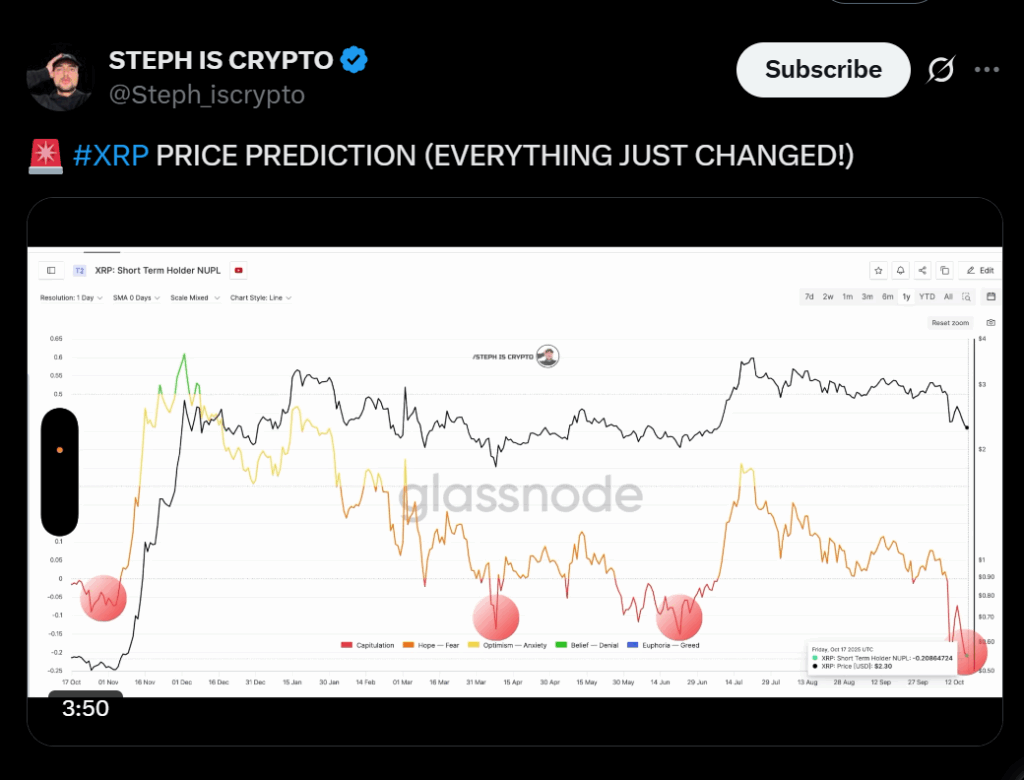

- NUPL ratio at file low (-0.2) signifies capitulation and doable backside.

- Institutional treasuries exceed $2B, led by SBI and GUMI allocations.

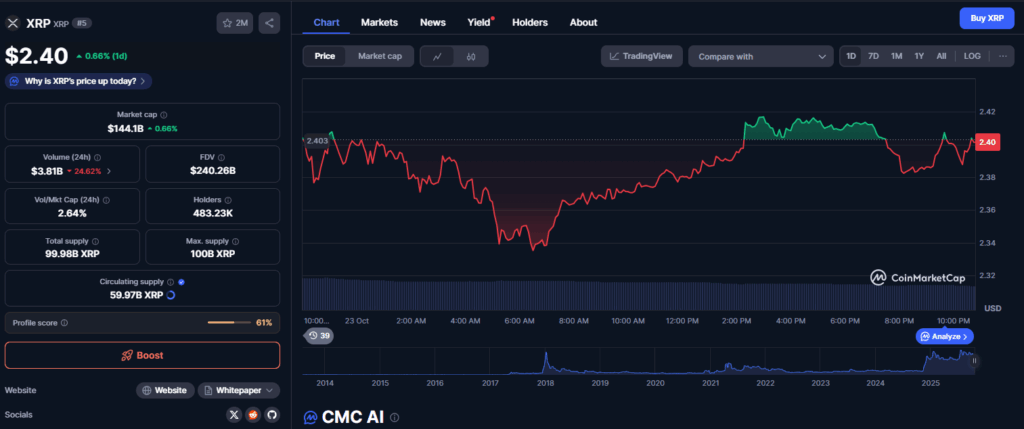

- XRP holds $2.40 and bounces off 0.618 Fibonacci help.

The XRP worth outlook has turned sharply bullish as key technical indicators and institutional exercise align for what analysts describe as a “potential launch part.” The short-term holder NUPL ratio has dropped to -0.2, marking the bottom degree ever recorded for XRP — an indication that short-term buyers are capitulating at historic ranges. In earlier cycles, related circumstances preceded explosive rallies, with XRP rallying almost 700% after comparable capitulation phases in 2024 and March 2025.

On the time of writing, XRP is holding close to $2.40, about 10% above final Friday’s low, whereas testing the 0.618 Fibonacci retracement — a degree the place institutional patrons typically accumulate. Technical charts present that this zone has repeatedly served as a springboard for multi-month uptrends, indicating that XRP could also be getting into the early phases of a structural restoration.

Institutional Shopping for Reshapes Market Dynamics

On the institutional aspect, greater than 11 firms have reportedly allotted a mixed $2 billion in XRP treasury holdings. Japan’s SBI Holdings confirmed its Evernorth XRP funding, adopted by GUMI’s $17 million place. This surge in company participation mirrors the Bitcoin company adoption pattern of 2020, reinforcing the notion of XRP as a liquid cross-border settlement asset quite than a speculative altcoin.

Ripple’s inside treasury flows and new company onramps are making a stronger base of non-retail demand, giving the asset a extra steady long-term worth basis. Analysts say that is the primary time XRP’s institutional base has matched its retail enthusiasm — a structural shift that’s fueling renewed optimism.

Technical Setups Help a $3.60 Worth Goal

Analysts like StephIsCrypto be aware that XRP’s weekly construction stays intact with greater highs and better lows, regardless of latest volatility. A clear break above the $2.80–$3.00 resistance zone might set off a brief squeeze that targets $3.60, a key psychological and Fibonacci degree.

The mix of record-low NUPL readings, rising institutional allocations, and retested Fibonacci help kinds a traditionally robust setup for a continued rally. With sentiment shifting quickly, XRP might mirror its 2024 restoration, when an analogous construction led to a sixfold worth improve inside months.

2025 Outlook: The Stage Is Set for Acceleration

As 2025 nears its ultimate quarter, XRP’s alignment of on-chain capitulation, institutional inflows, and technical resilience paints a situation the place “all the things simply modified.” Analysts argue that short-term concern has seemingly created a perfect accumulation part, and that XRP might quickly enter the markup part of its subsequent cycle.

If macro circumstances maintain regular and company treasuries proceed increasing, a transfer towards $3.60 and past by year-end stays firmly inside attain.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.