Each time the market experiences even a small surge, buyers rapidly start speculating whether or not an altcoin season is perhaps across the nook. This cycle has repeated itself by way of each main crypto bull run. Bitcoin often leads the preliminary restoration, setting off optimism, after which capital begins rotating into smaller belongings with larger danger and reward profiles.

Altcoins are the beneficiaries of this enthusiasm, typically seeing fast value actions as soon as confidence returns. With indicators throughout the market exhibiting renewed momentum and liquidity starting to rise once more, sentiment is popping more and more bullish. This might set the stage for a strong transfer in altcoins which have been consolidating and quietly constructing robust fundamentals.

Charge Reduce Expectations, Stablecoin Enlargement, and Altcoin Potential

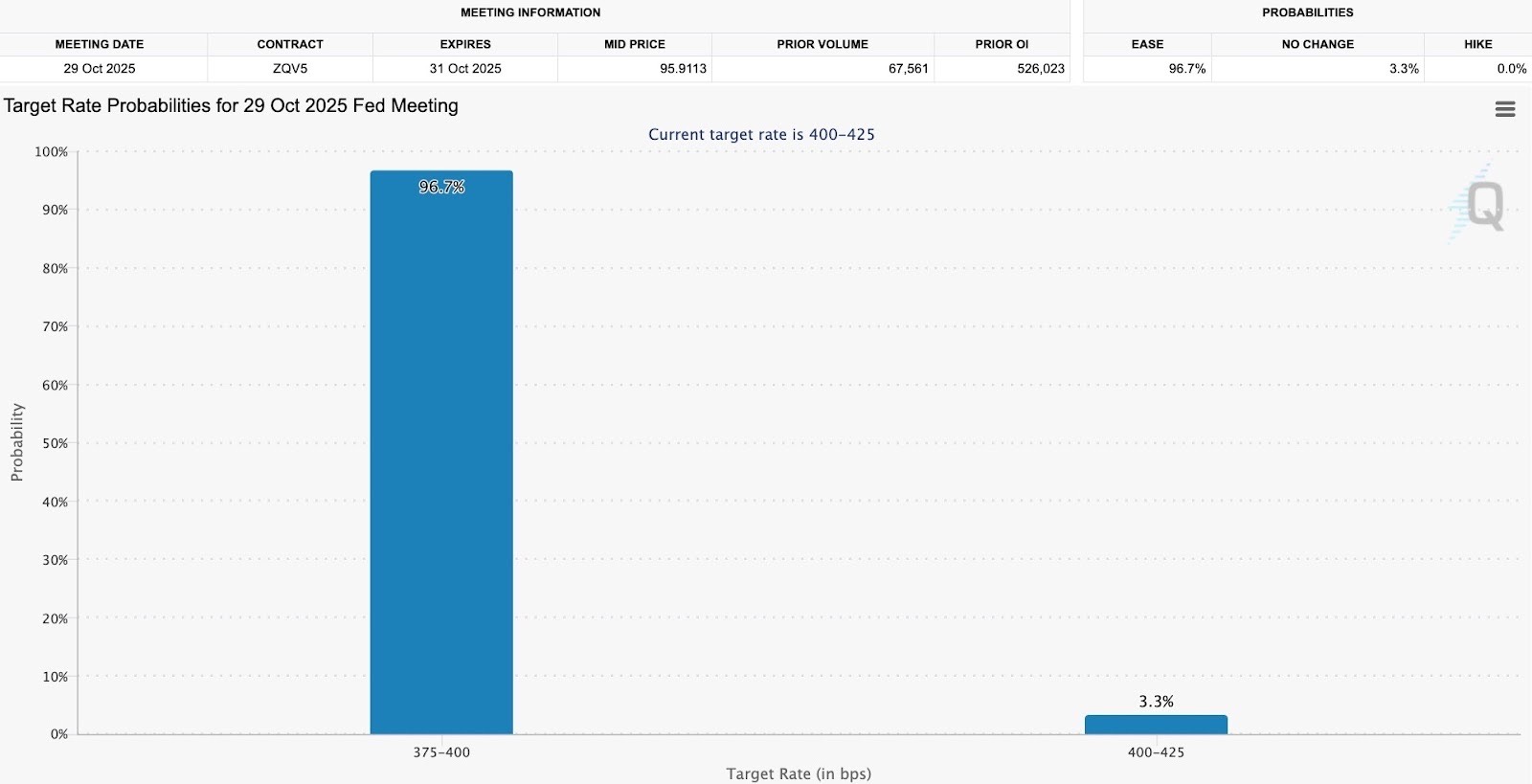

In keeping with the newest CME information, merchants are assigning a 97.8% likelihood of a 25 foundation level fee lower within the upcoming Federal Reserve assembly on Wednesday. Such an amazing consensus itself acts as a catalyst, reflecting market-wide anticipation of simpler financial situations.

