Be a part of Our Telegram channel to remain updated on breaking information protection

Paxos co-founder Charles Cascarilla has framed the unintentional minting of $300 trillion in PayPal’s PYUSD stablecoin as proof of blockchain transparency.

“It underscores the worth of the blockchain,” Cascarilla mentioned throughout a Federal Reserve crypto roundtable. “It truly reveals the transparency that you would be able to instantly have into what’s happening. On this case, an operational error that was solely inner to our techniques is now instantly seen to all people.”

He added that the your complete monetary system might have the identical stage of transparency over time, one thing he known as ”a very constructive factor” that ”can create confidence within the monetary system in a means that the opacity that exists right now has actually restricted.”

Cascarilla’s remarks come as regulators take into account whether or not or to not grant Paxos a Fed Grasp Account.

PYUSD Market Cap Briefly Surpasses International GDP

The Paxos blunder noticed PYUSD’s stablecoin briefly attain greater than 2x the worth of world Gross Home Product (GDP).

At 3:12 PM EST, Paxos mistakenly minted extra PYUSD as a part of an inner switch. Paxos instantly recognized the error and burned the surplus PYUSD.

This was an inner technical error. There isn’t any safety breach. Buyer funds are secure. We’ve addressed the basis…

— Paxos (@Paxos) October 15, 2025

Shortly after the unintentional mint, the crypto group started questioning the sudden surge within the stablecoin’s provide. Lower than an hour later, the staff moved the newly-minted tokens to an inaccessible handle that eliminated them from the provision.

Cascarilla mentioned that the corporate knew in regards to the mistake “inside a minute or two,” and mentioned the tokens by no means left the corporate’s inner techniques.

“The error was solely ours,” he mentioned. ”Actually, we didn’t function on the requirements that we anticipate of ourselves,”

Nonetheless, the crypto group has requested why it was really easy to mint trillions of {dollars} onchain within the first place. Some additionally raised considerations round what reassurances there are that stablecoins are in actual fact backed by the reserves that issuers declare they’ve.

Paxos And Different Stablecoin Companies Apply For Fed Grasp Accounts

Paxos and different crypto-native companies, similar to Anchorage Digital Financial institution and Ripple Labs, are within the strategy of making use of for Fed Grasp Accounts with the Federal Reserve.

It serves because the central account by way of which an establishment conducts its relationship with the Fed, together with deposits, funds, intraday/in a single day credit score, and the settlement of transactions.

It provides direct entry to the central financial institution’s fee and settlement infrastructure, enabling an establishment to carry deposits on the Reserve Financial institution.

Paxos and different candidates have confronted opposition to their functions from conventional banks.

Fed Governor Pitches “Skinny” Grasp Accounts

There could also be higher information forward. Governor Christopher Waller mentioned earlier this week that the Fed is analyzing a brand new form of account that’s provisionally known as a “skinny grasp account” for companies that aren’t full-fledged banks.

These new accounts would give companies entry to the Fed’s infrastructure with out granting the entire privileges of a full Fed Grasp Account. Among the key restrictions which are being contemplated embody no curiosity funds on balances, presumably no overdraft/discount-window entry, and stability caps.

Waller mentioned that the brand new accounts are a part of the central financial institution’s broader mission to embrace innovation. He added that “funds innovation strikes quick, and the Fed must sustain.”

The trouble has been labeled as a prototype at this stage, and the ultimate particulars haven’t but been finalized.

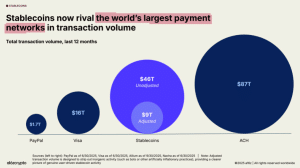

That’s as stablecoins processed round $9 trillion in transactions over the previous 12 months, in accordance to a current report by enterprise capital agency a16z.

Stablecoin transaction quantity (Supply: a16z)

“In years previous, stablecoins had been used principally to settle speculative crypto trades; as of the final couple years, they’ve develop into the quickest, least expensive, and most international option to ship a greenback,” the report mentioned.

The stablecoin market cap has additionally soared previous $300 billion following the signing of the GENIUS Act by US President Donald Trump, giving the business some long-awaited regulatory readability.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection