Be part of Our Telegram channel to remain updated on breaking information protection

S&P World slapped a junk ranking on Michael Saylor’s Technique, citing its heavy reliance on risky Bitcoin and restricted greenback liquidity.

The credit standing company initiated protection of the Bitcoin treasury agency with a B- ranking, six notches beneath funding grade, saying it has “speculative credit score high quality with elevated default threat.”

It pointed to the agency’s concentrated Bitcoin holdings, slender enterprise focus, and weak risk-adjusted capitalization as key weaknesses.

S&P additionally warned of an “inherent forex mismatch,” noting that every one of Technique’s debt is denominated in US {dollars} whereas almost all its property are held in Bitcoin. A pointy drop in BTC’s worth, it mentioned, might pressure the corporate to promote holdings at a loss to fulfill obligations, creating potential liquidity stress.

Saylor Lauds ‘First-Ever’ Ranking For A Crypto Treasury Agency

Nonetheless, Saylor took to X to have fun the event, calling it the “first-ever” ranking for a Bitcoin treasury agency from a “main credit standing company.”

S&P World Rankings has assigned Technique Inc a ‘B-‘ Issuer Credit score Ranking (Outlook Steady) — the first-ever ranking of a Bitcoin Treasury Firm by a significant credit standing company. https://t.co/WLMkFqkkCb

— Michael Saylor (@saylor) October 27, 2025

Others within the trade echoed Saylor’s remarks. Amongst them was KindlyMD CEO David Bailey, who predicted that the “market demand for treasury corporations is about to blow up” following the ranking.

Rankings are a requirement for a lot of pension funds and different institutional buyers to have the ability to spend money on company paper.

Technique Shares Climb

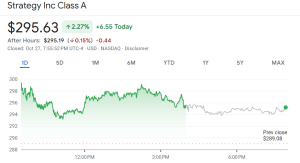

Technique shares climbed greater than 2% yesterday, however have slumped 9% prior to now month and greater than 19% in six months, in line with Google Finance.

MSTR worth (Supply: Google Finance)

Technique Retains On Shopping for

Technique, which was once an enterprise software program firm, makes use of virtually all of its extra money to buy BTC and develop its reserves. It additionally points convertible debt, most well-liked inventory, and fairness to lift capital for Bitcoin buys.

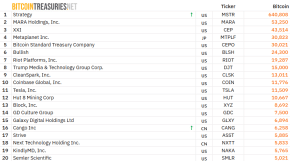

Since Technique began buying Bitcoin again in 2020, the corporate has turn out to be the biggest BTC treasury agency globally. Knowledge from Bitcoin Treasuries exhibits that Technique has collected 640,808 BTC over time. At present costs, this values the holdings at roughly $72.97 billion.

Technique can be sitting on an unrealized acquire of over 52%, which equates to greater than $25.53 billion.

High 20 company BTC holders (Supply: Bitcoin Treasuries)

Lately, nevertheless, Technique and different digital asset treasury corporations have confronted stress on account of their declining inventory costs, which has hindered their means to lift extra capital for extra buys.

Regardless of that, Technique has continued to buy Bitcoin at the same time as different crypto treasury corporations hit the brakes.

Technique’s newest Bitcoin purchase was on Oct. 27, when the agency bought one other 390 BTC for round $42.4 million at a mean worth of $111,117 per coin.

Technique has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/1d4Pmv8ub2

— Michael Saylor (@saylor) October 27, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection