- Aptos jumped 4% as buying and selling quantity surged 35%, outperforming most main cryptocurrencies.

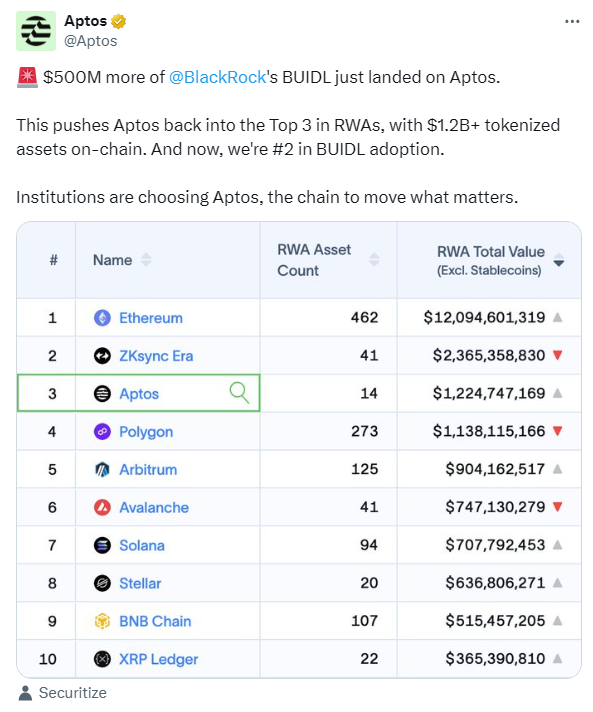

- BlackRock’s BUIDL Fund deployed $500M in tokenized property to Aptos, boosting its institutional credibility.

- Leap Crypto and Aptos Labs launched Shelby, a decentralized storage system aiming to rival conventional cloud options.

Whereas many of the crypto market has been crawling sideways, Aptos has quietly stolen the highlight. The layer-1 blockchain climbed 4% up to now 24 hours as buying and selling quantity spiked 35%, making it one of many few large-cap cash exhibiting actual power. With a market cap again above $2.3 billion, Aptos remains to be removed from its $19.90 all-time excessive, however its comeback story is gaining traction quick. Two catalysts are fueling this push — BlackRock’s huge $500M tokenization transfer and Leap Crypto’s new decentralized storage system, Shelby.

BlackRock’s $500M tokenization enhance

BlackRock’s BUIDL Fund has formally expanded to Aptos, including $500 million in tokenized property to the chain. This makes Aptos the second-largest blockchain for BUIDL deployment, proper behind Ethereum. The full tokenized asset worth on Aptos has now crossed $1.2 billion — rating it third globally within the tokenized real-world asset (RWA) race.

The BUIDL Fund, which BlackRock co-launched with Securitize, focuses on low-risk, liquid property like U.S. Treasuries and repo agreements. Initially constructed on Ethereum earlier in 2024, it branched out to Aptos in November to faucet into the community’s scalability and efficiency edge. For Aptos, this type of institutional validation is large. It alerts confidence in its infrastructure and positions the chain as a serious participant within the real-world asset motion.

Leap Crypto launches Shelby with Aptos Labs

In the meantime, Leap Crypto unveiled Shelby, a decentralized high-speed storage layer constructed alongside Aptos Labs. The objective? To interrupt away from reliance on centralized cloud giants like AWS and Google Cloud. Shelby combines Aptos’ blockchain coordination with distributed storage nodes and RPC endpoints, delivering what Leap calls “sub-second storage entry” and “programmable knowledge layers.”

It’s designed to be leaner, quicker, and cheaper than conventional cloud options — charging underneath $0.01 per GB monthly for writes and about $0.014 per GB for reads. Shelby’s structure additionally cuts the everyday replication think about half, from 4.5+ right down to 2, because of erasure coding that maintains sturdiness with out overdoing redundancy. This effectivity might make decentralized storage really aggressive for actual functions, one thing the blockchain world has lengthy struggled to attain.

Aptos appears to be like primed for extra momentum

Between BlackRock’s institutional belief and Leap Crypto’s technical innovation, Aptos is immediately sitting in a candy spot. Its fundamentals look stronger than ever, and the ecosystem’s give attention to scalability and real-world integration is paying off. With tokenization and decentralized infrastructure each trending scorching, Aptos may simply be one of the underrated layer-1 performs heading into 2025.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.