- XRP analyst Darkish Defender says XRP’s bullish construction is sort of full, with resistance at $2.85 and $5.85 in sight.

- XRP’s robust $2.22 help stays key as momentum builds for a possible breakout.

- CoinCodex sees XRP hitting $5 by 2029, however merchants are looking forward to a short-term surge if the orange resistance breaks.

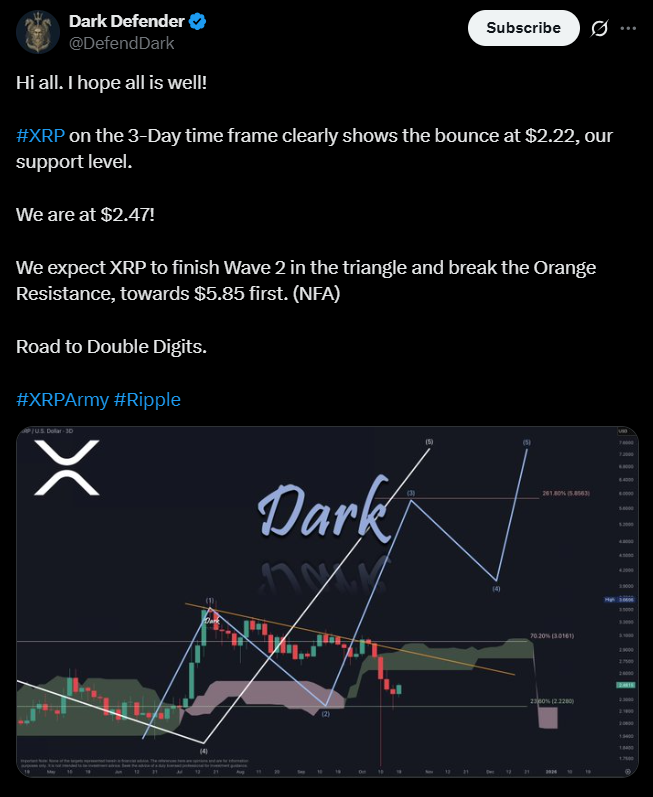

In keeping with crypto analyst Darkish Defender, XRP could also be on the verge of a significant bullish transfer after holding agency across the $2.22 help degree. In his newest publish, the analyst famous that XRP’s 4-hour and 3-day charts present the token finishing a key construction, with momentum indicators such because the RSI aligning carefully with situations seen earlier than XRP’s earlier rallies. “We will count on strikes contained in the triangle beneath,” he stated, “and all people will swap to bullish very quickly after XRP breaks the orange resistance.”

Resistance and Help Ranges to Watch

Darkish Defender’s chart identifies $2.22 as robust help — the place XRP lately bounced — and descriptions $2.85 and $5.85 as the following key resistance ranges. The analyst expects XRP to complete its present Wave 2 inside this triangular construction earlier than breaking upward, probably initiating a rally towards the $5.85 goal. He even hinted at a “street to double digits” in the long term, suggesting broader optimism for Ripple’s value trajectory as soon as the breakout is confirmed.

Broader Market and Lengthy-Time period Outlook

Whereas short-term technicals look favorable, different platforms like CoinCodex provide a extra conservative outlook. Their mannequin forecasts XRP buying and selling close to $2.63 in November, with a gradual climb to round $5 by 2029. This divergence highlights how XRP’s long-term efficiency might rely not simply on chart buildings, but additionally on macroeconomic situations and broader adoption of Ripple’s cost options.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.