Change-traded funds have grow to be some of the defining parts of this bull market. The frequency with which ETF-related headlines transfer the market highlights how intently institutional exercise is now tied to crypto sentiment. Every submitting or approval cycle sparks a wave of optimism or transient panic, underscoring how deeply conventional finance has merged with digital belongings.

Regardless of the volatility of latest weeks, the broader outlook stays firmly bullish. Institutional demand continues to rise, notably by way of ETFs, a construction favored by skilled buyers. This rising adoption paints a transparent image of confidence returning to the crypto ecosystem and factors to a market making ready for long-term growth.

Institutional Accumulation and ETF Growth Throughout World Markets

Since early 2024, the ETF panorama in crypto has expanded at a unprecedented tempo. Over 155 filings have been registered throughout greater than 35 digital belongings, a quantity that features not solely Bitcoin and Ethereum but in addition a number of mid-cap altcoins.

Analysts consider this determine may simply surpass 200 by subsequent 12 months, with exchanges in Asia, Europe, and North America now racing to introduce token-specific funds. What started with Bitcoin ETFs has advanced right into a broad motion reshaping how establishments acquire publicity to crypto.

Bitcoin ETFs have already grow to be a fixture in each conventional and digital markets, driving liquidity and investor confidence. Nevertheless, consideration is now shifting towards altcoin ETFs.

The launch of XRP and Polkadot ETFs this quarter has captured appreciable curiosity, suggesting that asset managers are exploring diversification past Bitcoin and Ethereum. These merchandise give institutional buyers structured, regulated publicity to tasks that have been as soon as thought-about too speculative for mainstream portfolios.

ETF replace: SEC’s been on pause since Oct 1, so timelines slid. When it reopens, I’m watching SOL first (mid-Oct), then XRP’s Oct 18–25 window. LTC missed Oct 2; ADA up subsequent; DOT/HBAR possible early Nov.

DYOR, NFA pic.twitter.com/fmsrvkvfik— XXLCycleEcho (@CycleEcho) October 5, 2025

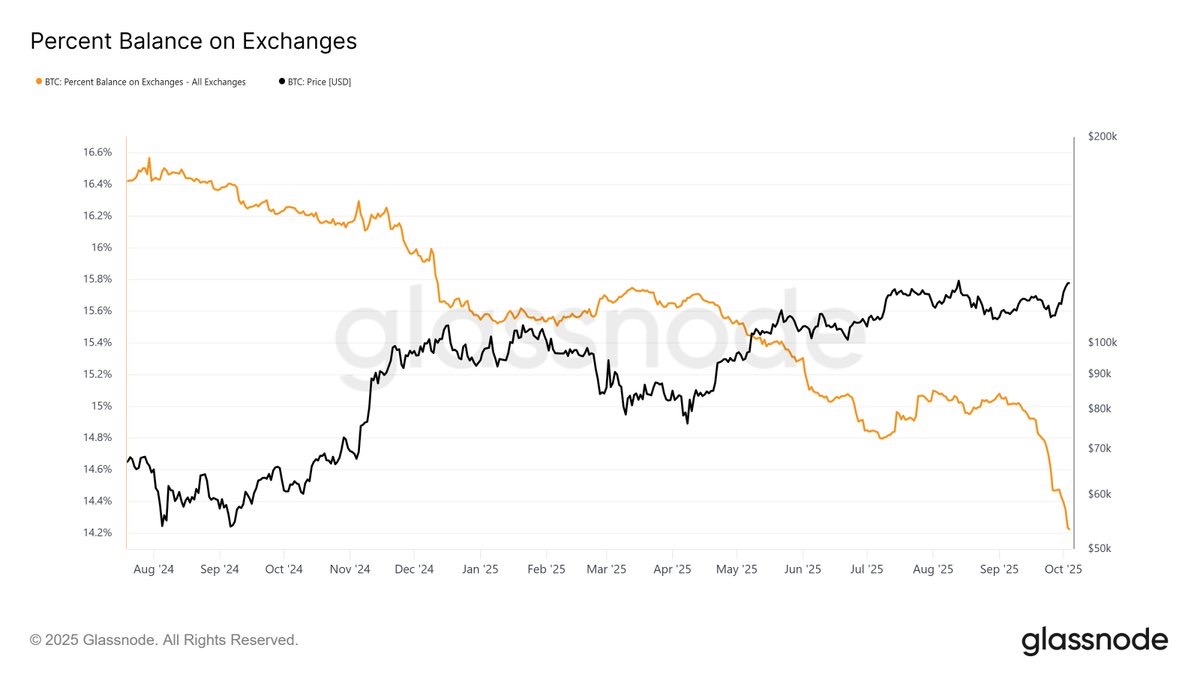

Bitcoin itself has mirrored this rising institutional curiosity. The asset presently trades close to the $107,000 vary and exhibits potential to achieve $115,000 if ETF momentum continues. Glassnode information reveals that extra long-term holders are taking earnings, with round 28,000 BTC leaving alternate reserves since October 15.

Whereas this promoting would possibly seem bearish on the floor, it displays renewed buying and selling exercise after months of accumulation, an indication of wholesome market participation returning.

This dynamic suggests a maturing ecosystem the place profit-taking and accumulation coexist. As Bitcoin stabilizes at increased ranges, ETF-driven demand may prolong positive aspects throughout altcoins related to new filings. For buyers watching institutional inflows develop every month, this era represents a pivotal accumulation window.

If momentum continues, the following ETF headlines may coincide with a strong new leg up for the broader crypto market, making now a compelling time to enter earlier than the following wave of capital totally arrives.

Greatest Crypto to Purchase Now – Initiatives That Might Pump With ETF Information

Snorter

Among the many newer era of Solana-based tokens, Snorter has emerged as some of the practical tasks of this cycle. It operates as a complicated AI-powered buying and selling bot inside Telegram, enabling merchants to execute complicated methods immediately from chat.

The system helps copy-trading, good order routing, and sentiment-driven alerts derived from on-chain analytics. Its worth lies within the simplicity of use, eradicating the necessity for exchanges or exterior dashboards whereas nonetheless providing professional-grade execution velocity.

Constructed on the Solana blockchain, Snorter advantages from excessive transaction throughput and minimal charges, making it ideally suited for real-time automated buying and selling. Its upcoming token launch on the twenty seventh follows a remarkably sturdy presale section that drew in substantial neighborhood consideration.

Traders see the token because the utility key to accessing superior tiers of Snorter’s bot community. The venture’s structure ensures constant token demand as customers stake or spend tokens to unlock analytics, premium alerts, and profit-sharing modules.

Market observers have linked Snorter’s momentum to the continuing dialog surrounding Solana ETF filings. Institutional publicity to Solana may simply amplify demand for ecosystem tasks like Snorter, particularly as merchants search for built-in instruments aligned with rising institutional quantity.

With restricted time remaining earlier than the general public launch, buyers in search of publicity to a working Solana-based buying and selling utility have a slim window to amass the token at its earliest valuation.

Pepenode

Pepenode represents a particular class of crypto innovation constructed round neighborhood mining and participation. The venture’s mine-to-earn system permits customers to mine digital frogs often known as “Nodes,” every contributing to the community’s reward cycle.

This interactive design has helped Pepenode appeal to a vibrant base of customers who worth energetic participation over passive holding. The mining loop additionally offers token shortage and gamified engagement, qualities which have pushed the token’s regular reputation throughout retail buyers.

What units Pepenode aside is the fusion of meme-driven power with real blockchain performance. Every mined node contributes to the ecosystem, and customers can commerce or merge their nodes for enhanced reward potential. The design ensures fixed community interplay, which in flip sustains liquidity and market depth.

The broader Pepe neighborhood has embraced the venture enthusiastically, viewing it as an evolution of the long-lasting frog meme that constructed the muse for earlier viral cash. Influencers similar to Borch Crypto and different market analysts have already featured Pepenode in latest protection, bringing important visibility to the presale.

The venture’s timing coincides with a rising wave of altcoin ETF curiosity, which may gasoline renewed demand for mid-cap neighborhood tokens. As investor consideration expands past Bitcoin and Ethereum ETFs, meme-rooted tasks with tangible programs like Pepenode could grow to be surprising beneficiaries of the following institutional cycle.

