November is nearly right here — and so is the controversy over what lies forward for the world’s second-largest cryptocurrency. Consultants stay divided on Ethereum’s trajectory, leaving the market with a pivotal dilemma: is shorting ETH a clever transfer or a dangerous guess?

Current analysis and the efficiency of exchange-traded funds recommend warning. Nonetheless, on-chain and derivatives information paint a unique image.

Sponsored

Why Some Analysts Suggest Shorting Ethereum

10x Analysis positions Ethereum as a greater hedge than Bitcoin for brief sellers within the present local weather. Their evaluation, shared amid ETH’s latest slide to under $4,000, highlights a serious weak spot that might seemingly amplify draw back dangers.

The bearish thesis facilities on Ethereum’s eroding “digital treasury” narrative, as soon as a magnet for institutional capital. This mannequin, exemplified by BitMine’s technique of accumulating ETH at price and offloading it to retail at premiums, fueled a self-reinforcing cycle all through the summer season. Nonetheless, 10x Analysis claimed that the loop has fractured.

“Market narratives don’t die with headlines — they die in silence, when new capital stops believing. Ethereum’s institutional treasury story satisfied many, however the bid behind it wasn’t what it appeared. Institutional choices positioning is quietly selecting a aspect, at the same time as retail seems the opposite means,” the submit learn.

Moreover, spot ETFs have been experiencing important outflows. Knowledge from SoSoValue confirmed that the ETH ETFs recorded outflows of $311.8 million and $243.9 million within the third and fourth weeks of October, respectively.

“ETH ETF outflow of $184,200,000 yesterday. BlackRock offered $118,000,000 in Ethereum,” analyst Ted Pillows added.

Sponsored

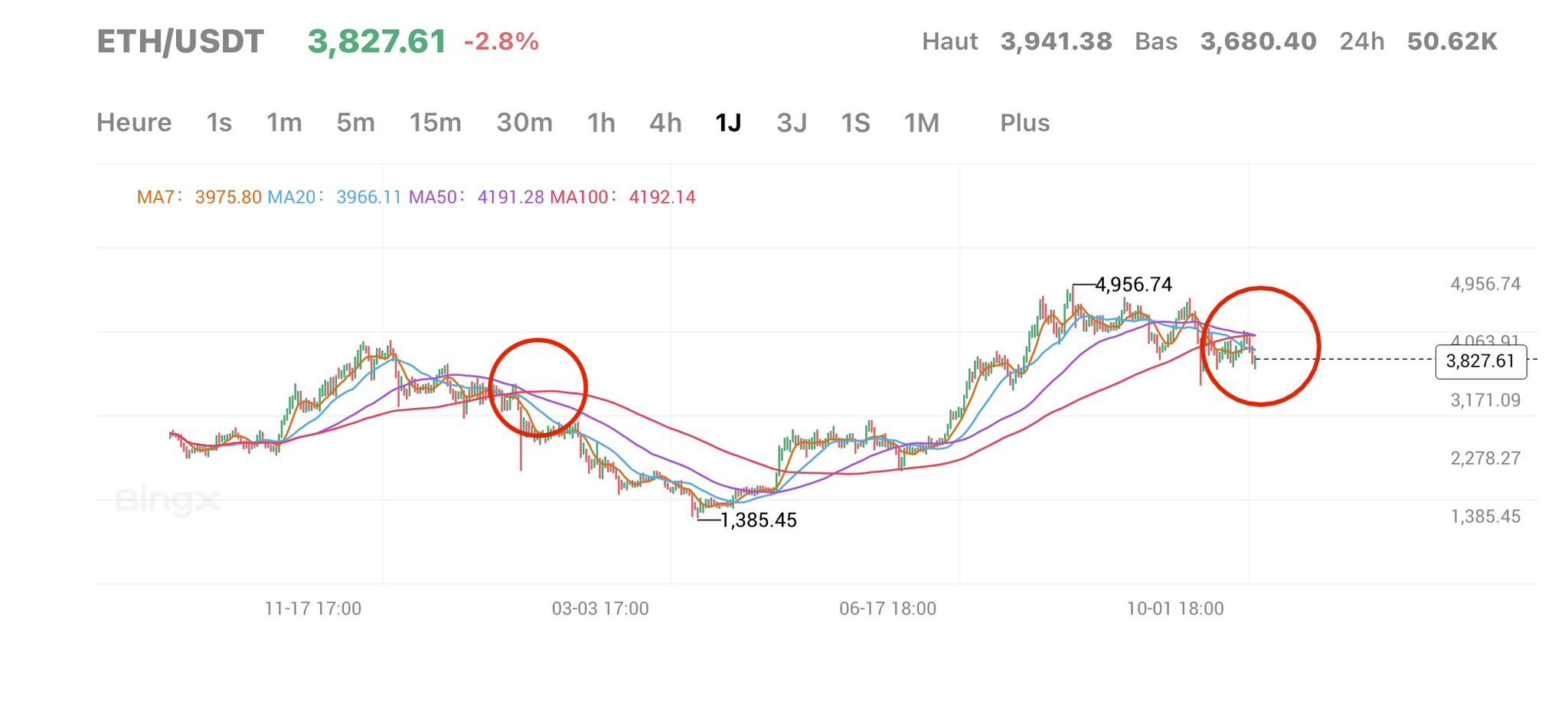

From a technical standpoint, an analyst identified that ETH is forming a bearish crossover. It is a technical evaluation sign indicating a possible downward pattern. He famous that the final time this sample emerged, Ethereum’s worth fell from about $3,800 to $1,400.

