Be a part of Our Telegram channel to remain updated on breaking information protection

A Bitcoin whale pockets from the Satoshi Nakamoto period has moved funds after over 14 years of dormancy as BTC choices open curiosity (OI) reaches a report excessive of $63 billion.

Buyers have but to react to the whale’s awakening, with the Bitcoin value recording a greater than 1% acquire up to now 24 hours.

Following the uptick, BTC trades at $111,001.95 as of 4:24 a.m. EST, knowledge from CoinMarketCap exhibits.

Bitcoin Whale Sends $16 Million In BTC

Knowledge from the on-chain monitoring platform Nansen exhibits that the whale handle despatched 150 BTC, price greater than $16 million, in a single transaction up to now 24 hours.

In the meantime, knowledge from the Bitcoin block explorer and analytics platform Memepool House suggests the whale in query as soon as held as a lot as 7,850 BTC. The handle that made the transaction has additionally been inactive since June 2011. Again then, the whale had consolidated 4,000 BTC into one pockets.

In response to the X account “MLM,” the whale earned the 4,000 BTC by means of mining between April and June of 2009.

A Satoshi-era pockets that mined 4,000 BTC between April and June 2009 – simply months after Bitcoin’s launch – and consolidated all the things into one pockets in June 2011, has simply transferred out 150 BTC after 14.3 years of dormancy.

It was price $67,724 again in 2011.

Now that very same…

— MLM (@mlmabc) October 23, 2025

The whale’s 4,000 BTC was price $67,724 again in 2011. At this time, that very same Bitcoin is price $442 million, in keeping with MLM.

In the meantime, one other X person, Emmet Gallic, who’s a self-employed blockchain analyst, mentioned the whale as soon as held 8,000 BTC throughout a number of wallets, and has been regularly promoting off its holdings by means of one other handle.

Different Satoshi-Period Whales On The Transfer

This isn’t the primary pockets from the Satoshi period to maneuver a few of its holdings this 12 months. In July, one other pockets with 80,201 BTC began shifting its cash to Galaxy Digital. It had additionally been dormant for 14 years, and made its remaining switch on July 16.

Each transfers are a part of a pattern noticed by crypto analyst Willy Woo, who mentioned in June that whales with greater than 10,000 BTC have been steadily promoting their holdings since 2017.

Bitcoin OI Soars

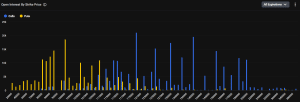

Whereas transfers by whales are usually seen as a precursor to promote exercise, Bitcoin derivatives markets recommend {that a} new bullish wave is constructing. In response to GoinGlass, BTC choices OI soared to a report $63 billion, and has been dominated by larger strike costs.

Crypto choices platform Deribit, which is now owned by Coinbase, additionally mentioned on X that there was a rise in OI on the $100,000 strike value. This implies that bears anticipate a drop in BTC’s value.

Nonetheless, there may be rather more OI at larger costs, together with at $120,000, $130,000, and $140,000, Deribit knowledge exhibits.

Bitcoin OI (Supply: Deribit)

When OI begins to pay attention at strike costs which might be properly above the present value, it means that merchants are primarily betting on or hedging for sturdy upside. The markets would possibly due to this fact see this as an indication that merchants count on Bitcoin’s value to achieve larger ranges.

Bitcoin Not Immune To 50% Crashes, Says Tom Lee

The OI vary between $100,000 and as excessive as $140,000 means that merchants nonetheless see Bitcoin as a risky asset.

Fundstrat CIO Tom Lee, who additionally chairs main Ethereum treasury agency BitMine, mentioned in a current interview with Anthony Pompliano that BTC isn’t resistant to 50% drawdowns.

I sat down with @fundstrat to debate whether or not AI is a bubble, why this can be probably the most hated inventory market rally in historical past, and the way deceptive financial knowledge shapes investor sentiment.

Tom additionally shares his newest views on Bitcoin, Ethereum, and why innovation in crypto markets is… pic.twitter.com/5GSKz5V1X0

— Anthony Pompliano 🌪 (@APompliano) October 24, 2025

“The inventory market has extra frequent 25% drawdowns“ regardless that it has “made plenty of progress during the last six years,” Lee mentioned.

“So if the S&P is down 20, Bitcoin may very well be down 40,” he added.

He then went on to say that Bitcoin has damaged out of its historic four-year cycle, which might have led to a peak this October.

Whereas Lee warns that Bitcoin’s value might nonetheless endure a steep drop, famend crypto dealer and analyst Michael van de Poppe informed his greater than 812.7K followers on X that the main crypto would possibly soar to a brand new all-time excessive (ATH) in November.

He mentioned that if Bitcoin builds a powerful basis above $112K, it might go on to achieve a brand new report value in November.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection