Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged down a fraction of a p.c up to now 24 hours to commerce at $113,618 as of 4:03 a.m. EST on buying and selling quantity that jumped 25% to $67.4 billion.

Merchants are positioning cautiously forward of the Federal Open Market Committee (FOMC) rate of interest resolution immediately, which is extensively anticipated to see a 25 foundation level lower within the benchmark price.

⚠️ Volatility Alert 🎢

Fed price lower resolution immediately at 11:30 pm (IST)

Crypto market is in strain and #Bitcoin caught between $110K and $116K as the general public await Fed price resolution and US-China deal. pic.twitter.com/rzjw2rax64

— BITCOIN EXPERT INDIA (@Btcexpertindia) October 29, 2025

Whereas already priced in, it might be a constructive for higher-risk property like crypto as a result of it’s going to assist increase liquidity by decreasing the price of capital.

Merchants are rigorously watching the liquidity scenario following indicators of renewed stress amongst US regional banks, and a still-uncertain international macro setting.

Can a price lower push the worth of Bitcoin increased?

Bitcoin Worth Consolidates Close to Key Help As Bulls Defend $113K Area

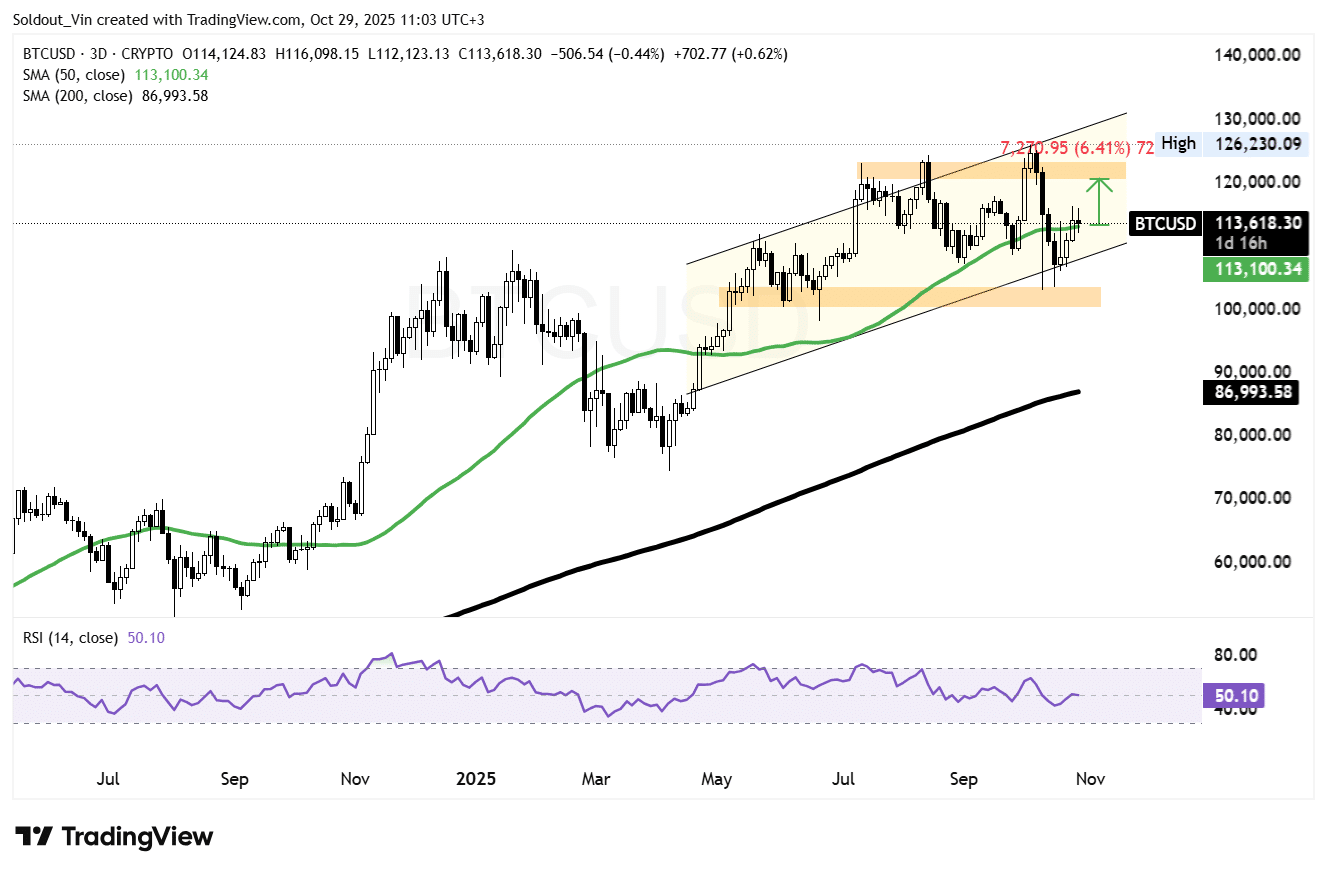

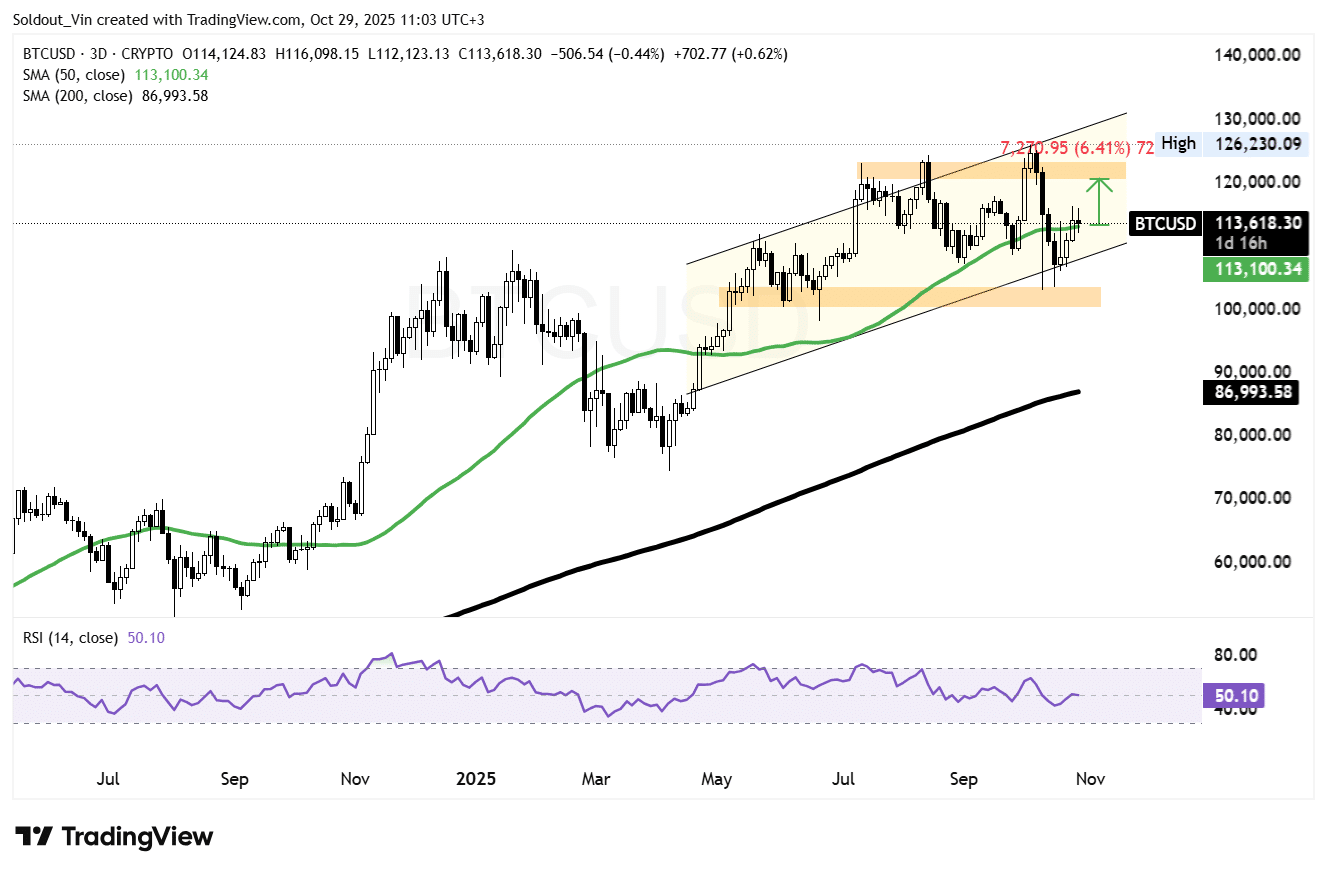

The BTC worth is displaying early indicators of exhaustion after failing to maintain momentum above the $120,000 zone, because the market consolidates inside a narrowing, rising channel.

At the moment buying and selling round $113,618, the Bitcoin worth is holding barely above the 50-day Easy Transferring Common (SMA) at $113,100, a crucial short-term help degree that has guided the bullish rally since mid-2025.

The worth of BTC motion has turned cautious after a number of rejections close to the higher boundary of the rising channel, round $126,000, the place sellers have persistently capped any makes an attempt to interrupt out. This zone has now grow to be the first resistance degree for Bitcoin’s worth.

