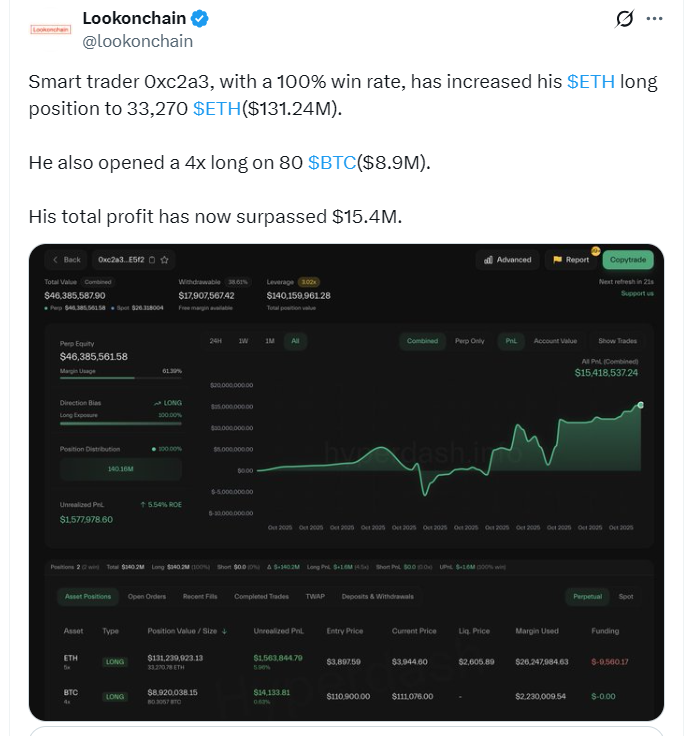

- A whale with a flawless 100% win fee opened a $131M lengthy place on Ethereum, signaling robust bullish conviction.

- Ethereum change reserves hit multi-year lows as holders transfer cash off exchanges, creating a possible provide squeeze.

- Analysts, together with Tom Lee, undertaking ETH may surge to $12K–$22K amid rising institutional adoption and DeFi growth.

