Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value tumbled 2% previously 24 hours to commerce at $111,230 as of three:36 a.m. EST on buying and selling quantity that jumped 9% to $73.6 billion.

The BTC drop got here because the crypto market turned sharply decrease on Tuesday after Federal Reserve Chair Jerome Powell mentioned one other rate of interest minimize in December is way from sure.

Powell: A December price minimize is “removed from” a foregone conclusion

Markets did NOT like that pic.twitter.com/EjrmJIAqLG

— Morning Brew ☕️ (@MorningBrew) October 29, 2025

Talking after the October Federal Open Market Committee (FOMC) assembly, which minimize charges by 25 foundation factors, Powell mentioned the US labor market is weakening whereas inflation stays “considerably elevated.”

He added that increased tariffs are including to cost pressures, which in flip creates a tough steadiness for the central financial institution.

The Fed determined to finish its balance-sheet runoff beginning December 1, saying reserves have reached ranges in line with ample liquidity, signaling that quantitative tightening is coming to an finish.

Powell mentioned the step was crucial as a result of repo charges and funding prices have been rising not too long ago.

Bitcoin Worth Holds Channel Help As Bulls Eye Restoration

The BTC value seems to be recovering after a quick correction that examined the decrease boundary of the rising channel sample round $104,000, with early indicators of renewed energy.

