Spot Bitcoin exchange-traded funds within the U.S. confronted a pointy reversal on Wednesday, recording their largest outflows in two weeks simply because the Federal Reserve decreased rates of interest by 25 foundation factors.

The coverage shift triggered turbulence throughout each conventional and digital markets, briefly pushing Bitcoin all the way down to $109,000 earlier than a modest rebound.

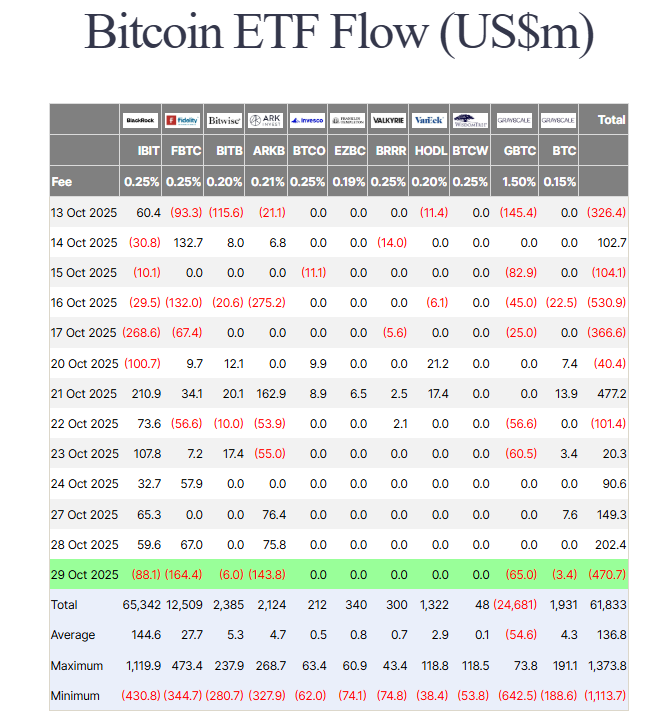

Knowledge from Farside Traders exhibits {that a} complete of $470 million exited Bitcoin ETFs in the course of the session. Constancy’s FBTC led the withdrawals with $164 million, adopted by ARK Make investments’s ARKB with $143 million and BlackRock’s IBIT, which noticed $88 million go away the fund. Grayscale’s GBTC misplaced one other $65 million, whereas Bitwise’s BITB registered smaller outflows of round $6 million.

The setback got here after a constructive begin to the week that noticed roughly $350 million in mixed inflows on Monday and Tuesday. Following Wednesday’s withdrawals, complete internet inflows throughout all U.S.-listed Bitcoin ETFs slipped to $61 billion, based on information from SoSoValue. Belongings beneath administration now stand close to $149 billion, equal to about 6.7% of Bitcoin’s market capitalization.

The Fed’s resolution to decrease charges – its second consecutive minimize – did not raise threat urge for food. Traders seem unsure about how lengthy financial easing will proceed amid persistent inflation issues. Markets steadied later within the day after studies of a gathering between U.S.

President Donald Trump and Chinese language President Xi Jinping, which hinted at potential progress on commerce relations. Regardless of the day’s turbulence, Bitcoin ETFs stay a dominant power in institutional holdings, collectively managing greater than 1.5 million BTC price an estimated $169 billion. BlackRock’s IBIT continues to guide the group with over 805,000 BTC, trailed by Constancy’s FBTC and Grayscale’s GBTC.

Market volatility has finished little to dampen long-term optimism amongst main Bitcoin backers. MicroStrategy chairman Michael Saylor reiterated his bullish view earlier this week, predicting that Bitcoin may attain $150,000 by the top of 2025 as adoption and institutional publicity deepen.