The Bitcoin market skilled one other eventful buying and selling week marked by a number of failed breakouts from the $115,000 resistance zone regardless of the announcement of one other rate of interest lower by the US Federal Reserve. As value motion presently consolidates round $110,000, information from the Bitcoin Choices market has supplied insights into merchants’ habits and common sentiment.

Bitcoin Choices Merchants Guess On Steady Market

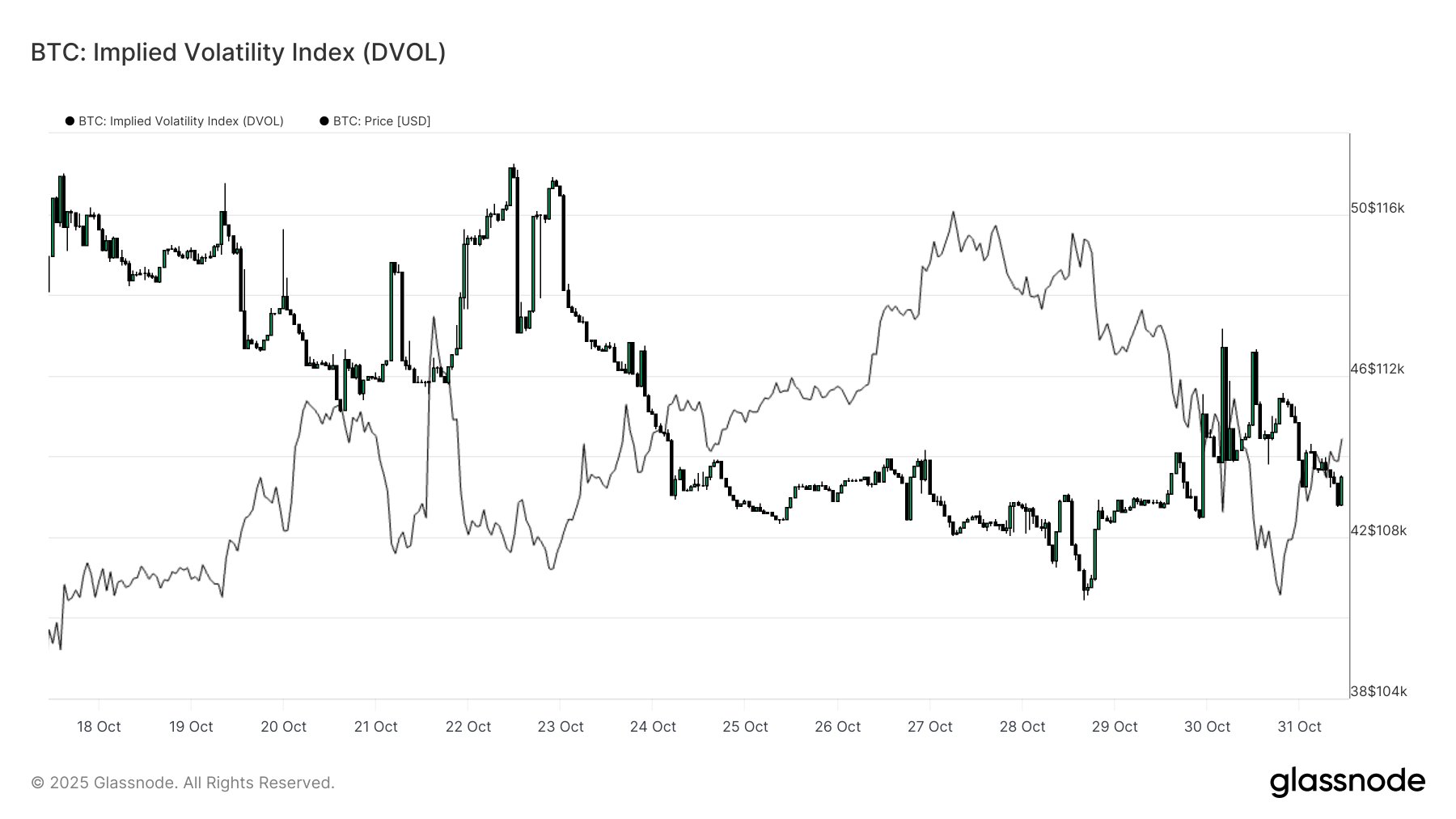

On Friday, distinguished blockchain analytics agency Glassnode shared its weekly replace of the Bitcoin choices market, analyzing merchants’ beliefs on future value motion. As earlier said, the Fed introduced its second charge lower for 2025 on Wednesday. Whereas this can be a well-liked bullish transfer, the hawkish tone indicating fewer cuts forward diminished merchants’ optimism, leading to a short rally for danger property corresponding to Bitcoin.

Amid this improvement, the BTC Implied Volatility Index, which measures how a lot volatility merchants anticipate sooner or later, is grinding decrease. This information means that merchants are pricing a calmer BTC with no expectations of a serious value transfer regardless of the current macro noise. In the meantime, the 1M Volatility Danger Premium additionally turned unfavorable as realized volatility moved quicker than implied volatility. Glassnode expects this improvement to mean-revert, that means the short-term volatility is overpriced and merchants are more likely to promote, thereby backing the narrative of an anticipated calm market.

Moreover, the Put/Name quantity additionally confirmed one other aspect to this narrative, producing a full retest to its lowest worth in October. Notably, merchants initially confirmed bullish motion with a wave of calls however quickly modified sentiment in keeping with the overall market. Nevertheless, amid the domination of calls, Glassnode notes impartial directional conviction, i.e, equal shopping for and promoting strain, backing the market’s insecurity in an instantaneous bullish or bearish transfer.

Little Hope On Value Upswing?

The 25-delta skew chart has supplied one other narrative that reveals a rising sense of warning. Notably, this metric measures the implied volatility between calls and places. When the 25-delta skew is impartial, it means merchants see a balanced danger as put and calls are equally priced. Following a short stint on this impartial zone, this metric is now rising once more, indicating that merchants are valuing places larger and are actively hedging in opposition to a value downswing.

Subsequently, whereas there is no such thing as a expectation of any vital value transfer within the short-term, Bitcoin Choice merchants seem considerably cautious of any value fall. At press time, Bitcoin is valued at $109, 304 reflecting a minor 1.94% acquire previously day. In the meantime, the each day buying and selling quantity is down by 11.62% and valued at $65.18 billion.

Featured picture from iStock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.