Zcash (ZEC) is now buying and selling slightly below a key technical resistance vary, with value motion exhibiting indicators of slowing following an earlier surge. On the time of writing, ZEC is priced at $240, with a 24-hour buying and selling quantity of $730 million.

In the meantime, the token is down barely previously 24 hours however stays up over 460% over the previous month (CoinGecko knowledge). The 24-hour value vary reveals a excessive of $308 and a low of $237, indicating excessive intraday volatility following a pointy rally.

Wedge Sample Approaches Resistance

Present chart patterns present ZEC forming an ascending wedge. This construction usually seems throughout sturdy rallies and sometimes indicators some extent the place momentum begins to slender. The value is now approaching a resistance zone between $280 and $313, marked by Murrey Math ranges. These ranges are sometimes referenced by merchants during times of overextension.

Motion into this zone has slowed. If quantity will increase, the value could check this resistance once more. If not, the market could begin to flip again towards decrease assist ranges. The closest zones of assist on the chart seem at $250 and $220.

As well as, the Relative Power Index (RSI) has reached 69, near the everyday overbought mark of 70. The 14-day RSI transferring common is now at 70, which suggests momentum has stretched.

To date, the RSI has not damaged above the overbought stage. Nevertheless, staying close to these ranges could result in sideways buying and selling as individuals watch for a brand new course. A brief pullback can be a standard response when RSI hovers at these highs.

Multi-Yr Breakout Meets Preliminary Goal

ZEC just lately accomplished a significant technical breakout. Based on analyst Javon Marks, the token ended a downtrend that lasted over a 12 months and a half. After the breakout, the value moved shortly towards $308, which matched a key goal. Marks said,

“One other >1,000% callout within the books.”

A second goal has been positioned close to $596.65, although this stays above present ranges.

The transfer adopted a interval of low resistance and accelerating shopping for quantity. The value has not but proven any prolonged correction, although exercise close to $308 could result in consolidation.

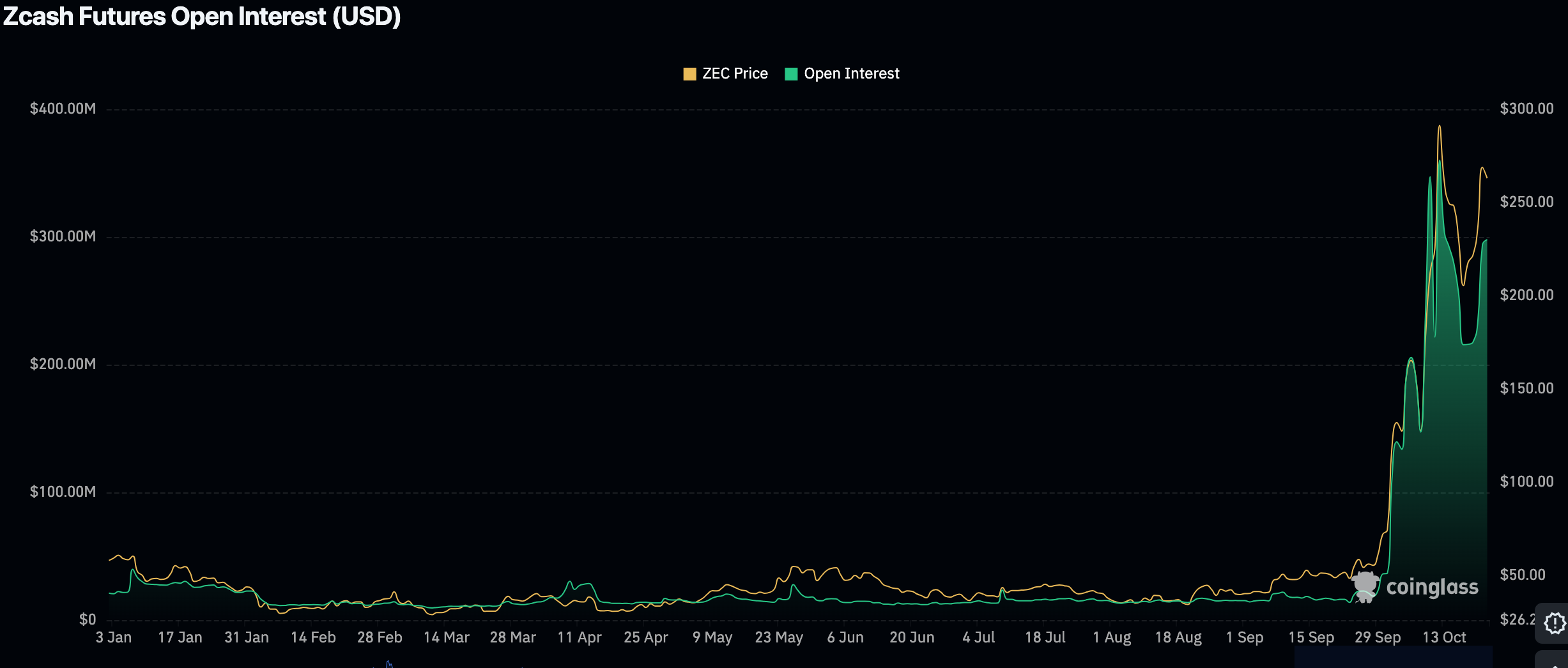

Futures Curiosity and Combined Market Sentiment

Based on Coinglass, open curiosity in ZEC futures reached $306.3 million, rising from below $50 million in September. This sharp enhance displays a surge in speculative participation. Such development usually coincides with increased volatility and bigger place sizes.

Market sentiment stays cut up. Analyst Henry wrote,

“ZEC appears to be like cooked. $311 wick was the exit liquidity.”

He additionally added that failure to carry above $300 may result in strikes towards the mid-$240 vary. He referenced a attainable head and shoulders sample forming, whereas noting that bulls would want to behave shortly to vary momentum.

As CryptoPotato posted on X, Zcash founder Zooko responded to latest value hypothesis by saying,

“I don’t know why the Zcash value has been skyrocketing. And I don’t know if it will return down.”

He additionally dismissed options of coordinated market manipulation, calling them “simply extra cynical propaganda.”

The submit ZEC Hits $308 Then Dumps Onerous: What’s Subsequent for This Breakout? appeared first on CryptoPotato.