The final time the Fed delivered constructive information aligned with dovish coverage expectations, the crypto market skilled a broad rally inside days, led initially by Bitcoin earlier than capital rotated into altcoins.

This time, the setup seems comparable however probably stronger. Liquidity situations are enhancing, and macro sentiment is tilting towards danger belongings. What is especially noteworthy is the latest $8.5 billion improve in circulating stablecoins from issuers corresponding to Tether and Circle following the market correction earlier this month.

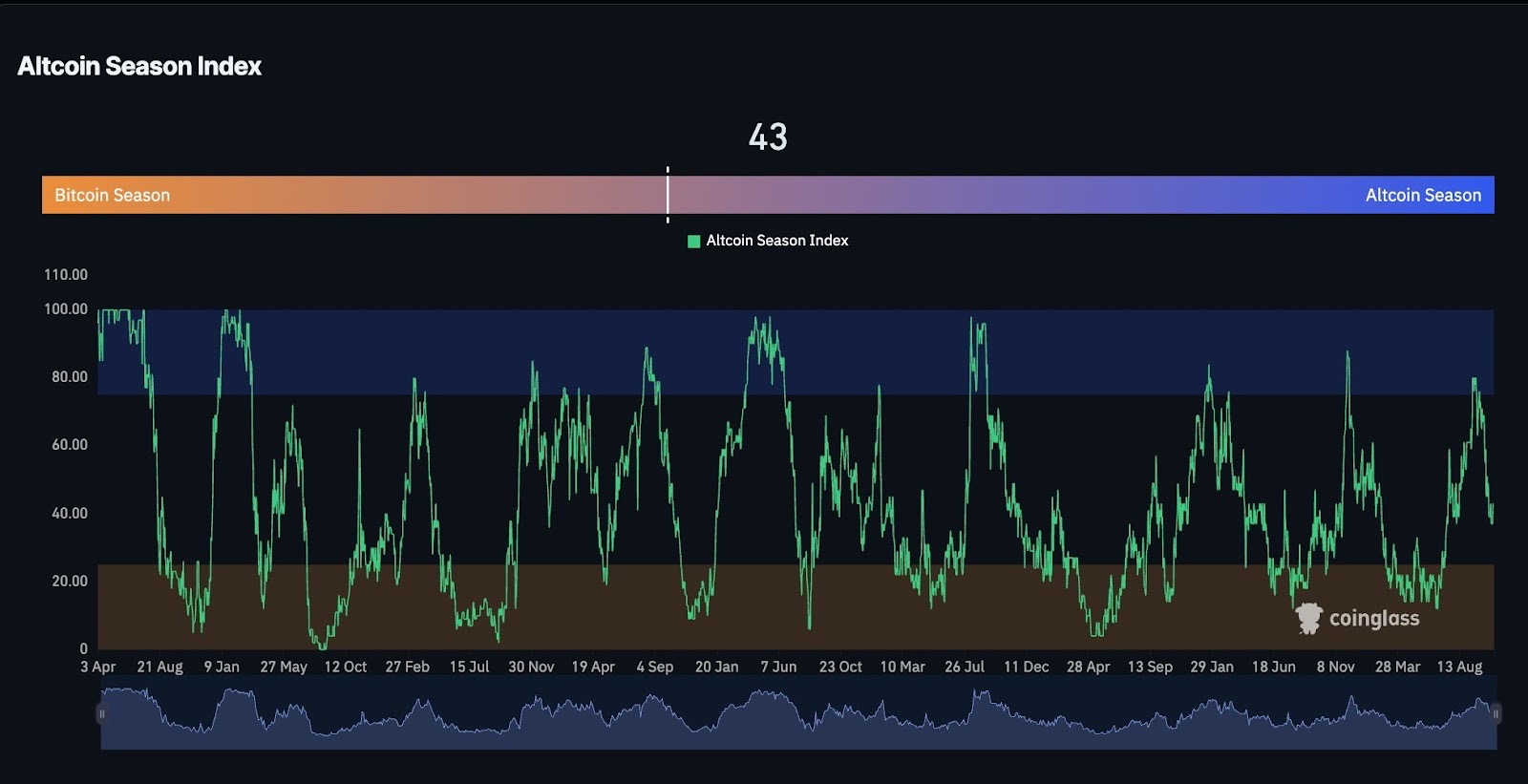

Traditionally, surges in stablecoin provide have preceded robust shopping for exercise throughout exchanges, as new liquidity flows into digital belongings searching for yield or speculative alternative. Regardless of these bullish undercurrents, it isn’t but formally altcoin season, in line with the Altcoin Season Index, which at present stands at 43.

