Bitcoin (BTC) stays in a consolidation section following the October 10 market crash, with bulls now pushing costs again above vital resistance ranges. The restoration towards the $115K area has renewed optimism throughout the market, because the month-to-month shut approaches and merchants anticipate a attainable shift in momentum.

In accordance with a number of analysts, this section might characterize the calm earlier than the storm, a typical sample seen earlier than massive directional strikes. On-chain knowledge and liquidity metrics recommend that capital is accumulating on the sidelines, able to rotate into Bitcoin as soon as clear bullish affirmation seems.

If BTC manages to interrupt above its earlier all-time excessive (ATH), analysts imagine it might set off a brand new impulsive section, just like the post-accumulation surges noticed in earlier bull cycles. Funding charges stay steady, suggesting that leverage remains to be reasonable — a constructive signal for a possible sustainable rally.

Moreover, liquidity focus close to key resistance zones signifies {that a} decisive breakout might shortly appeal to institutional and retail inflows. As volatility compresses and the market digests latest shocks, Bitcoin seems to be constructing energy for its subsequent main transfer, with liquidity and sentiment aligned for a attainable bullish continuation into November.

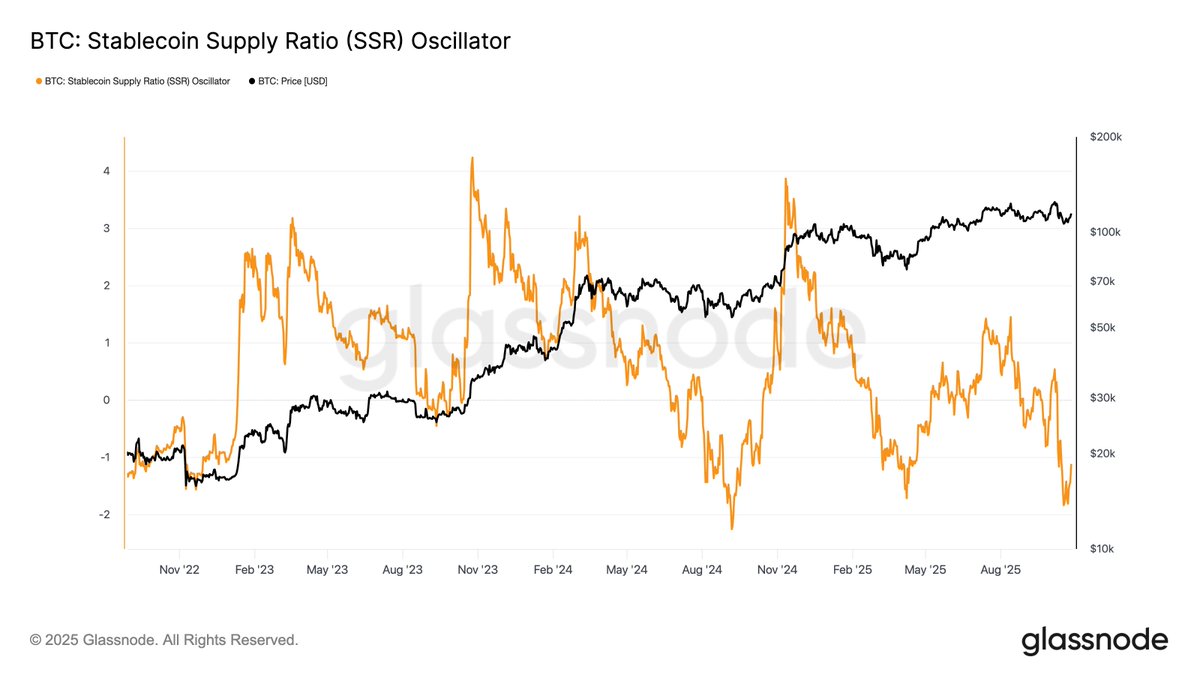

Bitcoin Liquidity Builds as Stablecoin Provide Ratio Hits Cycle Lows

In accordance with Glassnode knowledge, the Stablecoin Provide Ratio (SSR) Oscillator stays close to its cycle lows, signaling a interval of excessive stablecoin liquidity relative to Bitcoin’s market capitalization. In easy phrases, this implies there’s a substantial quantity of shopping for energy sitting in stablecoins — the digital money reserves of the crypto ecosystem — ready for the precise second to re-enter the market.

Traditionally, such circumstances have usually preceded main bullish phases for Bitcoin. When stablecoin liquidity is excessive, it implies that buyers are holding capital in readiness moderately than fleeing the market fully. As soon as market confidence strengthens, these reserves usually movement again into danger belongings like Bitcoin and Ethereum, making a wave of bid-side strain that fuels upward momentum.

In the mean time, Bitcoin is buying and selling simply above $115K, nonetheless recovering from the October 10 crash that disrupted short-term sentiment. But, regardless of latest volatility, liquidity indicators such because the SSR recommend that the market’s underlying construction stays wholesome. Stablecoins now characterize a good portion of whole crypto liquidity, and their abundance signifies that contributors are positioned to purchase the dip as soon as conviction returns.

Analysts interpret the present SSR development as a bullish latent sign, reflecting a macro setup just like these seen earlier than earlier enlargement phases. If Bitcoin manages to stabilize and reclaim larger ranges, the surplus liquidity sitting in stablecoins might act as a catalyst for a powerful impulse transfer, driving BTC towards a brand new cycle excessive. On this context, the SSR’s place close to historic lows would possibly characterize not only a signal of warning, however an early sign that the subsequent main liquidity-driven rally might already be forming beneath the floor.

BTC Retests Resistance as Bulls Regain Management

Bitcoin (BTC) continues its restoration, buying and selling round $115,300 after a powerful rebound from the $108K area earlier this month. The 12-hour chart reveals a transparent upward construction forming, with bulls now difficult the $117,500 resistance degree, a zone that has repeatedly acted as each help and rejection in latest months.

BTC is at the moment buying and selling above the 50-day and 100-day transferring averages, signaling renewed short-term energy, whereas the 200-day MA round $113K has was a stable help base. A sustained breakout above $117.5K might open the door for a transfer towards $120K–$123K, confirming a short-term impulsive section and doubtlessly restoring investor confidence after weeks of consolidation.

Quantity has been rising alongside value, suggesting real shopping for curiosity moderately than speculative spikes. Nonetheless, BTC’s momentum stays delicate to macroeconomic elements and liquidity circumstances. A rejection at this degree might result in one other retest of $111K, sustaining the consolidation vary.

General, Bitcoin’s present technical construction seems to be constructively bullish. If value manages to shut above $117.5K with sturdy quantity, it will probably affirm the tip of the post-crash stagnation and set the stage for a brand new leg larger, supported by enhancing liquidity and market sentiment.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.