- Hedera’s first U.S. ETF (HBAR ETF) launches Tuesday on Nasdaq by way of Canary Capital.

- The ETF advantages from new SEC itemizing requirements and automatic approval guidelines.

- Tight creation/redemption design and enterprise-focused tech might appeal to institutional capital.

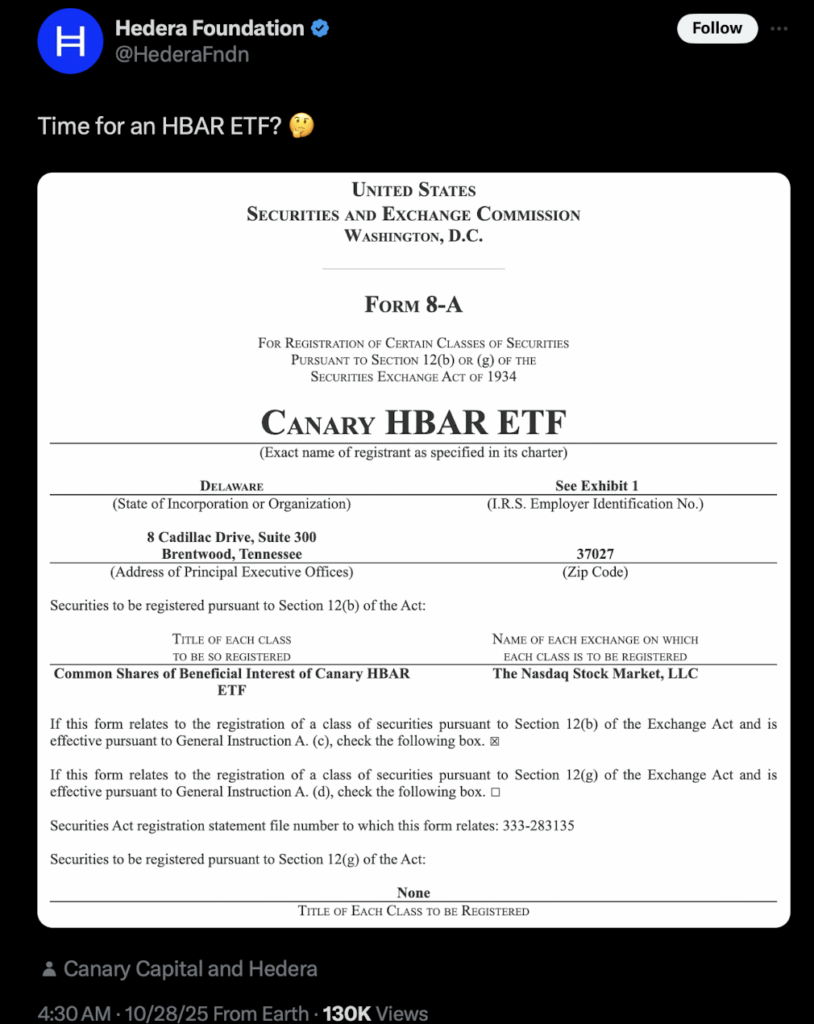

The crypto market is gearing up for one more huge second this week. Hedera’s native token, HBAR, is getting its first-ever U.S. exchange-traded fund (ETF), courtesy of Canary Capital. The fund — merely known as the HBAR ETF — will begin buying and selling on Nasdaq alongside Canary’s Litecoin ETF, marking a recent wave of institutional entry to digital property.

Canary’s CEO, Steven McClurg, confirmed the launch after the agency wrapped up its required filings with the SEC earlier this week. The transfer comes as regulators undertake a extra streamlined course of below the so-called “shutdown playbook,” which permits ETF registrations to go efficient mechanically after 20 days if no delaying amendments are in place.

A Strategic Launch Amid SEC Coverage Shifts

The timing isn’t random. Simply final month, the SEC launched new generic itemizing requirements permitting exchanges to listing spot commodity ETFs quicker — a significant change from the lengthy, bespoke evaluation course of used earlier than.

That shift, mixed with non permanent shutdown steering from the SEC’s CorpFin division, explains how a number of crypto ETFs — together with Bitwise’s Solana ETF on the NYSE and Canary’s HBAR and Litecoin ETFs on Nasdaq — are hitting the market at practically the identical time.

For Hedera, this debut means extra than simply publicity. It’s a key step towards mainstream adoption, giving registered funding advisors (RIAs) and institutional gamers a compliant, brokerage-accessible method to put money into HBAR with out managing non-public wallets or coping with direct custody.

Market watchers say early buying and selling flows will reveal how a lot urge for food there’s for enterprise-grade Layer 1 blockchain publicity in conventional finance. It’ll additionally present whether or not capital from offshore ETPs or centralized exchanges begins migrating into these newly permitted U.S. automobiles.

Why This HBAR ETF Is Completely different

This isn’t simply one other crypto ETF launch. The HBAR ETF stands aside from earlier Bitcoin and Ethereum merchandise in a few necessary methods.

First, its creation and redemption mechanics — based mostly on newer ETF guidelines — are designed to maintain its market value tightly aligned with web asset worth (NAV). That’s an enormous enchancment over early crypto funds that always traded at large premiums or reductions.

Second, Hedera’s distinctive Hashgraph expertise and its enterprise-focused governance mannequin make it a non-EVM different in a market dominated by Ethereum-compatible networks. For portfolio managers who need to diversify past EVM-based good contract platforms, this might be a refreshing choice.

If Canary’s ETF attracts sturdy liquidity and maintains tight spreads from day one, analysts count on different issuers to observe shortly with their very own HBAR merchandise — very similar to what occurred with Solana’s ETF lineup earlier this 12 months.

The Larger Image: Timing, Volatility, and Market Temper

The launch additionally arrives at an fascinating macro second. This week’s lineup contains main tech earnings and an upcoming FOMC choice, each of which might shake investor sentiment throughout threat property.

How the HBAR ETF performs in its opening days will rely upon whether or not consumers deal with it as a long-term automobile for publicity or as a short-term speculative commerce. The steadiness between main market creations (recent inflows) and secondary market buying and selling will reveal whether or not it turns into a liquidity magnet — or simply one other volatility amplifier in an already unpredictable market.

Both means, this launch alerts one thing larger: Hedera is stepping firmly into Wall Road’s enjoying discipline. And if historical past’s any information, as soon as institutional doorways open, capital not often stays on the sidelines for lengthy.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.