- Invoice Morgan says Chainlink’s strategic reserve acts like a slow-motion inventory buyback, tightening provide as adoption grows.

- Evernorth’s XRP Treasury will recycle yield into extra XRP purchases, doubtlessly offsetting Ripple’s escrow releases.

- Each tasks might see decreased provide and elevated institutional demand heading into 2026, establishing for long-term energy.

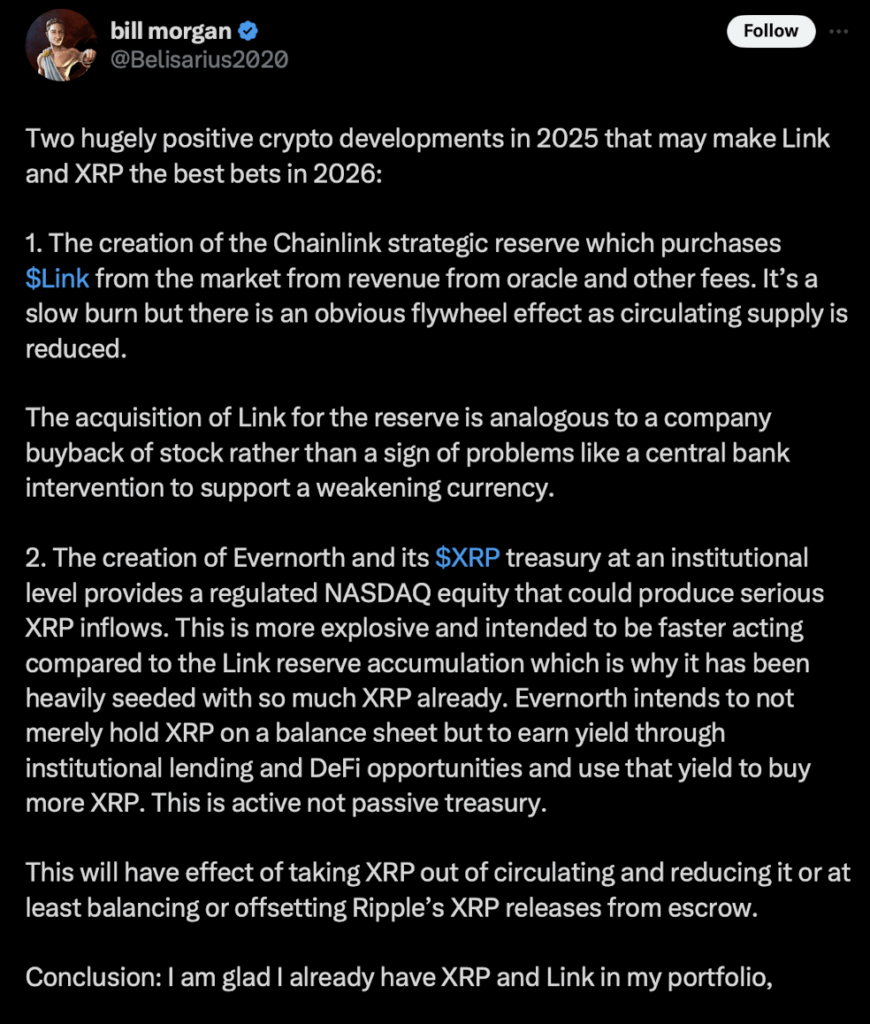

Professional-Ripple lawyer Invoice Morgan believes each XRP and Chainlink (LINK) is likely to be on observe for standout performances in 2026 — thanks to 2 key developments unfolding in 2025. In an in depth publish, Morgan defined how each tasks are introducing mechanisms that would scale back circulating provide and strengthen long-term market well being.

Chainlink’s Strategic Reserve Might Tighten Provide Over Time

Morgan started by pointing to Chainlink’s new strategic reserve, a characteristic that quietly accumulates LINK from the open market utilizing income generated from oracle and repair charges. He likened it to a company inventory buyback, saying it displays “confidence and sustainability — not desperation.”

This mechanism, he defined, creates a form of “flywheel impact” the place the reserve retains absorbing LINK over time. As extra charges roll in and adoption grows throughout DeFi and enterprise networks, this gradual however regular accumulation tightens provide, driving shortage. The setup, in keeping with Morgan, offers LINK a pure worth assist mechanism that strengthens the longer the system runs.

Briefly — Chainlink’s design rewards long-term persistence. As its oracle community expands, fewer tokens stay in circulation, which might give LINK a gentle upward thrust heading into 2026.

Evernorth’s XRP Treasury: Institutional Demand Accelerator

On the XRP facet, Morgan spotlighted the launch of Evernorth, a regulated NASDAQ-listed entity constructed to handle an institutional XRP treasury. In contrast to passive holding fashions, Evernorth’s strategy is energetic — it makes use of XRP for lending, staking, and DeFi yield technology, then recycles the earnings again into buying extra XRP.

Morgan known as it “an accumulation loop,” saying it might finally neutralize Ripple’s escrow releases by continually pulling XRP off the market. This cycle might steadily scale back the full circulating provide whereas concurrently creating sustained shopping for stress.

He additionally famous that Evernorth affords institutional buyers a compliant entry level into the XRP ecosystem — one thing the crypto business has been ready for. If regulatory readability continues to enhance in 2025, he believes Evernorth might set off “critical institutional inflows” into XRP.

2026 Outlook: Lengthy-Time period Holders Might Win Huge

Morgan wrapped up by reaffirming his personal conviction, saying he’s “glad to already maintain XRP and LINK.” His outlook frames each belongings as benefiting from two distinct however complementary techniques of accumulation — Chainlink via regular, revenue-driven buybacks, and XRP via institutional, yield-based acquisition.

If these mechanisms hold constructing momentum into 2025, he predicts 2026 might be a breakout 12 months for each tokens. With decreased provide stress, enhancing liquidity situations, and rising institutional confidence, XRP and LINK is likely to be poised for a powerful, sustained rally — one pushed extra by fundamentals than hype.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.