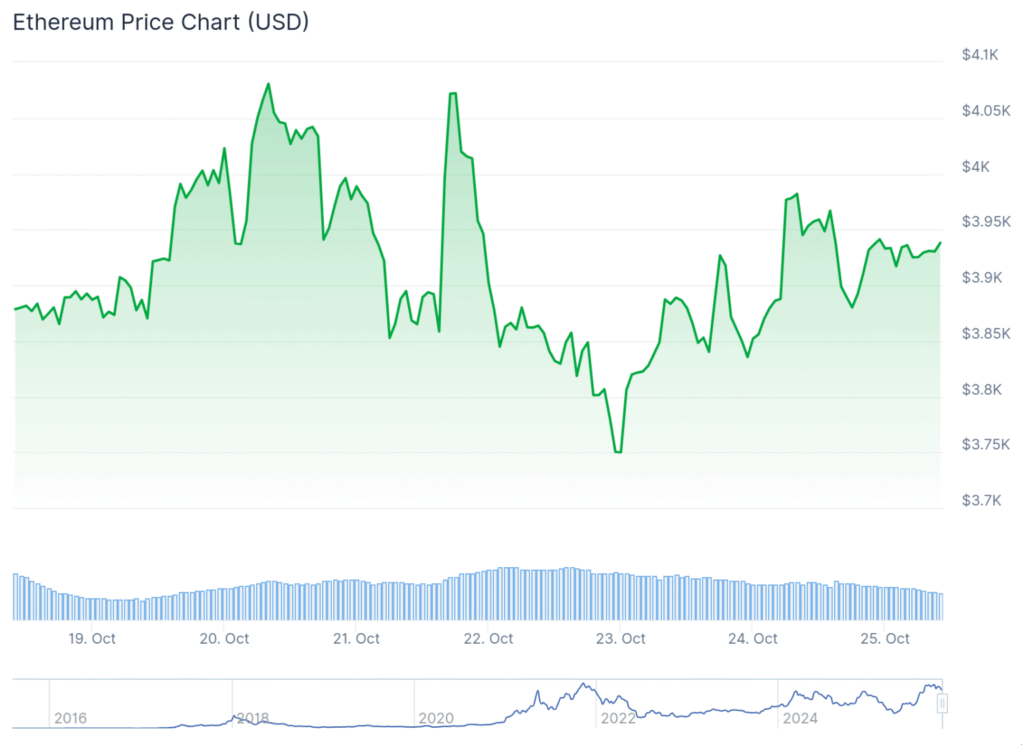

Ethereum simply crossed again above the $4,000 mark, and one whale appears completely sure it’s headed larger. The dealer — who reportedly has an ideal win fee — opened an enormous lengthy place price $131 million, betting large that ETH nonetheless has room to run. On the identical time, change reserves have fallen to multi-year lows, tightening provide and setting the stage for what could possibly be a severe value squeeze if momentum continues.

A Excellent Monitor Document Meets a Huge Wager

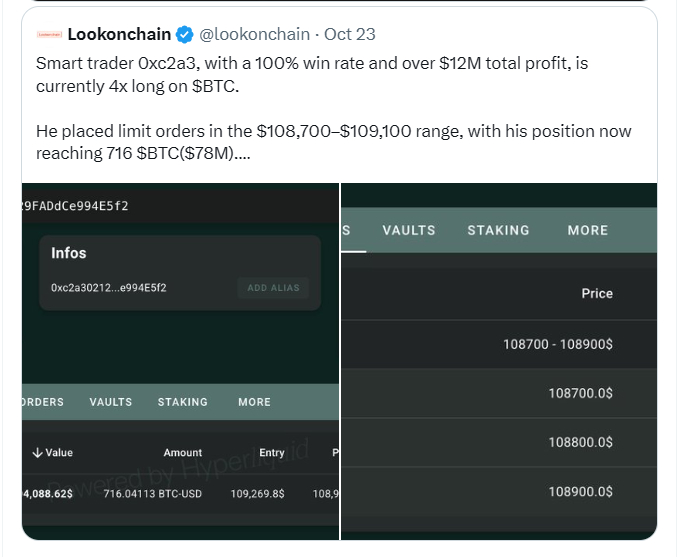

This dealer’s historical past is one thing out of a legend — a 100% win fee throughout all recorded positions. In line with on-chain information, they’ve now added 33,270 ETH to their portfolio, all lengthy, valued at simply over $131 million. They’ve additionally gone lengthy on 80 Bitcoin with 4x leverage, price practically $9 million. In simply the previous two weeks, the dealer has locked in $16 million in earnings, exhibiting a constant skill to time the market when others hesitate. Their newest wager suggests confidence that Ethereum isn’t accomplished climbing — not by a protracted shot.

Shrinking Alternate Provide Provides Gas

ETH reserves on centralized exchanges are at their lowest ranges in years. Extra holders are shifting cash into chilly storage, a traditional signal of long-term confidence and decrease promoting stress. When this occurs, the market typically sees sudden spikes — just because there’s much less ETH obtainable for merchants to promote. It’s a setup that would enlarge any upward transfer, particularly as retail merchants start chasing breakouts above $4,000. Proper now, Ethereum’s market cap sits at roughly $478 billion, with $37 billion in day by day buying and selling quantity.

Analysts Goal $12K–$22K Lengthy Time period

Fundstrat’s Tom Lee stays probably the most bullish voices on Ethereum, predicting it may soar between $12,000 and $22,000 as institutional adoption grows and DeFi expands. Sentiment amongst merchants backs that optimism — about 82% stay bullish, eyeing $4,300 as the following resistance and $3,800 as a agency assist zone. If ETH can break above $4,100 within the close to time period, analysts say it may open the floodgates for a brand new leg larger, particularly with whales already positioning forward of the transfer.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.