A brand new report from CCData claims that whole commerce quantity within the crypto trade hit an all-time excessive in November, reaching $10 trillion. Donald Trump’s guarantees of regulatory friendliness helped spur intense development.

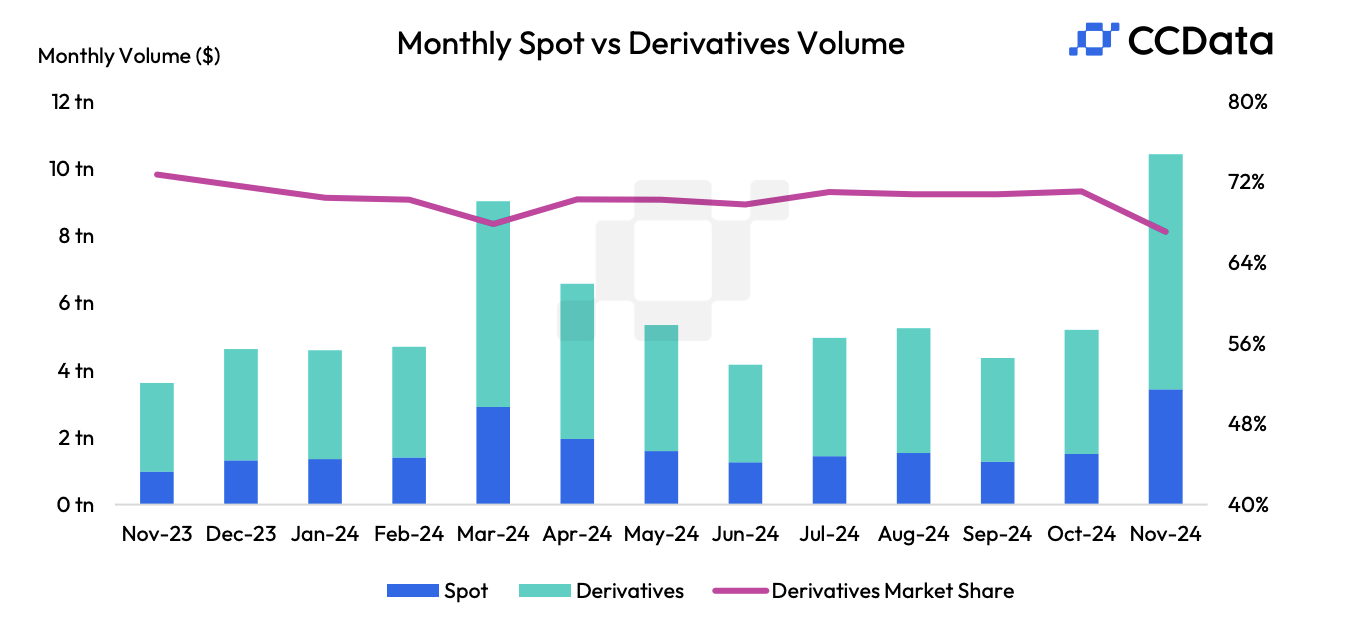

Derivatives buying and selling performed an enormous position on this enhance, representing a majority of centralized change visitors.

CCData Alternate Report

The report analyzed buying and selling knowledge on centralized exchanges and recognized a number of intriguing tendencies on this development sample. For one factor, Donald Trump’s electoral victory performed a key position because the trade awaits a friendlier regulatory setting. Jacob Joseph, senior analysis analyst at CCData, spoke with Bloomberg about this development:

“This sentiment is clear within the elevated urge for food for belongings like Ripple, which has traditionally confronted heightened regulatory scrutiny. Optimism can be evident on the institutional aspect, with CME volumes seeing a major uptick and substantial inflows into spot Bitcoin ETFs over the previous month, Joseph claimed.

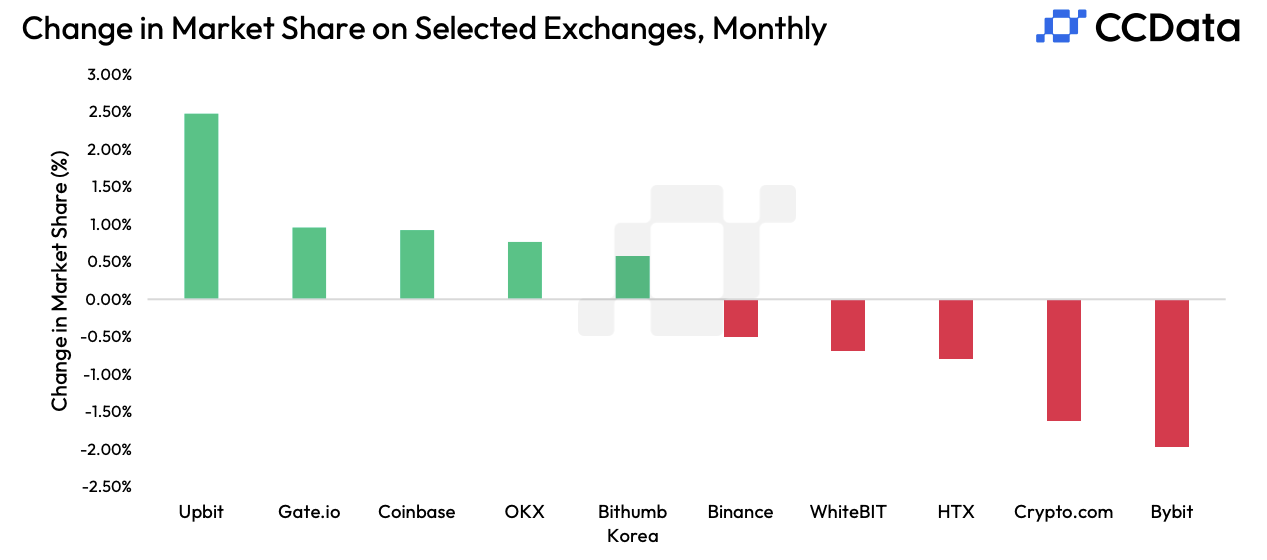

Nevertheless, the agency was clear that this development was not localized to US-based firms. The truth is, CCData claimed the fastest-growing change was Upbit in South Korea, which noticed month-to-month spot buying and selling surge by 358%. Amazingly, these positive factors came about regardless of South Korean regulators accusing Upbit of 600,000 KYC violations.

Crypto choices buying and selling additionally enormously elevated, contributing to those general positive factors. CCData claimed that choices volumes on the Chicago Mercantile Alternate (CME) hit an all-time excessive, with $5.54 billion in Bitcoin choices alone.

That represents a 152% rise, and different belongings confirmed related development. Derivatives trades, in truth, represented nearly all of general quantity.

The OCC accredited Bitcoin ETF choices buying and selling in November, doubtless encouraging different choices buying and selling. CCData solely checked out direct crypto visitors via centralized exchanges, so ETF volumes should not included of their knowledge. Nevertheless, these choices nonetheless generated enormous volumes, with BlackRock surpassing $425 million on the primary day.

Altogether, the mixed spot and derivatives buying and selling quantity on centralized exchanges rose greater than 100% from October to November. The ultimate whole, by CCData’s reckoning, was $10.4 trillion. This spectacular milestone helps contextualize the large bull market within the crypto house.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.