- Ethereum is buying and selling round $3,900 after $93M in ETF outflows, with $3,800 serving as key help earlier than a potential rebound.

- BlackRock offered $101M price of ETH, signaling short-term warning amongst establishments.

- Analysts like Tom Lee and Arthur Hayes stay bullish, projecting ETH might hit $10K–$22K by 2027.

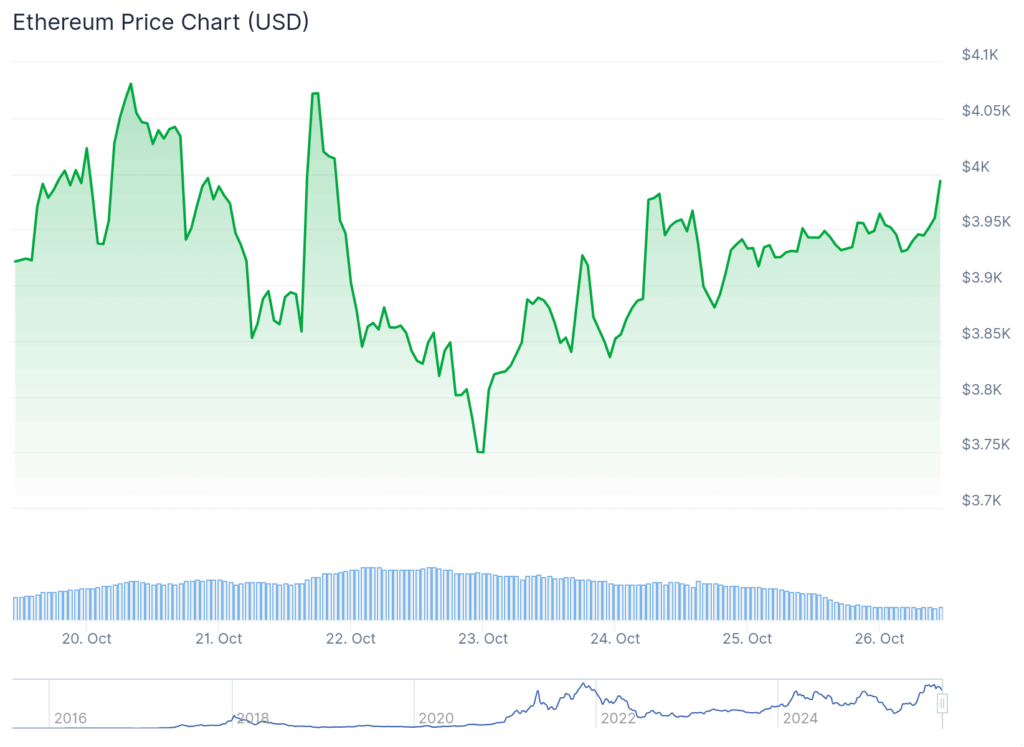

Ethereum’s been dancing across the $4,000 mark all week, testing resistance time and again however failing to stay the touchdown. The second-largest cryptocurrency is holding close to $3,900 — nonetheless strong — whilst $93 million flowed out of Ethereum ETFs. The short-term sentiment feels shaky, however long-term analysts are staying optimistic, with some nonetheless calling for an enormous run towards $10,000 and even past within the subsequent few years.

Quick-Time period Pullback, Lengthy-Time period Religion

Proper now, ETH is buying and selling round $3,926, with market cap hovering close to $474 billion and every day buying and selling quantity over $34 billion. Analysts like Ted Pillows assume a fast retest of the $3,800 degree might come earlier than the subsequent actual transfer larger. Traditionally, that zone has been a dependable help degree — the place patrons are likely to step in to cease additional drops. A clear bounce from there would possibly lastly give Ethereum the momentum to reclaim $4,000 convincingly.

On the ETF aspect, it’s been a tough stretch. BlackRock offered about $101 million price of ETH, contributing to $93 million in whole outflows throughout Ethereum ETFs. These institutional redemptions normally level to short-term warning — funds pulling again whereas the market cools off. Nonetheless, on-chain metrics stay sturdy, and plenty of traders are viewing this dip as nothing greater than a pause earlier than the subsequent push.

Analysts Nonetheless See a $10K–$20K Future

Regardless of the near-term wrestle, Ethereum’s big-picture outlook stays overwhelmingly bullish. Ali Martinez and Arthur Hayes each venture ETH climbing towards $10,000 by 2027, citing constant progress in DeFi exercise and institutional adoption. Hayes even known as latest volatility “simply noise in an uptrend.” In the meantime, Tom Lee says Ethereum’s truthful worth would possibly sit someplace between $12,000 and $22,000 — making present costs look virtually low cost by comparability.

Technically, ETH wants a every day shut above $4,000 to substantiate momentum, with the subsequent resistance sitting close to $4,140. If it breaks that, $5,000 turns into the subsequent apparent goal. But when worth dips beneath $3,800, merchants will probably be watching $3,550 because the essential help zone. Both approach, the sentiment is evident: short-term strain, long-term conviction. Ethereum would possibly simply be catching its breath earlier than the subsequent leg larger.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.