Bearish Sentiment Meets Bullish Knowledge: Can Ethereum Rebound in November?

Nonetheless, not all indicators align with the bearish outlook. Some recommend a possible rebound for Ethereum in November.

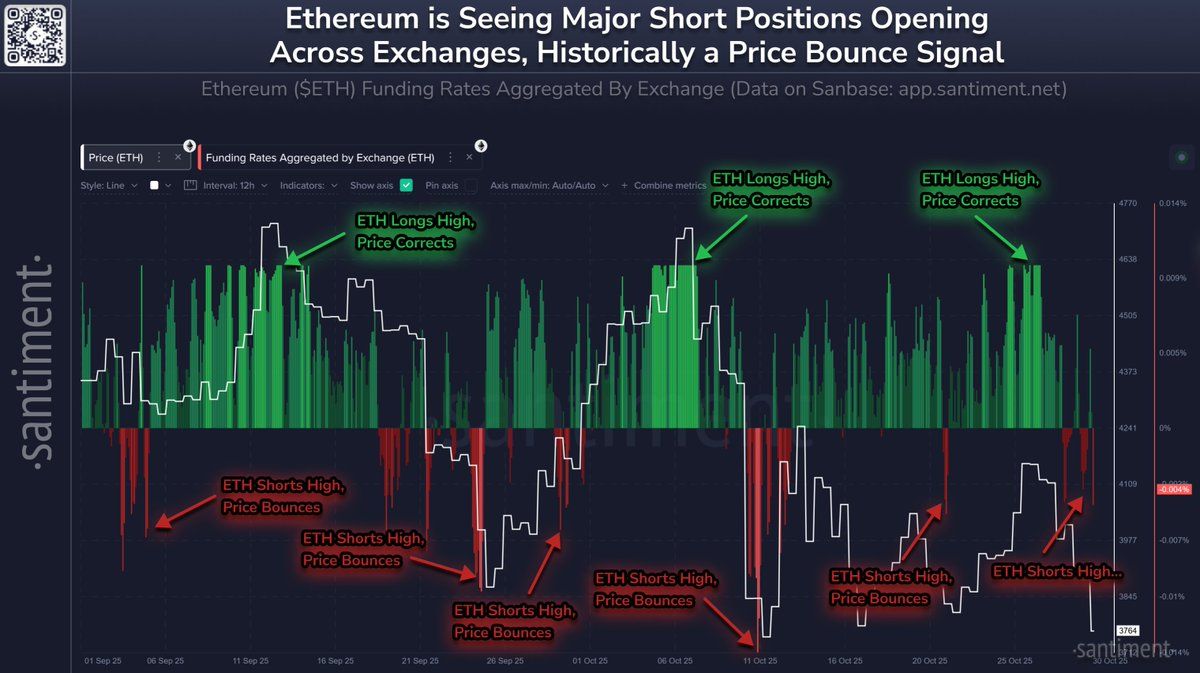

Santiment famous that as Ethereum slipped to $3,700, merchants started opening brief positions as soon as once more — a conduct that, paradoxically, precedes a worth rally. The submit emphasised that during the last two months, funding charges throughout exchanges have change into a key indicator of the place ETH would possibly head subsequent.

Sponsored

When funding charges flip constructive, signaling that lengthy positions dominate, costs usually appropriate as extreme optimism builds up. Conversely, when shorts prevail and funding charges flip adverse, the chance of a rebound will increase.

“When main longs dominate (greed), costs appropriate. When main shorts dominate, there’s a excessive chance of a bounce.” Santiment highlighted.

One other analyst famous that the Ethereum “Ecosystem Day by day Exercise Index” has reached a report excessive, signaling sturdy community engagement.

Sponsored

This surge in on-chain exercise gives a strong elementary basis for Ethereum, suggesting that the market’s energy is being pushed by real person development fairly than hypothesis.

“This excessive stage of participation has the potential to offer sturdy assist for additional worth appreciation sooner or later.,” CryptoOnchain acknowledged.

Thus, Ethereum’s outlook heading into November stays finely balanced. On one hand, institutional dynamics, ETF outflows, and bearish technical patterns recommend warning. Then again, strengthening on-chain exercise and derivatives information level to rising person engagement and potential restoration.

Whether or not ETH extends its decline or levels a rebound could finally depend upon which pressure proves stronger within the weeks forward.