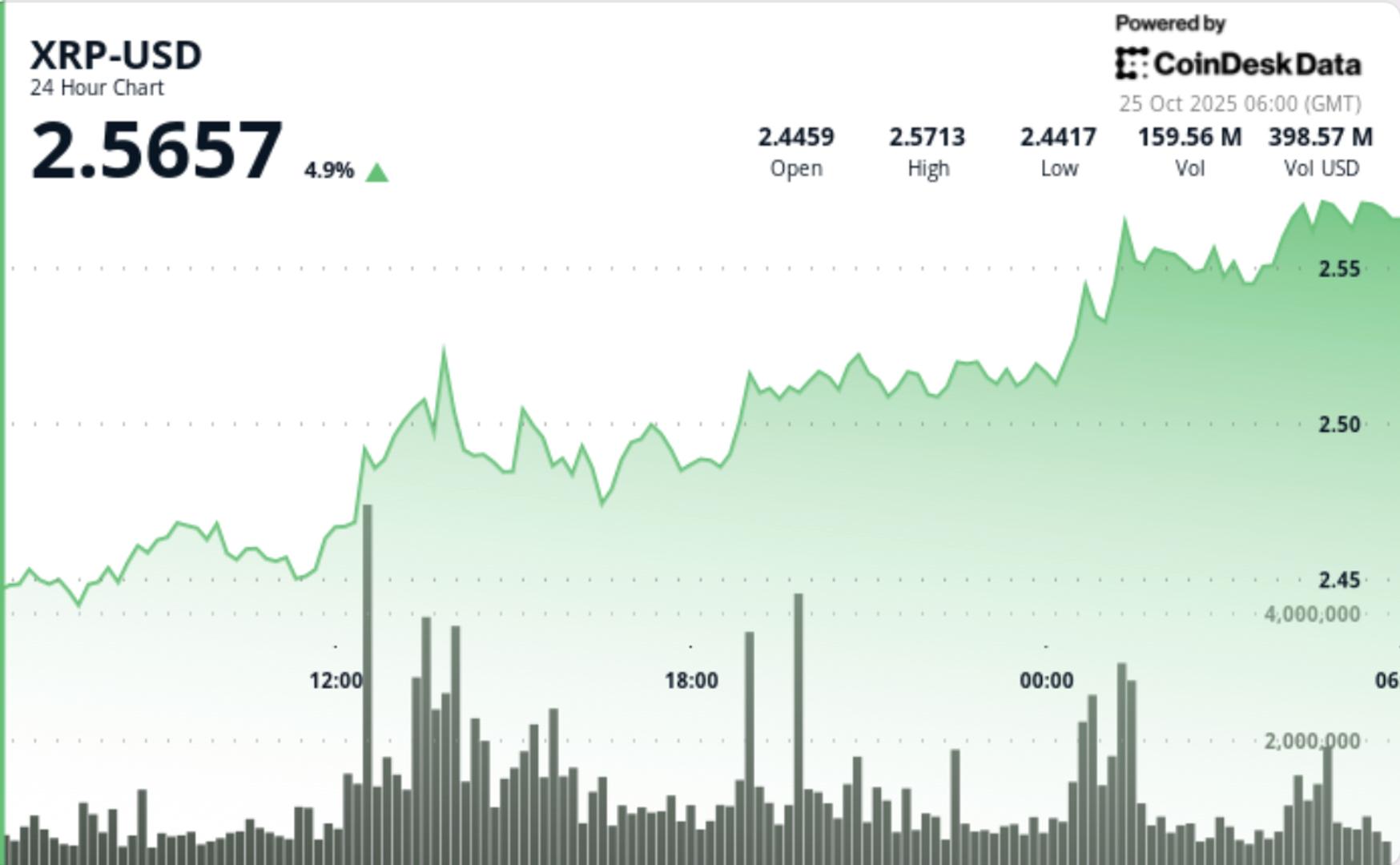

XRP prolonged positive aspects above the $2.50 mark on Thursday, breaking key resistance as quantity surged 31% above weekly averages. The transfer got here amid broader risk-on sentiment throughout crypto markets, with bitcoin climbing and merchants rotating into high-cap tokens displaying technically outlined setups.

Information Background

- The token’s newest advance adopted weeks of consolidation between $2.35 and $2.50, with technical strategists monitoring an inverse head-and-shoulders base by way of mid-October.

- Thursday’s decisive transfer by way of the neckline at $2.50 confirmed that sample, opening a possible continuation part towards the $2.65–$2.80 vary if shopping for persists.

- Market positioning shifted as macro sentiment improved. Softer U.S. inflation information and falling Treasury yields triggered risk-on flows into main altcoins. XRP outperformed the CoinDesk 5 index by roughly 5 share factors, signaling asset-specific accumulation somewhat than sector momentum.

Worth Motion Abstract

- XRP climbed from $2.50 to $2.57 throughout the session, with intraday quantity peaking at 142 million — 31% above its seven-day imply.

- The breakout was outlined by three sequential increased lows at $2.44, $2.48 and $2.51, confirming managed accumulation by way of the $2.50 zone.

- Whereas transient profit-taking emerged close to $2.58, XRP held above breakout help, suggesting establishments added publicity on retests.

- Elevated spot quantity mixed with muted derivatives leverage confirmed real shopping for curiosity somewhat than short-squeeze dynamics.

Technical Evaluation

- The finished inverse head-and-shoulders formation now defines XRP’s near-term technical bias. Momentum indicators, together with RSI and MACD, each turned increased on the each day chart, whereas quantity growth validates the power of the transfer.

- Quick resistance lies at $2.60, adopted by secondary targets close to $2.80. Failure to carry $2.50 on a closing foundation would neutralize the bullish construction, doubtlessly inviting rotation again towards $2.40–$2.42 help.

What Merchants Ought to Know

Merchants are monitoring whether or not $2.50 holds as the brand new base — a degree now considered the pivot for short-term development affirmation. Change steadiness information reveals XRP reserves down roughly 3.3% since early October, a traditionally bullish sign linked to whale accumulation phases.

Open curiosity has stabilized and funding charges stay impartial, leaving the transfer largely spot-driven. Sustained quantity above 130 million by way of the weekend may validate continuation towards $2.70–$2.80, whereas fading participation could entice costs again contained in the $2.40–$2.55 vary.