The present stage stays some of the enticing entry factors for these seeking to interact early in a fast-rising neighborhood asset.

Bitcoin Hyper

Bitcoin Hyper stands as some of the technically bold extensions of the Bitcoin ecosystem. It’s designed as a Bitcoin Layer 1 answer that improves transaction velocity, scalability, and on-chain effectivity with out compromising Bitcoin’s underlying safety.

The community helps good contract integration and high-throughput settlement, making it a pure bridge between Bitcoin’s foundational worth and trendy decentralized purposes. Builders can deploy dApps, funds, and bridging protocols on Bitcoin Hyper, increasing what has lengthy been thought-about a static chain into a completely programmable atmosphere.

With ETF approvals persevering with to attract institutional consideration towards Bitcoin, the timing for Bitcoin Hyper couldn’t be extra aligned. Institutional accumulation by way of ETF autos often redirects liquidity towards Bitcoin and its closest infrastructural extensions.

As Bitcoin trades close to $107,000 and doubtlessly heads towards the $115,000 vary, tasks that immediately improve its ecosystem are positioned to profit first. Bitcoin Hyper’s design caters exactly to that narrative, serving as a scalability and utility layer for the world’s most acknowledged asset.

Past its core protocol, the venture integrates staking mechanisms and liquidity incentives that reward community participation, making certain long-term engagement. The elevated institutional publicity that ETFs carry will possible speed up consciousness and developer curiosity in parallel Bitcoin infrastructures.

Bitcoin Hyper due to this fact represents not solely a utility-driven innovation but in addition an early-stage alternative tied on to Bitcoin’s increasing function within the institutional period.

Greatest Pockets Token

Greatest Pockets Token represents a whole reinvention of what a contemporary crypto pockets could be. Relatively than serving solely as a storage software, it features as a full Web3 ecosystem, permitting customers to retailer, commerce, stake, and discover new tasks all inside a unified interface.

Its native token powers each core characteristic of the platform, from transaction price reductions to governance, making it one of many few pockets ecosystems the place the token itself has deep practical utility. The platform provides seamless integration throughout main networks together with Ethereum, Solana, and Binance Good Chain, offering customers with a multi-chain expertise designed for each inexperienced persons and superior merchants.

Greatest Pockets’s upcoming options, similar to token launch monitoring, presale participation, and real-time on-chain portfolio analytics, place it as a necessary gateway to the broader DeFi market. It has additionally launched AI-assisted discovery instruments that assist customers consider early-stage tasks, enhancing entry to high quality investments with no need exterior evaluation platforms.

💥 $16M Raised & Counting! 💥

We’re constructing the pockets for the following period of crypto:

✅ Purchase new tokens early, immediately in-app

✅ Purchase and swap throughout chains in a single place

✅ Full portfolio management, no muddleObtain the app in the present day! 📲 https://t.co/Ykt3PTsnvy pic.twitter.com/aKKy9x1LMu

— Greatest Pockets (@BestWalletHQ) September 22, 2025

The venture’s latest fundraising success, with greater than $16 million already raised, displays the sturdy confidence surrounding its roadmap. As ETF-driven adoption continues to push establishments and retail buyers towards digital belongings, the demand for safe, all-in-one storage options is ready to climb sharply.

This development naturally locations Greatest Pockets Token in a positive place. Its ecosystem is designed to develop in tandem with rising person exercise throughout exchanges and ETF-linked inflows. With its launch approaching, Greatest Pockets stands as some of the promising crypto infrastructure performs in a market getting into a brand new section of institutional participation.

Conclusion

The regular rise in ETF approvals displays rising confidence amongst institutional individuals and a transparent return of long-term curiosity in crypto markets. With liquidity enhancing and Bitcoin holding agency inside an upward construction, consideration is popping towards tasks that provide practical ecosystems moderately than speculative hype.

This section favors tokens constructed on actual adoption, confirmed engagement, and sound structure, with some nice examples being the tasks talked about above. As institutional capital continues to broaden its presence by way of ETF channels, the atmosphere is changing into more and more favorable for buyers who acknowledge the significance of getting into early whereas the market continues to rebuild its power and path.