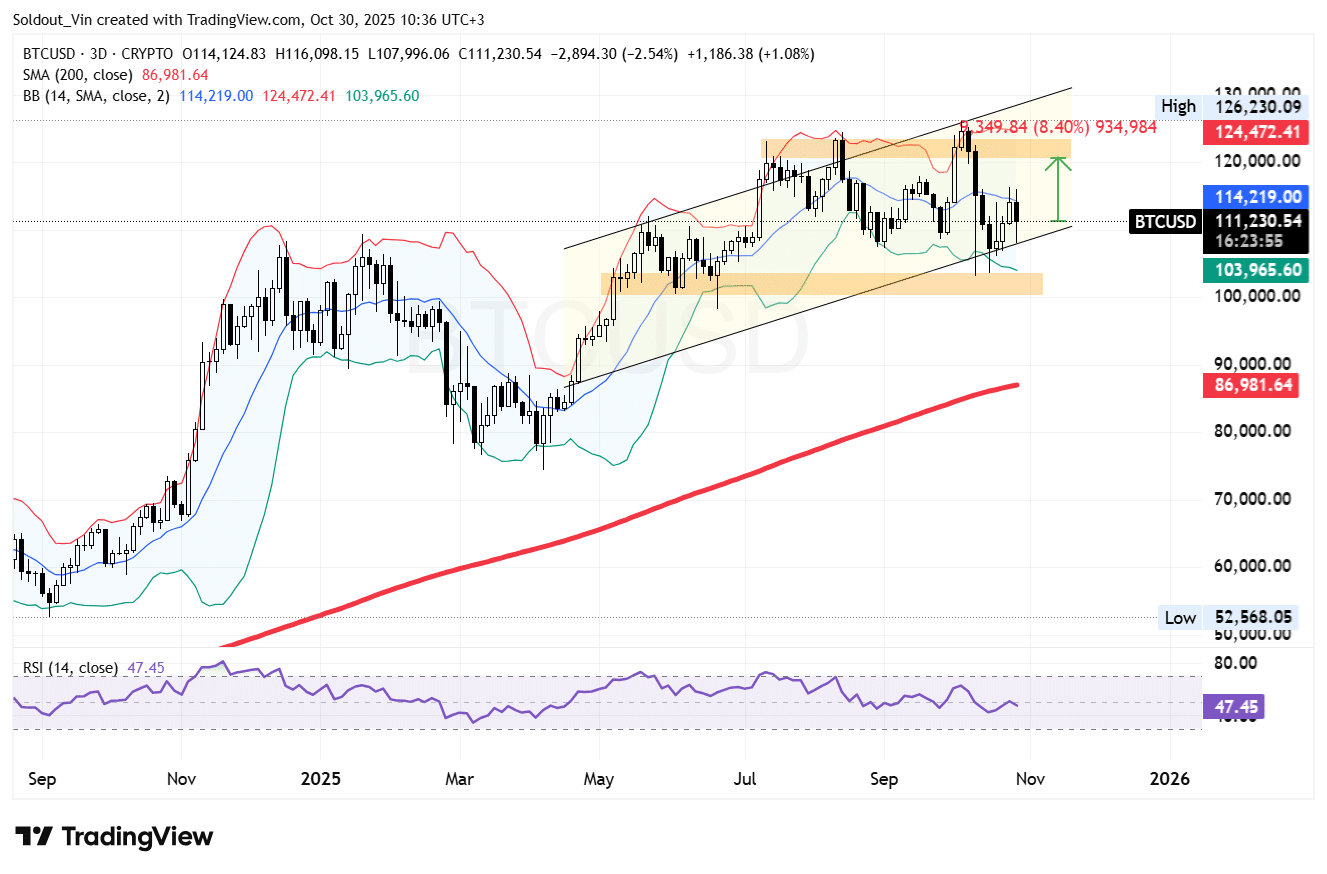

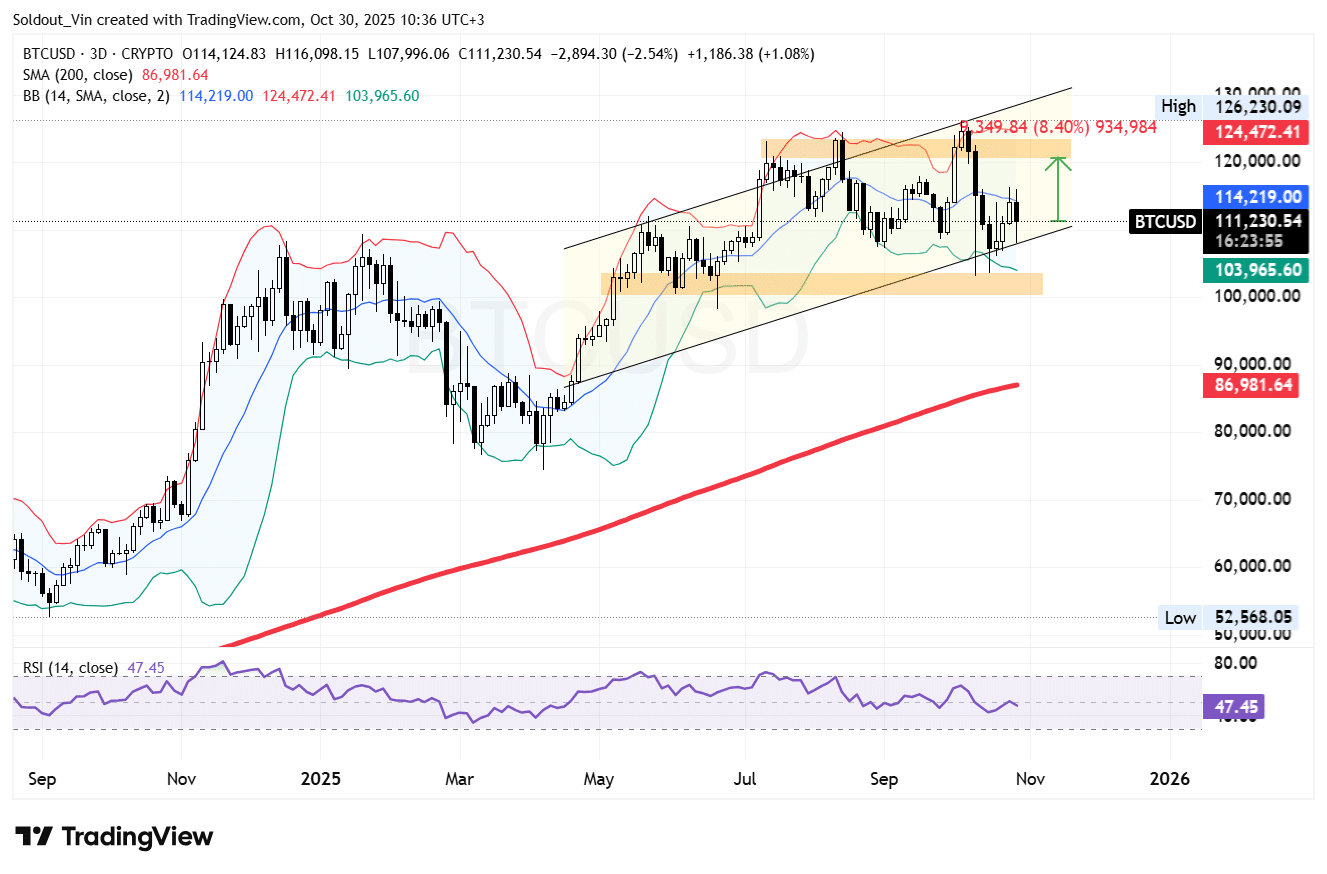

The Bitcoin value on the 3-day chart reveals it buying and selling close to $111,230, rebounding from the decrease Bollinger Band at $103,965. This bounce highlights robust shopping for exercise throughout the present rising channel.

BTC stays inside a medium-term bullish channel, though the latest collection of decrease highs has launched some short-term consolidation. The 200-day Easy Shifting Common (SMA), presently at $86,981, continues to behave as a long-term base, which confirms that the macro development stays bullish.

In the meantime, the center Bollinger Band, round $114,219, is serving as the subsequent stage of resistance, with a breakout above it more likely to reestablish upward momentum towards the higher boundary close to $124,472.

The Relative Energy Index (RSI), is buying and selling at 47.45, suggesting that the value of BTC is presently in an equilibrium, which implies that the asset is neither overbought nor oversold.

BTC Worth Prediction: Bulls Goal Costs Above $120K

General, the BTC/USD chart reveals the BTC value stays constructively bullish. The Bollinger Band rebound, mixed with robust help above the 200-day SMA, displays underlying market resilience.

If bulls handle to push BTC above $114,000 and maintain the breakout, it will seemingly affirm the continuation of the medium-term uptrend, with potential to revisit the rapid resistance round $120,800, an 8% surge from the present stage.

Sustained bullish momentum may push BTC’s value to the subsequent resistance stage on the higher Bollinger Band at $124,472.

Nonetheless, a failure to take care of help above the $104,000 stage may delay this restoration section and invite deeper consolidation, with the subsequent cushion towards downward stress at $100,470.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection