BTC. Bitcoin Customary Treasury Firm rounds out the highest 5 with 30,021 BTC.

The remainder of the highest 15 company Bitcoin holders, which incorporates Riot Platforms, CleanSpark, Coinbase, and Tesla, maintain smaller quantities of BTC.

DAT NAVs Collapse, Wiping Out Billions In Paper Wealth

Whereas there was preliminary investor euphoria round DAT companies, the hype bubble round these corporations has seemingly popped, in keeping with 10x Analysis.

“The age of economic magic is ending for Bitcoin treasury corporations,” mentioned 10x Analysis analysts in a report final week.

“They conjured billions in paper wealth by issuing shares far above their actual Bitcoin worth — till the phantasm vanished,” the analysts added.

Within the “monetary magic trick,” the DAT companies managed to switch wealth from retail traders who overpaid for the businesses’ shares into precise Bitcoin for the companies. As such, shareholders have misplaced billions of {dollars} whereas executives have gathered actual BTC, the analysts mentioned.

The analysts highlighted Metaplanet for example. Of their report, they mentioned that the Asia-based agency remodeled a market cap of $8 billion that was supported by simply $1 billion in precise Bitcoin holdings right into a $3.1 billion market cap firm that holds $3.3 billion in BTC.

The stress on DAT NAVs has led to Metaplanet briefly suspending the train of its “twentieth to twenty second sequence” inventory acquisition rights from about Oct. 20 to Nov. 17 as a part of an effort to optimize its “capital elevating methods.”

*Discover Relating to Designation of Suspension of Train of the twentieth to twenty second Collection of Inventory Acquisition Rights Issued by way of Third-Social gathering Allotment* pic.twitter.com/63E2tXrGSH

— Metaplanet Inc. (@Metaplanet_JP) October 10, 2025

Technique itself skilled an identical “boom-and-bust cycle in its web asset worth,” the analysts famous.

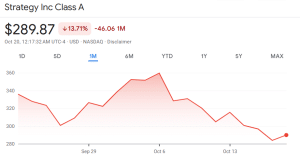

Taking a look at Technique’s share value, the corporate’s inventory has dropped over 13% previously month, information from Google Finance reveals.

Technique share value efficiency over the previous month (Supply: Google Finance)

The losses continued previously week, with the corporate’s inventory value dropping greater than 5% throughout this era. Nevertheless, Technique’s share value did rise over 2% throughout Friday’s buying and selling session.

The latest drop in Technique’s inventory value coincides with a decelerate within the firm’s Bitcoin purchases. Though Technique appears to be persevering with its BTC accumulation, the quantity of cash purchased with every of the latest purchases has been so much smaller than the quantities seen with buys earlier this 12 months.

Technique’s final Bitcoin buy was final week on Oct. 13, when the agency purchased 220 BTC. Previous to this latest buy, the corporate additionally purchased 196 BTC on Sept. 29 and 850 BTC on Sept. 22.

These buy quantities are considerably smaller than the 1,955 BTC purchased on Sept. 8, or the 21,021 BTC and the ten,100 BTC purchased on July 29 and June 16, respectively.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection