- Ethereum Basis moved 160,000 ETH ($654M) between inner wallets — no trade exercise detected.

- Analysts view it as routine treasury or safety upkeep, not a market transfer.

- ETH worth rebounded above $4,000, signaling calm sentiment regardless of the big switch.

Based on Lookonchain knowledge, the funds have been despatched from one EF-controlled deal with to a Gnosis Protected pockets, which is mainly a safe multi-signature vault. That element alone makes it clear this wasn’t a transfer to a centralized trade. In less complicated phrases: no dumping, no panic, simply what appears to be like like an inner shuffle of treasury funds.

Routine Shuffle or Hidden Motive?

Every time the Ethereum Basis strikes ETH, it tends to spark wild hypothesis. Up to now, related pockets exercise generally occurred proper earlier than token gross sales, which had merchants sweating bullets. This time, although, there’s zero indication of something like that.

Contemporary knowledge from Arkham exhibits all 160,000 ETH are nonetheless sitting safely in EF-controlled wallets. Analysts consider it’s a part of a safety improve or routine treasury administration—possibly even a reorganization of inner custody techniques.

Nonetheless, that doesn’t cease the rumor mill. Some neighborhood members assume the timing might tie to Ethereum’s newest push towards scaling and new governance changes. However for now, all indicators level to enterprise as typical contained in the Basis.

ETH Worth Rebounds Previous $4,000 Regardless of the Transfer

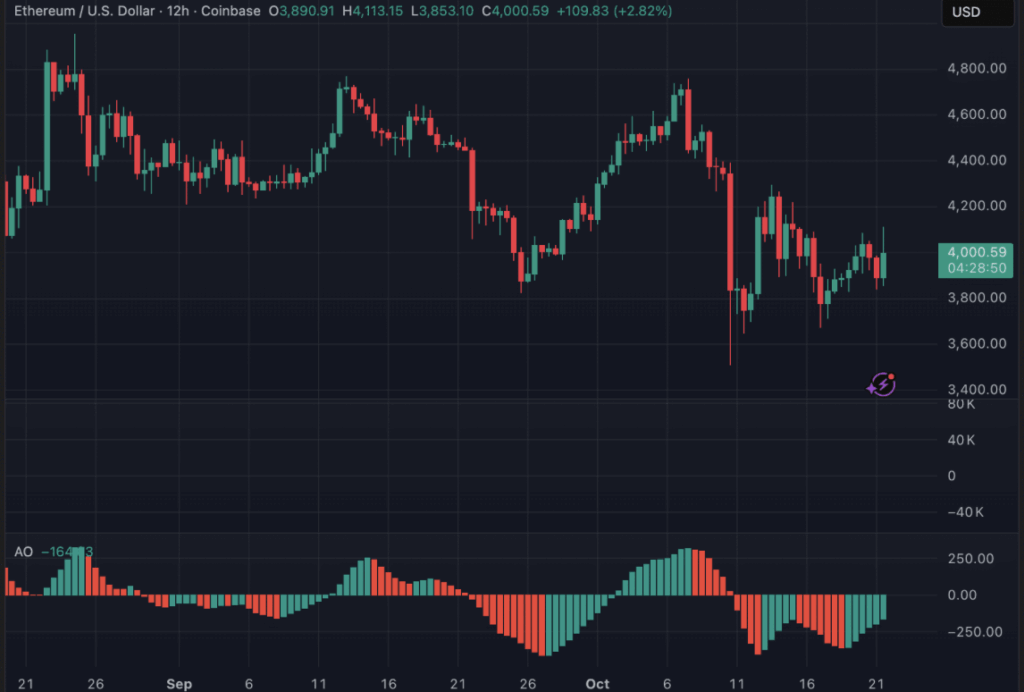

Surprisingly (or possibly not), Ethereum’s worth didn’t even flinch after the information. Actually, ETH rose 2.8% previously 12 hours, climbing again above the $4,000 mark after dipping beneath $3,600 earlier this week.

The Superior Oscillator (AO) flipped inexperienced for the primary time in days, suggesting a light return of bullish momentum. That tells us merchants aren’t treating the transaction as a warning signal — fairly the alternative, really. The market appears to have shrugged it off fully.

If something, this calm response exhibits simply how mature Ethereum’s ecosystem has turn out to be. A half-billion-dollar switch barely strikes the needle anymore.

Why It Nonetheless Issues

Though this transfer doesn’t appear market-related, folks pay shut consideration when the Ethereum Basis shifts funds. With such an enormous stash of ETH beneath its management, even the smallest signal of promoting can ripple throughout the market.

Traditionally, when EF sends ETH to exchanges, costs are likely to wobble. However on this case, not one of the funds have left inner wallets, and no uncommon brief exercise has appeared on derivatives markets.

It’s extra probably only a custodial replace — boring, sure, however necessary for holding the Basis’s safety hermetic.

Market Outlook: Calm, for Now

Technically talking, Ethereum appears to be like regular. Resistance sits close to $4,200, with a wholesome assist zone round $3,700. If bulls handle to push by $4,250, a short-term breakout towards $4,500 might be on the playing cards.

For now, EF’s transfer doesn’t appear to be rocking the boat. The switch matches neatly right into a sample of operational housekeeping — not a liquidation sign. Merchants can breathe simple, not less than for now.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.