- Cardano is holding close to $0.64, with merchants in search of affirmation of a short-term backside after a 20% month-to-month drop.

- The community surpassed 115 million transactions, marking eight years of constant uptime and regular ecosystem development.

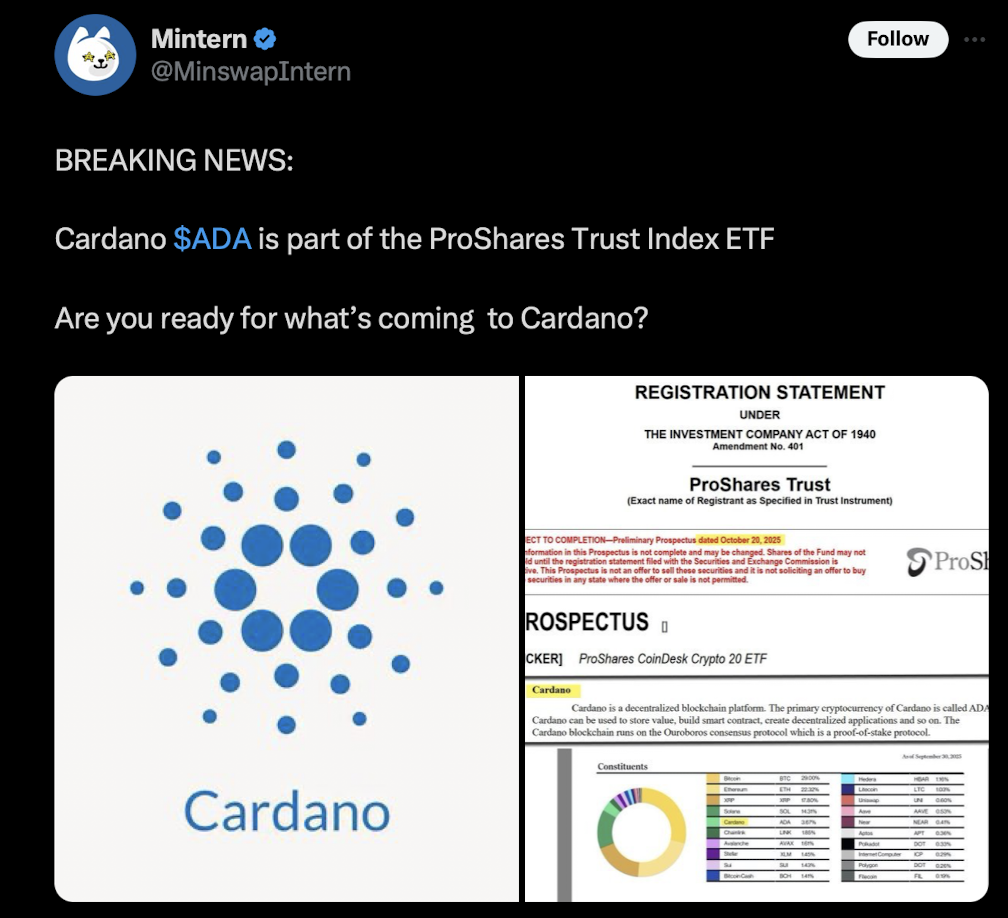

- Institutional inclusion through the ProShares Belief ETF and resilient on-chain exercise counsel underlying energy regardless of worth weak spot.

Cardano’s worth is sitting round $0.64, looking for its footing after dropping over 20% up to now month. Regardless of the decline, ADA managed a small 2.6% every day acquire and a 1.2% uptick for the week — a modest signal that merchants may be testing the waters once more.

The transfer comes as buyers weigh new catalysts like community development, long-term milestones, and rising institutional publicity.

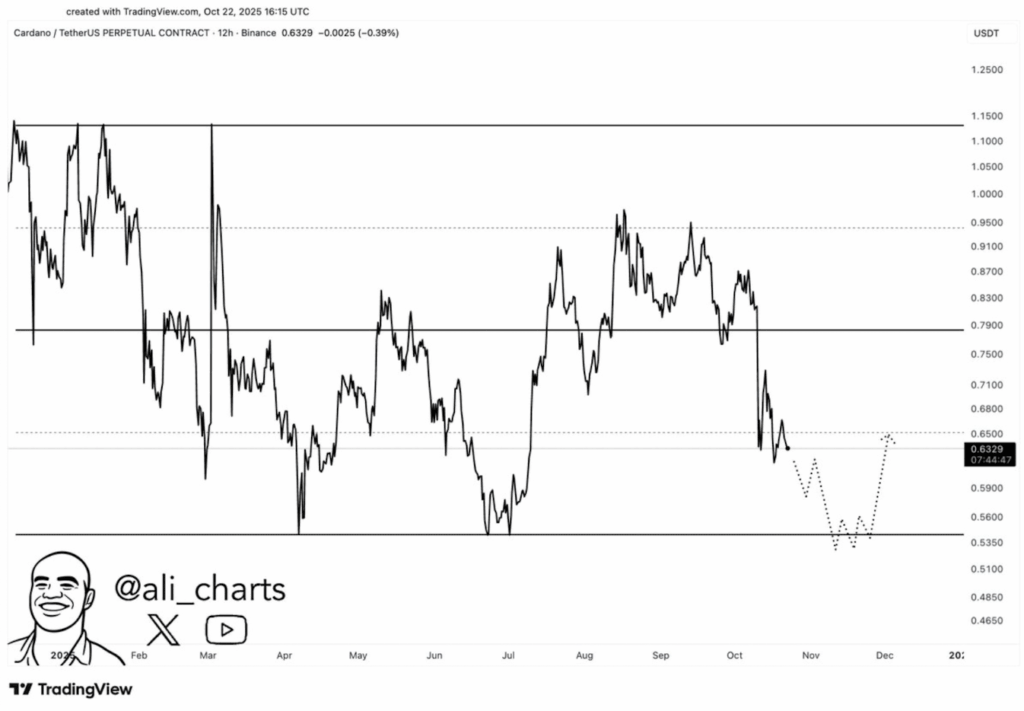

Merchants Concentrate on the $0.64 Help Zone

Proper now, all eyes are on the $0.64 degree, the place consumers appear to be quietly stepping again in after weeks of stress. Intraday buying and selling has been uneven, however quantity spikes close to that vary counsel some accumulation.

Analysts are protecting an in depth watch on 12-hour ADA/USDT charts, utilizing them to easy out short-term volatility and spot structural shifts. A couple of issues they’re in search of — increased lows, firmer closes above short-term resistance, and quantity affirmation.

If ADA can maintain regular right here, this might mark the beginning of a consolidation section earlier than its subsequent directional push. Then again, a clear break under this degree may reset the chart solely.

Spherical numbers like $0.64 usually act as magnets for liquidity, and Cardano appears to be no exception. The extra instances it checks this space with out breaking down, the stronger that base turns into.

Cardano’s Community Development: Eight Years and 115 Million Transactions

Cardano just lately crossed a large milestone — 115 million transactions on its mainnet. The community has now been operational for greater than eight years, a uncommon feat in crypto longevity.

Group members on X (previously Twitter) have been fast to focus on the achievement, pointing to Cardano’s constant uptime and slow-but-steady growth cycle. Since its launch, Cardano has advanced by means of a number of eras — from Byron and its Ouroboros proof-of-stake mannequin, to increasing utility with sensible contracts and DeFi integrations.

Wallets like Daedalus and Yoroi have supported customers from day one, offering safe methods to retailer ADA and work together with decentralized apps.

Institutional participation can also be beginning to choose up. The ProShares Belief Index ETF just lately added ADA to its portfolio, a transfer that improves visibility and opens entry to buyers by means of conventional brokerage platforms. For a lot of, this marks one other small however necessary step towards mainstream recognition.

November Outlook: Awaiting a Sample Shift

Heading into November, merchants are as soon as once more zooming in on short-term construction. The $0.64 space stays the important thing battleground — if ADA can kind a transparent sample of upper lows on the 12-hour chart, it’d sign that sellers are lastly dropping energy.

Market watchers are additionally taking note of transaction quantity after the 115 million milestone. Sustained on-chain exercise often interprets to stronger liquidity — and smoother worth discovery.

In the meantime, institutional buyers are maintaining a tally of the ETF itemizing, monitoring whether or not ADA maintains its place inside the fund. Any enhance in publicity may assist reinforce long-term stability.

For now, the setup stays easy: if ADA holds above $0.64, consolidation may give approach to restoration. A decisive drop under it, although, may result in one other spherical of promoting earlier than consumers regroup.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.