A cluster of long-idle Bitcoin moved again into circulation Wednesday, elevating contemporary questions on promoting strain as costs slide from latest highs.

Associated Studying

Sleeping Cash Stir After Years

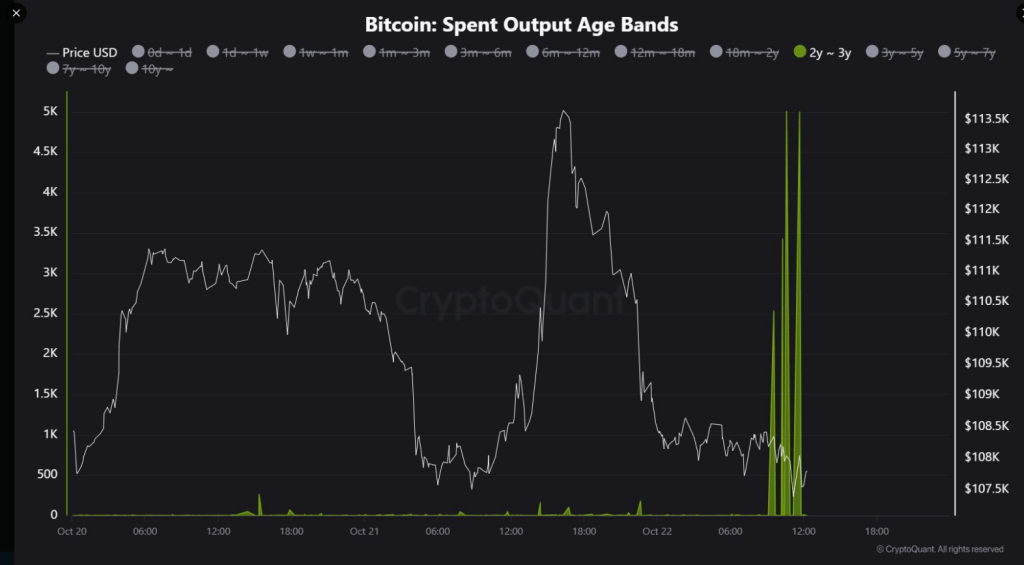

In keeping with CryptoQuant analyst JA Maartun, precisely 15,965 BTC that had been idle for about three years had been shifted earlier within the day. The cash moved whereas Bitcoin traded beneath $110,000, and at roughly $108,000 a coin the batch is price about $1.724 billion.

CryptoQuant’s on-chain data present these addresses had little to no exercise since late 2022 and early 2023, and the funds had been despatched to undisclosed locations.

Market watchers flagged the timing. Previous cash waking up throughout a pullback can sign profit-taking, or just inside reshuffles between non-public accounts and buying and selling venues.

Reviews have disclosed that such strikes typically replicate tax planning, trade custody adjustments, or massive holders adjusting positions — however the actual motive right here isn’t public.

15,965 BTC aged 2–3 years simply moved on-chain ⏱️

This cohort has been dormant since late 2022–2023—till now. pic.twitter.com/vw2z0fjHvv

— Maartunn (@JA_Maartun) October 22, 2025

New Whales Underwater

Knowledge from market trackers level to strain on newer massive holders who purchased close to latest highs. These so-called new whales carry a median price of $113,000 per BTC, leaving many positions underwater whereas costs commerce beneath that degree. The unrealized losses tied to those wallets are approaching $7 billion, in accordance with the identical datasets.

On the identical time, accumulation by different huge wallets continues. Analysts reported that about 26,500 BTC have flowed into accumulation addresses in latest days, an indication that some massive gamers are including quietly in the course of the dip.

This mixture of promoting and shopping for creates a tug-of-war in value motion. Brief-term dynamics are fragile. Assist round $107,000–$108,000 is one degree merchants are watching intently. If that zone holds, a bounce is feasible; if it fails, additional draw back towards $100,000 might observe.

Value Targets Spark Debate

The massive actions have intensified debate over how excessive Bitcoin would possibly go subsequent. In keeping with public feedback, the CEO of Galaxy Digital mentioned reaching $250,000 by year-end would require “a heck of a variety of loopy stuff.”

Different market figures hold extra bullish targets in play: Fundstrat’s Tom Lee and BitMEX’s Arthur Hayes have every voiced conviction in $200,000–$250,000 outcomes, pointing to potential coverage strikes and inflows as drivers.

Institutional numbers are a part of the backdrop. Galaxy Digital reported a document quarter with $29 billion in income, a determine that supporters cite as proof of rising institutional involvement available in the market. That progress is a part of why some traders stay assured whilst short-term charts wobble.

Associated Studying

Open Curiosity Falls, Threat Eases

In the meantime, on-chain analytics supplier Glassnode reveals open curiosity has dropped by about 30%, decreasing a few of the extra speculative strain that may amplify strikes.

Decrease open curiosity typically cools violent swings and makes value tendencies simpler to learn, at the very least till contemporary catalysts arrive.

Featured picture from Pexels, chart from TradingView