In the meantime, the 200-day SMA, at present round $86,993, stays properly beneath the BTC worth, reinforcing the macro construction’s bullishness.

Nonetheless, the short-term trajectory is more and more fragile because the 50-day SMA flattens, suggesting a possible lack of upward momentum.

The Relative Power Index (RSI) stands at 50.10, indicating that BTC is in equilibrium, neither strongly bullish nor bearish. This implies the market is in a part of indecision, awaiting a catalyst to find out the subsequent main transfer, on this case, the FOMC resolution.

BTC Targets The $120,800 Zone

From a structural standpoint, the $113,000–$115,000 zone now serves because the make-or-break help space, aligning carefully with the 50-day SMA and the mid-range of the rising channel sample.

A rebound from this degree may spark renewed shopping for curiosity and drive the value of BTC again towards the $126,600 resistance band, roughly 6.4% from the present ranges.

Conversely, an in depth beneath $113,000 might set off deeper promoting strain, exposing the $105,000–$100,000 area, which coincides with the decrease boundary of the rising channel boundary, which can also be a traditionally robust demand zone.

This bearish sentiment is supported by TD Sequential, drawn by standard analyst on X, Ali Martinez, who says the sequence is flashing a promote sign.

TD Sequential has known as each Bitcoin $BTC swing.

– July: Promote = 7% correction

– August: Promote = 13% correction

– Early September: Purchase = 10% rebound

– Late September: Purchase = 15% rally

– Early October: Promote = 19% correctionIt’s now flashing a promote sign! pic.twitter.com/kNoxWiY14l

— Ali (@ali_charts) October 29, 2025

For now, Bitcoin merchants stay cautious, with sentiment balanced between bullish channel help and resistance strain close to all-time highs, because the FED price lower resolution looms.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection