Bitcoin (BTC) is trying to reclaim key resistance ranges this week as merchants brace for the US Federal Reserve assembly later at the moment—a pivotal occasion that would set the tone for danger property heading into November. Market volatility has tightened in latest days, with buyers watching whether or not the Fed will keep its restrictive coverage or trace at easing amid slowing macro indicators.

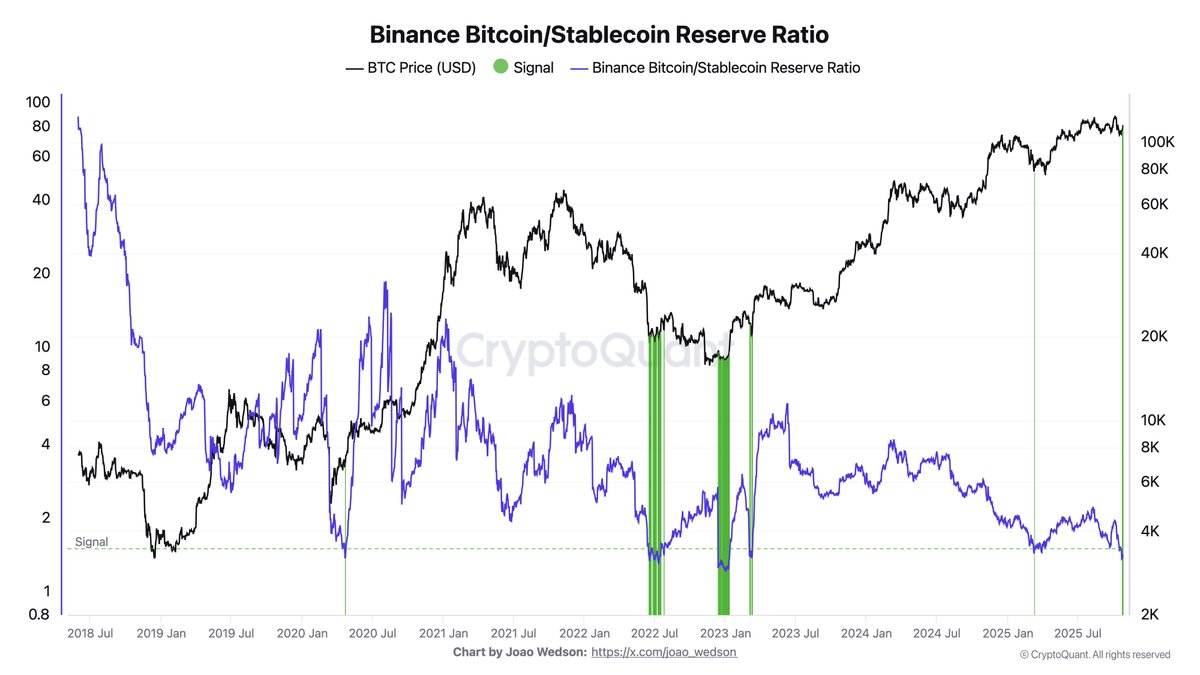

In accordance with high analyst Darkfost, on-chain information reveals that the BTC Stablecoin Reserve Ratio on Binance is as soon as once more flashing a purchase sign, a sample that has traditionally preceded upward value actions. The sign follows weeks of market turbulence triggered by the October tenth liquidation occasion, which erased billions in leveraged positions throughout exchanges. The ensuing spillover within the derivatives market additionally rippled into spot markets, amplifying volatility and testing investor conviction.

Whereas some members opted to hedge or rotate into stablecoins, others noticed the downturn as an accumulation alternative—a dynamic now mirrored in Binance’s shifting reserve ratios. As Bitcoin consolidates round vital ranges, merchants are positioning for what might be the subsequent vital transfer, with macro coverage and liquidity situations doubtless dictating route.

Bitcoin Indicator Flashes Purchase Sign For The Third Time This Cycle

In accordance with on-chain analyst Darkfost, the latest market exercise has triggered main shifts inside Binance reserves, each in stablecoins and BTC holdings. Amid the post-liquidation restoration, one clear development has emerged from the noise: the BTC/Stablecoin reserve ratio on Binance is now flashing a purchase sign for the third time this cycle—a sample that has traditionally preceded sturdy upward strikes in Bitcoin’s value.

Darkfost notes that this similar sign has appeared at vital turning factors previously. In January 2023, Bitcoin rallied from $16,600 to $24,800. The second occasion, in March 2023, preceded a surge from $20,300 to $73,000, marking the start of a serious bullish part. The latest prevalence, in March 2025, was adopted by one other substantial transfer from $78,600 to $123,500.

This recurring sign displays a structural change inside Binance’s reserves: stablecoin holdings are rising relative to BTC reserves. In different phrases, there’s a rising quantity of stablecoins able to enter the market whereas BTC reserves proceed to fall. Such a dynamic usually creates situations for a provide shock, the place shopping for demand begins to outpace accessible provide, setting the stage for a possible bullish reversal.

What makes this setup notably notable is its context. This sample normally varieties throughout bear markets or following deep corrections, when accumulation phases start to rebuild market power. Seeing it develop now—whereas Bitcoin consolidates close to key assist ranges—is uncommon and suggests that enormous holders and institutional members might already be positioning for the subsequent main upward part.

Bitcoin Faces Resistance As Bulls Try To Reclaim Momentum

Bitcoin (BTC) is consolidating round $112,900, displaying early indicators of restoration after bouncing from its 200-day transferring common (purple line) close to $108,000. The value construction means that BTC is trying to regain bullish momentum however continues to face notable resistance at $117,500, a degree that has capped a number of rallies since late August.

The 50-day (blue) and 100-day (inexperienced) transferring averages at present converge round $114,000–$115,000, reinforcing this zone as a short-term barrier. A clear break and every day shut above this space would affirm renewed shopping for power and probably set off a transfer towards $120,000–$123,000, the place prior liquidity clusters exist.

On the draw back, the 200-day MA stays the vital assist to observe. So long as Bitcoin holds above it, the broader uptrend construction stays intact, regardless of latest volatility. An in depth under $108,000, nevertheless, may expose BTC to a deeper correction towards $102,500, the place the subsequent vital assist lies.

Market members seem cautious forward of the Federal Reserve assembly this Wednesday, with merchants balancing macro uncertainty towards enhancing on-chain metrics. The continuing consolidation might subsequently act as a pre-breakout accumulation part, with a decisive transfer prone to observe as soon as coverage readability and liquidity route are established.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.