Be a part of Our Telegram channel to remain updated on breaking information protection

The US Federal Reserve is getting ready to affix the “revolution in funds” and produce crypto “from the fringes” of finance into the mainstream.

That’s based on Governor Christopher Waller, who stated on the Fed’s Funds Innovation Convention in Washington on Oct. 21 that the central financial institution will grant stablecoin issuers and fintech companies entry to its cost system by proposed “skinny” grasp accounts.

The transfer underscores a dramatic shift within the Fed’s method to digital property and decentralized finance. Waller stated applied sciences like stablecoins, tokenized property, and AI are “now not on the fringes however more and more woven into the material of the cost and monetary programs.”

“Funds innovation strikes quick, and the Federal Reserve must sustain,” he stated. “We intend to be an energetic a part of that revolution.”

Fed Intends To Be Half Of The “Expertise-Pushed” Revolution In Funds

Addressing a room filled with business leaders, together with Chainlink CEO Sergey Nazarov, Coinbase CFO Alesia Haas, Circle President Heath Tarbert, and a number of other Fed officers, Waller stated the decentralized finance (DeFi) neighborhood is now not “seen with suspicion and scorn.”

Unimaginable management immediately from Governor Chris Waller on the concept of a “skinny” Fed Account particularly for funds use instances for eligible establishments.

This can allow an entire host of alternatives to additional the US because the chief in funds and stablecoins. pic.twitter.com/QTIfYnRsfx

— Nathan McCauley ⚓ (@nathanmccauley) October 21, 2025

“Quite, immediately, you’re welcomed to the dialog on the way forward for funds in the USA and on our house discipline—one thing that will have been unimaginable a number of years in the past,” he stated. “As you all know, we’re nicely right into a technology-driven revolution in funds.”

Fed To Provide Streamlined Accounts For Stablecoin And Fintech Suppliers

Governor Waller stated that he has instructed Fed employees to discover what he calls a “cost account,” that might be aimed toward offering extra help “to these actively reworking the cost system.”

These accounts could be a lighter model of a masters account, and might be focused at companies that don’t essentially want all the “bells and whistles of a grasp account, or entry to the complete suite of Federal Reserve monetary providers.”

He stated that the so-called ”skinny” cost accounts could be out there to “legally eligible entities” that might want to comply with the central financial institution’s Pointers for Evaluating Accounts and Companies Requests.

Establishments receiving these accounts would face particular operational restrictions which can be designed to restrict Fed steadiness sheet publicity.

Along with that, the accounts wouldn’t earn curiosity on deposited balances. They could additionally carry obligatory steadiness caps to manage their measurement.

He then went on to say that the “skinny” grasp accounts would exclude low cost window borrowing and sure Fed funds providers the place the central financial institution can not adequately management overdraft dangers.

“The thought is to tailor the providers of those new accounts to the wants of those companies and the dangers they current to the Federal Reserve Banks and the cost system,” Waller defined throughout his speech,” he stated throughout his speech.

“Accordingly, and importantly, these lower-risk cost accounts would have a streamlined timeline for evaluation,” he added.

The Fed’s opening as much as the stablecoin sector follows months after US President Donald Trump signed the GENIUS Act into legislation in July.

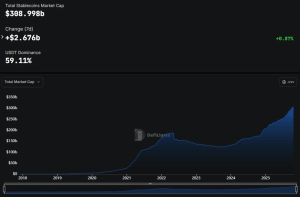

That is the primary regulatory framework on the federal degree that establishes the necessities for stablecoin companies trying to problem their tokens within the US. The stablecoin market cap has since damaged above $300 billion for the primary time.

Stablecoin market cap (Supply: DefiLlama)

New “Skinny” Grasp Accounts May Profit Ripple, Kraken, Circle, And Custodia Financial institution

The brand new “Skinny” grasp accounts might speed up the approval course of for crypto-native companies resembling Ripple, Kraken and Custodia Financial institution, who’re all pursuing Fed grasp accounts by prolonged authorized processes.

One purpose the method has been so prolonged is as a result of conventional finance banks have additionally pushed again towards the functions.

Ripple’s CEO, whereas talking at DC Fintech Week earlier this month, commented on the pushback and referred to as the banks “hypocritical” for saying that the crypto sector needs to be held to the identical normal whereas not being given entry to infrastructure like Fed grasp accounts.

It might additionally profit different companies that function within the digital asset house who’re making an attempt to realize entry to the Fed’s funds infrastructure.

One in all them is USD Coin (USDC) issuer Circle, who has utilized for a nationwide banking/belief constitution. That is usually seen as a prerequisite for full Fed account entry.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection