- EGRAG Crypto initiatives a 244% surge for XRP, probably reaching $5.50–$6.00.

- Historic traits present smaller crashes every cycle, hinting at rising stability.

- Analysts anticipate a short-term correction earlier than XRP resumes its upward climb.

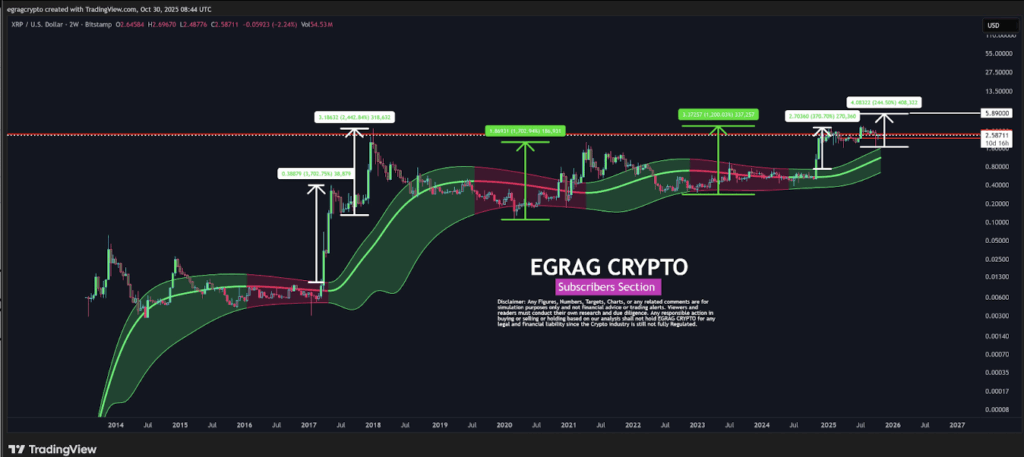

Market analyst EGRAG Crypto thinks XRP nonetheless has loads of room to run earlier than this bull cycle hits its peak. Utilizing the Gaussian Channel, he’s projecting a attainable 244% soar from present costs, which might utterly flip the concept that the rally is already accomplished. XRP, together with many of the market, tried to push increased earlier this week however bumped into resistance. Even so, it’s managed to remain afloat—up a modest 2% over the previous seven days—whereas different high belongings slipped into crimson territory.

EGRAG’s Gaussian Channel Forecast

In his newest breakdown, EGRAG turned to the Gaussian Channel—a device that tracks development path and momentum—to map out XRP’s long-term path. He in contrast at this time’s setup to the 2017–2018 bull run, when XRP surged roughly 3,700% and hit about $0.39 earlier than cooling off. By comparability, the present cycle’s rally sits round 370%, barely a tenth of that transfer. If historical past rhymes, his mannequin hints at one other large leg up, probably sending XRP into the $5.50 to $6.00 vary.

EGRAG doesn’t purchase into the concept of “diminishing returns,” the place every market cycle supposedly yields smaller beneficial properties. He identified that XRP climbed practically 1,700% in the course of the 2021 cycle—even with the SEC lawsuit hanging over it. With higher tech, extra adoption, and bettering sentiment, he believes the following explosive transfer might simply take XRP past $5 within the months forward.

Shrinking Losses and Indicators of Maturity

Wanting again at earlier bear markets, EGRAG observed one thing fascinating—XRP’s crashes are getting smaller. The primary main downturn worn out 96% of its worth, the following dropped 86%, exhibiting a gradual enchancment. If that development retains up, the following correction may solely attain round 76%, suggesting a maturing market that’s turning into extra resilient. Primarily based on this sample, he estimates that if XRP hits $5–$6 on the high, the following bear market might backside round $1.20–$1.40.

Even in a softer situation—say XRP peaks at $3.65—EGRAG’s mannequin factors to a correction close to $0.87, nonetheless in keeping with long-term restoration cycles. For traders who purchased in underneath $0.50, this setup appears to be like favorable regardless of how uneven the short-term worth motion will get.

Blended Quick-Time period Views, Bullish Lengthy-Time period Tone

Different analysts share EGRAG’s bullish long-term stance, although they see attainable turbulence forward. DustyBC, as an example, expects a small corrective section earlier than XRP begins a 3rd main wave up, focusing on between $2.00 and $2.40 for the following key stage. Equally, dealer Casi Trades marked $2.68 because the resistance that lately rejected worth motion, noting assist zones round $2.42, $2.03, and $1.65. A drop beneath $2.42 might stretch the correction towards $1.65, which matches the 0.618 Fibonacci stage—usually seen as a robust reversal level.

Regardless of the short-term uncertainty, the larger image nonetheless leans constructive. EGRAG’s Gaussian Channel mannequin paints a setup the place XRP might rally previous $5, probably increased, if its historic rhythm continues. For now, the overall settlement is that this cycle nonetheless has gas left, and XRP’s construction retains bettering because the market matures.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.