Altcoin season is usually declared when the index crosses above 75, a degree that alerts that almost all of top-performing belongings have began outperforming Bitcoin. The present studying due to this fact means that the market remains to be in its accumulation part, a stage that always precedes probably the most explosive upside strikes as soon as rotation begins.

The chart information reinforces this interpretation. The index exhibits prior surges into altcoin season territory adopted by resets that allowed capital to consolidate earlier than the following leg larger. With Bitcoin dominance nonetheless comparatively robust and danger urge for food progressively rising, this positioning signifies that the following main transfer may favor altcoins as confidence builds.

Combining the macro tailwinds of a possible fee lower, the seen rise in stablecoin liquidity, and the early-stage metrics on the altcoin index, situations are forming that might precede a major rotation. Buyers anticipating this shift could discover that the current second, earlier than the official onset of altcoin season, gives a number of the greatest uneven alternatives for figuring out excessive potential tokens earlier than the broader crowd takes discover.

Finest Crypto to Purchase Now – Undervalued Tokens to Purchase

Finest Pockets Token

Finest Pockets Token has develop into some of the promising belongings within the rising intersection between self-custody, person expertise, and AI-driven analytics. As Web3 matures, the necessity for accessible but highly effective pockets infrastructure has develop into one of many market’s defining challenges. Finest Pockets has managed to show that problem into its power.

The platform gives a unified gateway for DeFi, buying and selling, and NFT administration throughout a number of chains whereas introducing clever pockets options that simplify the complexities of Web3 for each new and skilled customers.

On the core of this ecosystem lies the BEST token, which acts because the utility and governance spine. It’s used to unlock unique pockets options, earn tiered staking advantages, and take part in early-access token launches built-in inside the Finest Pockets ecosystem.

What units it aside is how seamlessly it fuses user-centric design with on-chain intelligence. Its AI-powered assistant helps customers uncover new tokens, handle portfolios, and determine yield alternatives with real-time market evaluation immediately embedded within the pockets interface.

💥 $16M Raised & Counting! 💥

We’re constructing the pockets for the following period of crypto:

✅ Purchase new tokens early, immediately in-app

✅ Purchase and swap throughout chains in a single place

✅ Full portfolio management, no muddleObtain the app at this time! 📲 https://t.co/Ykt3PTsnvy pic.twitter.com/aKKy9x1LMu

— Finest Pockets (@BestWalletHQ) September 22, 2025

The undertaking’s success to this point speaks volumes. Having raised over $16 million, it has already constructed a robust basis of credibility in a crowded market. The rise in adoption mirrors broader investor urge for food for self-custodial options, particularly as centralized platforms proceed to face scrutiny.

If the anticipated fee cuts and contemporary liquidity inflows do set off an altcoin rally, Finest Pockets Token may simply develop into one of many standout performers of the cycle. It combines performance, development readiness, and robust token utility, three traits that always precede exponential returns throughout altcoin season.

Sei

Sei is at present some of the technically superior Layer 1 networks within the digital asset area, designed particularly for trading-focused purposes.

In contrast to general-purpose chains that always wrestle with transaction congestion, Sei introduces a extremely optimized parallel execution engine that allows sub-second finality and minimal transaction price. This makes it notably engaging for decentralized exchanges, prediction markets, and real-time on-chain buying and selling instruments that depend upon velocity and reliability.

Its structure incorporates native order-matching logic and front-running prevention, making a framework that feels tailored for the following era of on-chain buying and selling protocols.

The ecosystem has been increasing quickly, with builders migrating to Sei to construct merchandise that profit from its unmatched efficiency layer. As liquidity and person numbers proceed to rise, Sei’s function within the broader DeFi ecosystem is starting to reflect what Solana as soon as represented in its early breakout part.

Regardless of this accelerating development, Sei’s market capitalization stays beneath $1.3 billion, a determine that seems considerably undervalued when in comparison with friends providing comparable throughput. Even a modest revaluation to $3 billion would signify greater than a twofold achieve, which appears attainable given its tempo of adoption and developer engagement.

This makes Sei an interesting choice for buyers seeking to accumulate earlier than the following liquidity wave hits altcoins. With the Fed poised for a fee lower and stablecoin inflows surging, situations are aligning completely for infrastructure tokens like Sei to seize renewed momentum. In a market looking for velocity, scalability, and dependability, Sei delivers all three with clear precision.

Bitcoin Hyper

Bitcoin Hyper has gained visibility throughout the crypto group as some of the formidable makes an attempt to increase Bitcoin’s performance past its conventional limitations. As a Bitcoin Layer 2, it allows sooner, cheaper transactions and introduces programmable utility by way of EVM compatibility, permitting builders to construct decentralized purposes and monetary instruments that anchor themselves in Bitcoin’s unmatched safety base.

What makes Bitcoin Hyper stand out isn’t just its technical proposition however its timing. The crypto market at present sits between cycles, with Bitcoin dominance elevated however altcoin valuations nonetheless compressed. Traditionally, this stage has been the incubation interval for the following era of high-growth belongings.

Bitcoin Hyper’s ecosystem growth, which incorporates liquidity bridges, DeFi integrations, and plans for interoperability with different main networks, positions it as a core contender for the upcoming wave of capital rotation. This method has resonated with merchants and analysts alike, together with influencers corresponding to Austin Hilton, who’ve highlighted its potential to bridge Bitcoin’s dominance with the innovation seen on newer sensible contract platforms.

Furthermore, Bitcoin Hyper advantages from the psychological benefit of affiliation. Buyers are naturally drawn to belongings that join on to Bitcoin’s id whereas providing the pliability of a high-performance chain.

As confidence rebuilds throughout the market and liquidity flows improve, notably following the $8.5 billion stablecoin injection and expectations of a dovish Fed, Bitcoin Hyper’s twin positioning as each a Layer 2 resolution and a narrative-driven token may propel it into the highlight.

If the market’s subsequent part certainly favors utility-backed altcoins, Bitcoin Hyper may emerge as one in all its defining leaders.

Pepenode

Pepenode represents some of the artistic evolutions within the meme coin panorama, bringing real on-chain utility to an area that has lengthy relied on hype alone. It blends the cultural energy of memes with the technological spine of decentralized mining, particularly a mine-to-earn mannequin that permits customers to generate tokens by way of participation somewhat than hypothesis.

This construction has given Pepenode an id far past its playful mascot. It operates as a gamified mining community the place holders can contribute computational sources or full interactive duties to earn rewards, making a dynamic and participatory ecosystem that sustains person engagement.

The undertaking has already gained vital traction, elevating over $1 million in its early part. That achievement displays greater than retail enthusiasm, it exhibits a rising urge for food for meme-driven initiatives that mix creativity with financial substance. Pepenode’s mining mechanism not solely introduces actual engagement but additionally decentralizes token distribution, which strengthens its long-term sustainability.

Its tokenomics are designed to encourage group participation whereas sustaining shortage, and the undertaking’s increasing social presence throughout Telegram and X has helped it construct some of the vocal rising communities within the meme sector.

Altcoin season has not but begun, however speculative momentum is quietly returning, and tokens with energetic communities are inclined to outperform as soon as rotation begins. The infusion of over $8.5 billion in new stablecoins means that liquidity is able to re-enter danger belongings, and meme cash with actual performance like Pepenode are prone to be among the many earliest beneficiaries.

For buyers in search of comparable cryptos with potential, our repeatedly up to date information on one of the best crypto to purchase now may very well be a very good place to begin their analysis.

Its mixture of tradition, innovation, and financial design locations it able to carry out strongly as soon as the broader market turns. For buyers searching for early publicity to artistic initiatives with natural development potential, Pepenode gives exactly the type of uneven alternative that defines pre-altcoin season accumulation phases.

Conclusion

Because the market edges nearer to a decisive part, the present mixture of liquidity development, dovish financial expectations, and regular investor optimism presents a uncommon alternative. The broader sentiment stays cautiously constructive, with Bitcoin’s power setting the muse for the following capital rotation.

As soon as confidence spreads and the altcoin index begins its climb, early-positioned belongings with actual use circumstances and engaged communities typically lead the rally. The initiatives highlighted above align strongly with that sample. Their rising ecosystems, practical depth, and early-stage valuations make them effectively positioned to seize momentum as soon as the following true altcoin season lastly begins to unfold.