Keep within the loop with our weekly crypto digest as we get you on top of things on the most popular traits and occasions within the crypto house.

Right here’s what occurred in crypto this week:

UK Bitcoin ETPs From BlackRock And Others Begin Buying and selling In London After FCA Ends Ban

BlackRock’s iShares Bitcoin ETP is now buying and selling on the London Inventory Trade, following the FCA’s determination to elevate its retail crypto ban. This opens regulated Bitcoin entry for UK traders.

The Monetary Conduct Authority (FCA) lifted the ban on crypto ETNs for skilled traders in March 2024, although the ban on retail entry to such merchandise remained firmly in place.

It was not till August this yr that the monetary watchdog shifted its stance, saying it might enable non-public traders to entry crypto ETPs from October eighth, 2025 if they’re listed on a regulated funding trade.

Particular person traders will now be capable to entry the merchandise utilizing normal brokerage accounts and tax environment friendly Shares and Shares ISA and SIPP accounts till April 2026, at which period they’ll solely be accessible for brand spanking new funding via Revolutionary Finance ISAs.

Japan Mulls Permitting Native Banks To Purchase And Promote Crypto

Japan’s Monetary Companies Company (FSA) is contemplating letting native banks purchase and promote cryptocurrencies and is about to debate reforms in an upcoming assembly that would combine crypto into conventional banking.

If accredited, banks may turn out to be key gamers in crypto buying and selling and custody, doubtlessly boosting retail entry. This follows Japan’s historical past of progressive crypto insurance policies, additional bridging TradFi and DeFi.

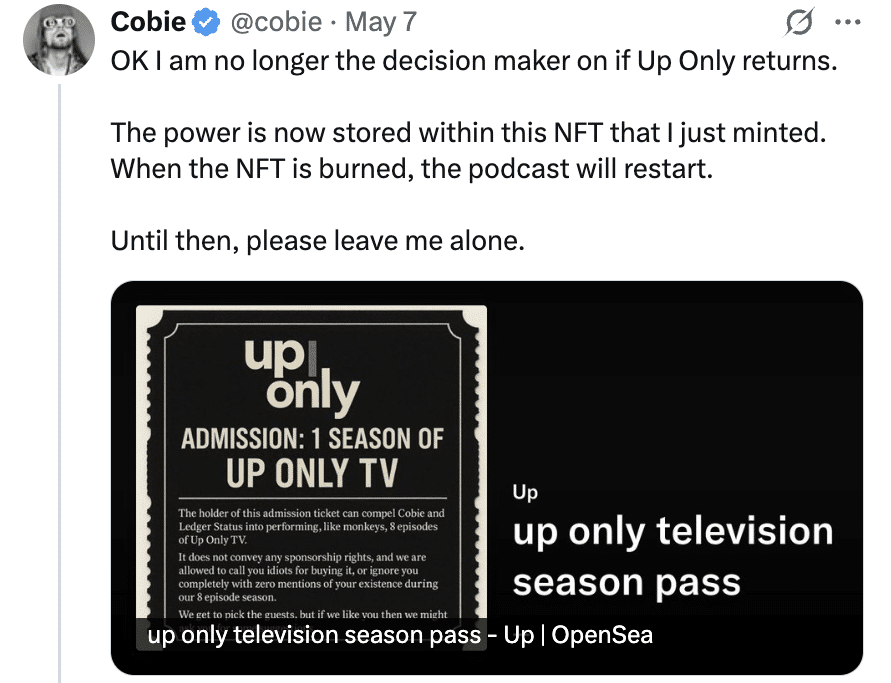

Coinbase Buys Cobie’s Up Solely NFT For $25 Million

Based on onchain information, Coinbase paid the well-known crypto dealer Jordan Fish, also called Cobie, $25 million in USDC for his Up Solely NFT.

For context, in Could, Cobie mentioned if somebody purchased the NFT, he would restart his podcast, which has not had a brand new episode since December 2022, shortly after the FTX collapse. The NFT’s nice print states that if purchased, Cobie and his cohort Ledger have to provide eight episodes of the once-popular podcast.

Coinbase CEO Brian Armstrong later confirmed the acquisition. “The rumors are true, we purchased the NFT. Up Solely TV is coming again,” he mentioned in a put up to X.

Coinbase Acquires Echo For $375 Million To Dive Into On-Chain Fundraising

Coinbase World is buying fundraising platform Echo for about $375 million in money and inventory.

The deal provides Echo’s Sonar token-sale infrastructure, which has raised over $200 million to this point, to Coinbase’s providing.

The trade plans to combine crypto capital-formation instruments and finally help tokenized securities and real-world property, reinforcing its strategic push into early-stage blockchain investing.

Solana Quietly Ends Assist For Saga Cell Telephone Simply Two Years After Launch

Solana Cell has discontinued help for its Saga cellphone, launched in 2023, after simply two years.

No extra software program updates or safety patches shall be offered, shifting focus to their new machine, the Seeker.

This determination raises eyebrows, particularly given the quick lifecycle of a $1,000 Web3-focused machine. Customers are left with out essential updates, doubtlessly impacting safety.

Hong Kong’s First Spot Solana ETF Begins Buying and selling On October 27

Hong Kong has launched its first spot Solana (SOL) ETF, set to start buying and selling on October twenty seventh, marking a big step for crypto adoption in Asia, with Solana becoming a member of Bitcoin and Ethereum in regulated funding merchandise.

This ETF positions Solana because the third main crypto asset to achieve such approval in Hong Kong, following profitable BTC and ETH ETFs earlier this yr.

Crypto Buying and selling Agency FalconX To Purchase ETF Supervisor 21Shares

Crypto buying and selling agency FalconX is about to amass ETF supervisor 21Shares, as reported by the Wall Road Journal.

The main institutional crypto prime dealer goals to bolster its portfolio by integrating 21Shares’ experience in crypto ETFs. This acquisition aligns with FalconX’s latest strikes, like staking a majority in Monarq Asset Administration.

21Shares, recognized for its numerous ETF choices together with Solana and Polkadot, brings vital worth. This deal may speed up institutional adoption, mixing buying and selling prowess with structured funding merchandise.

Closing Ideas

In order that’s it for this week!

To remain forward of the sport with the freshest crypto information and insights delivered straight to your inbox, think about subscribing to UseTheBitcoin’s e-newsletter at this time.

Have a incredible week forward!