The pre-FOMC dip in Bitcoin seems to be regular, with good assist at round 112K. Buying and selling above 120K will open the door to 143K, in response to analysts and pricing fashions.

Bitcoin has simply entered a downturn, however has remained secure at an important assist of $112,000. This was attributed by market watchers as a typical pre-FOMC correction, the place no important detrimental adjustments could be had. This hunch is mostly perceived to be a ground take a look at and never a change in path.

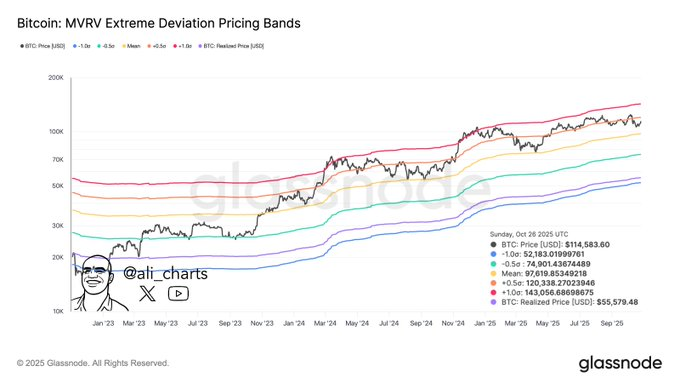

Why $120,000 Is the Essential Threshold

Analysts observe that Bitcoin has to clear 120,000 to set the stage of a strong upsurge.

The long-term worth ranges indicate that exceeding this level would eradicate previous resistance and create area to the following huge goal at round 143, 000.

These bands are based mostly on on-chain knowledge they usually are likely to act as freeway lanes guiding the next worth actions.

In line with one chart by Ali Charts, the Bitcoin worth is near this necessary band of $120K, pending as it’s proper beneath it.

Supply – Ali_charts x

When reclaimed, the path seems much less congested till it reaches the higher band close to $143,000. This milestone isn’t assured, however very more likely to be achieved when over $120K is reached.

The Help at $112,000 Holds

The present dip is regular, as defined by one other in style opinion of CryptoMichNL on X.

Supply: CryptoMichNL X.

Bitcoin is testing its decrease restrict across the stage of $112,000, and it mustn’t lose this stage to maintain the uptrend. In case this stage continues, the market could begin transferring upward once more very quickly.

Glassnode market knowledge present a provide of latest consumers close to $111,000, with sellers more likely to be discovered round $117,000. This tug of warfare establishes a worth vary that preconditions the following breakout.

In a nutshell, a short-term decline in Bitcoin earlier than the announcement of the Federal Reserve is regular.

The bulls want to interrupt via on the extent of 120,000, and I suppose it might open the gates to a rush to 143,000. The assist of 112,000 can also be essential in direction of protecting the bullish momentum.