- Peter Brandt believes Bitcoin might attain $250K, however says it’s a chance, not a assured consequence.

- He additionally warned BTC might drop to $60K, relying on broader market situations.

- Brandt stays impartial, able to commerce both lengthy or brief based mostly on Bitcoin’s subsequent transfer.

Whilst Bitcoin struggles to remain above $108K, veteran dealer Peter Brandt is again with one in every of his boldest takes but. He says Bitcoin might soar to $250,000 — however earlier than you begin dreaming about yachts, there’s a twist. Brandt clarified that his prediction isn’t a matter of certainty and even chance… it’s a chance. In true Bayesian trend, he reminded his followers that either side of the market stay very actual — that means BTC might simply as simply slide the opposite manner, possibly even towards $60K.

A $250,000 Bitcoin — not a promise, however a chance

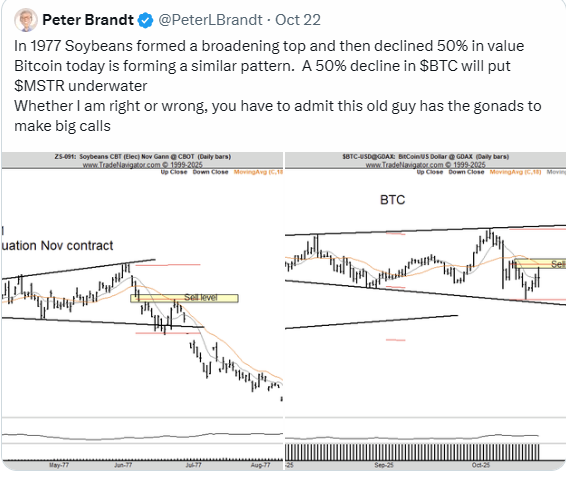

In his October 22 publish on X, Brandt defined that his view stems from macroeconomic developments and the shifting panorama of digital property. He doesn’t declare to know when Bitcoin will transfer — solely that, below the suitable situations, the flagship crypto might ultimately climb to 1 / 4 of one million {dollars}. With Bitcoin buying and selling round $108,300 on the time, it’s fairly a leap. Nonetheless, optimism from figures like Brandt retains sentiment from falling utterly flat, particularly as BTC continues to check key resistance zones.

Curiously, Brandt’s imaginative and prescient aligns with one made months in the past by Cardano founder Charles Hoskinson, who pointed to rising company curiosity from giants like Apple and Microsoft. That sort of mainstream consideration, Hoskinson argued, may very well be the gas Bitcoin wants for one more historic rally.

The twist — a potential plunge to $60,000

However Brandt didn’t cease there. Alongside his bullish situation, he additionally talked about a possible drop — all the way in which all the way down to $60,000 — relying on how market sentiment shifts. He framed it as an asymmetrical wager: robust upside if issues break proper, steep draw back if macro situations worsen. True to his model, Brandt doesn’t lean on predictions alone; he trades the market because it strikes. He even responded to a different dealer’s publish about Bitcoin’s descending sample, saying he’s able to go lengthy or brief relying on what the charts present subsequent.

It’s the sort of pragmatic view that’s made Brandt probably the most revered names in buying and selling circles — bullish sufficient to see the long-term potential, however grounded sufficient to know that Bitcoin doesn’t care about anybody’s predictions.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.