• Fed indicators fewer charge cuts forward, sparking a risk-off wave.

• Trump–Xi talks disappoint, reigniting trade-war fears.

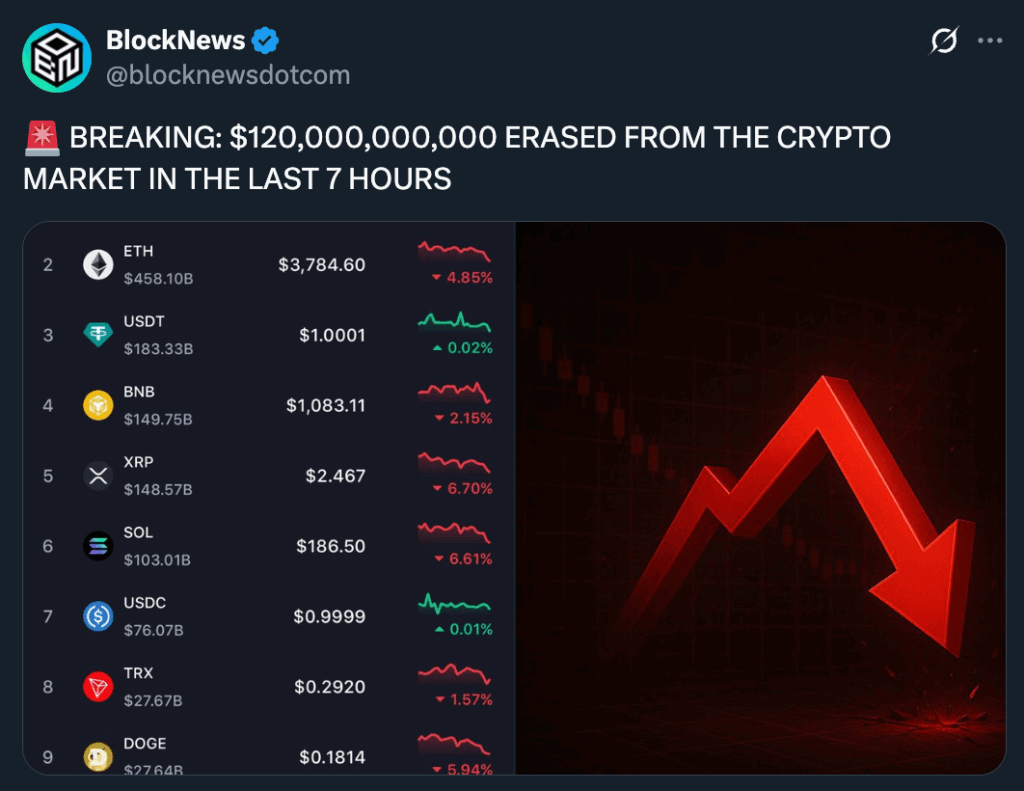

• $800M in leveraged liquidations wipe out $120B in crypto market worth.

The crypto market nosedived Wednesday after the Federal Reserve introduced a smaller-than-expected charge lower and hinted that future reductions is probably not assured. Traders had priced in aggressive easing, anticipating a number of cuts by means of early 2026 — however the Fed’s cautious tone crushed that optimism.

Bitcoin and Ethereum each tumbled as threat sentiment evaporated, dragging the broader market with them. Merchants who had positioned for a dovish shock discovered themselves caught in a sell-the-news wave that rapidly cascaded throughout the board.

When the central financial institution indicators slower stimulus, liquidity-sensitive property like crypto are likely to undergo first. The end result was swift: spot and futures markets noticed purple inside minutes of the Fed’s announcement.

Trump–Xi Summit Fails to Spark Confidence

Markets had additionally been banking on a confidence increase from the much-hyped assembly between President Donald Trump and Chinese language President Xi Jinping. As a substitute, the talks ended with obscure guarantees and few concrete outcomes.

Whereas China agreed to chop some tariffs and resume restricted agricultural imports, traders have been hoping for a broader commerce truce. The dearth of rapid breakthroughs despatched a wave of disappointment by means of world markets — and crypto, as soon as once more, bore the brunt of risk-off sentiment.

Analysts say the renewed trade-war nervousness reminded merchants simply how fragile world demand stays, notably for tech and blockchain sectors uncovered to cross-border flows.

Liquidations Amplify the Crash

Leverage added gasoline to the fireplace. Inside hours of the Fed’s assertion, over $800 million in leveraged positions have been liquidated throughout main exchanges. Knowledge from Coinglass confirmed that greater than 165,000 merchants have been worn out as costs broke key help zones.

Bitcoin briefly dipped beneath $110,000, triggering a sequence response of compelled liquidations throughout altcoins. Ethereum, Solana, and different high-beta property posted double-digit losses in the identical window, as futures funding charges flipped adverse.

Total, crypto’s market capitalization shed over $120 billion in lower than eight hours, one of many steepest drops since early 2025.

The Backside Line

This wasn’t a single-event crash — it was an ideal storm of financial warning, geopolitical uncertainty, and over-leveraged buying and selling. The Fed’s message of restraint collided with renewed tariff jitters and speculative positioning that merely couldn’t maintain.

Till policymakers make clear their stance on future cuts — and Washington and Beijing present actual progress — threat property like crypto are prone to stay beneath stress. For now, merchants are tightening stops and ready for the subsequent macro sign earlier than reentering.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.