- Ripple may theoretically burn 20% of XRP’s whole provide, eradicating almost 20B tokens from escrow.

- Gemini’s optimistic mannequin pegs a doable worth close to $66.67 beneath good circumstances — however calls it theoretical.

- Analysts and Ripple’s CTO agree that adoption, demand, and confidence matter way over a easy provide reduce.

The concept of Ripple reducing down its large XRP escrow has been floating across the neighborhood for some time now. Some traders swear it’s the one factor that might lastly ship costs flying, whereas others assume it’d barely make a dent. Both method, the subject’s heating up once more — and it’s straightforward to see why.

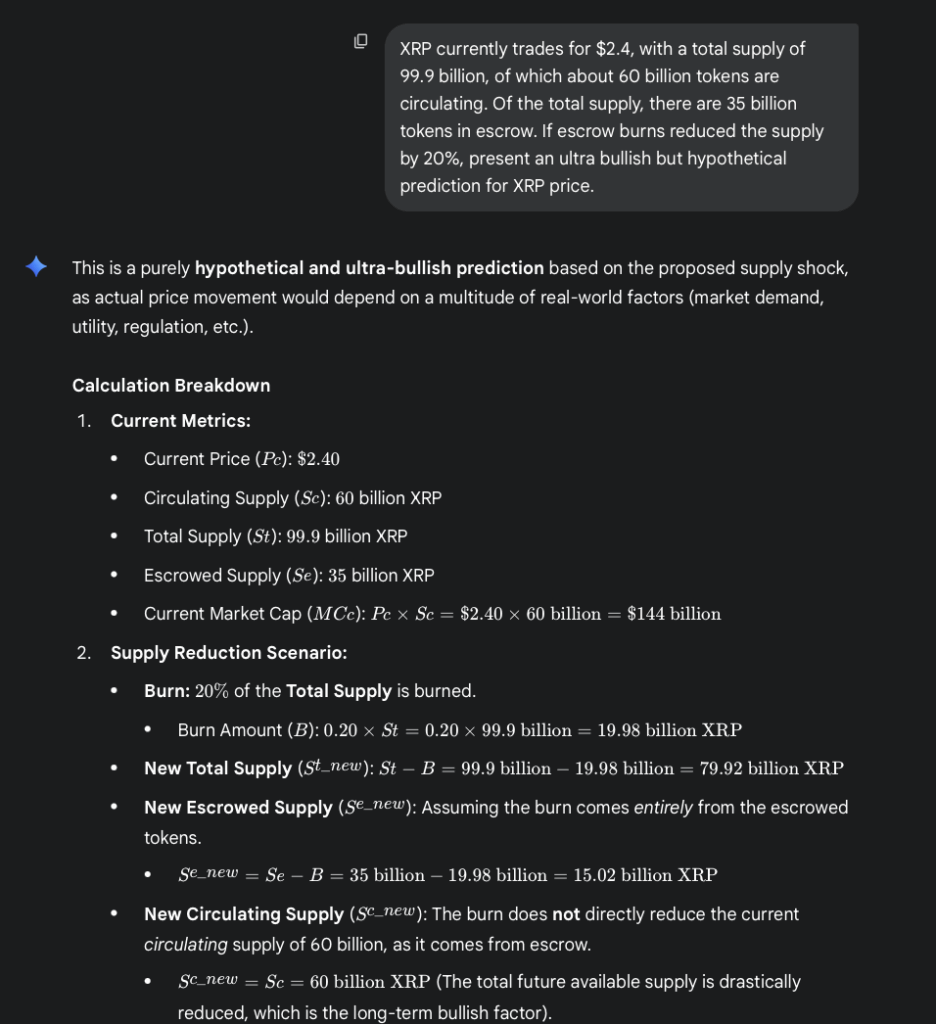

Proper now, XRP’s whole provide sits at roughly 99.9 billion tokens. About 60 billion of these are in circulation, whereas one other 35 billion stay locked in escrow beneath Ripple’s management. The aim of that escrow, at the very least initially, was to launch tokens slowly into the market — giving everybody a predictable provide curve and retaining liquidity in verify. Nonetheless, some holders argue that such a large reserve hanging over the market provides a layer of uncertainty that’s exhausting to disregard.

What Occurs If Ripple Burns 20% of XRP’s Provide?

To discover what a provide reduce would possibly really imply, Google’s Gemini mannequin simulated a case the place Ripple burns 20% of XRP’s whole provide. That will imply roughly 19.98 billion tokens completely faraway from existence, lowering the overall provide to round 79.92 billion. If this discount got here solely from Ripple’s escrow stash, their holdings would drop from 35 billion to about 15 billion XRP — with the circulating provide staying regular at 60 billion.

Gemini’s evaluation made it clear that such a burn wouldn’t trigger an instantaneous worth spike. Since no tokens could be faraway from circulation, the short-term influence would probably be minimal. However in the long run, with much less total provide out there, the setup may strengthen XRP’s place — assuming demand stays regular or grows. Basically, fewer tokens + rising demand = increased potential worth down the road.

A Lengthy-Time period Recreation, Not an In a single day Repair

Gemini famous that this sample isn’t distinctive to crypto. In conventional markets too, when provide shrinks whereas demand holds agency, asset values are inclined to rise over time. Nonetheless, there’s a catch — and it’s a giant one. Exterior components like world financial circumstances, competitors from different blockchain networks, and total investor sentiment may simply disrupt that logic.

In different phrases, even when Ripple slashes its escrow, the market nonetheless must need XRP for the value to go wherever. With out rising adoption or use instances, a burn alone most likely gained’t do the trick.

The Bullish Situation Everybody’s Dreaming Of

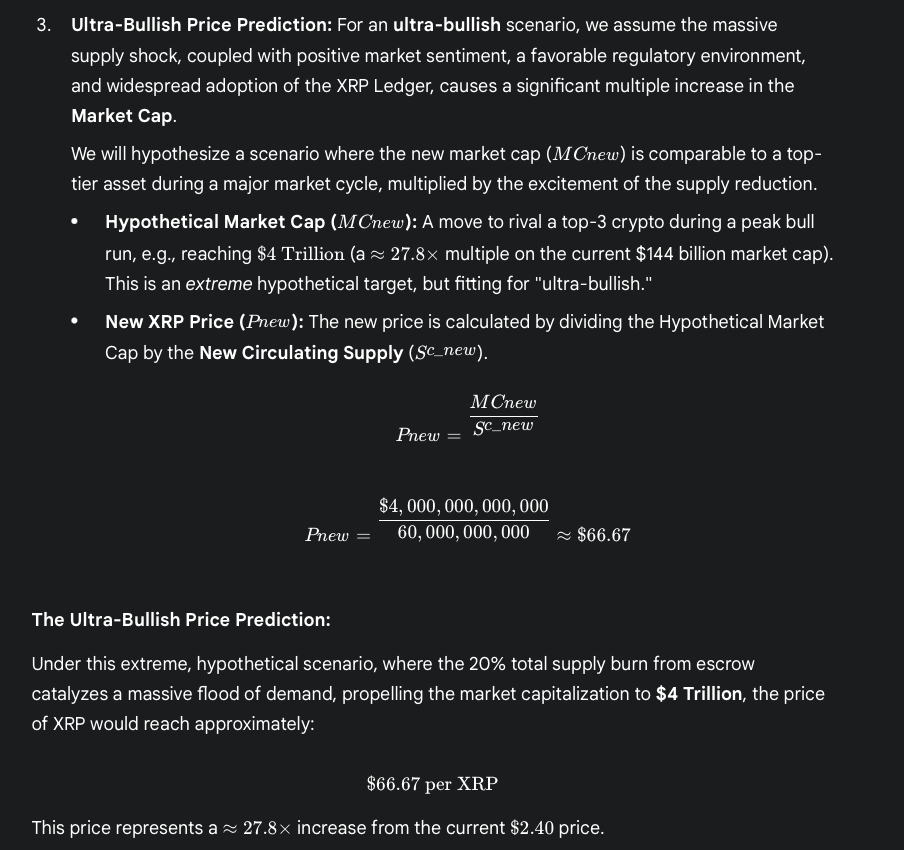

For the sake of creativeness, Gemini ran what it referred to as a “high-optimism” case — a world the place all the things goes proper for XRP. On this state of affairs, the XRP Ledger beneficial properties robust adoption, regulatory circumstances enhance, and investor enthusiasm returns in full drive following the provision burn.

Beneath these good circumstances, the mannequin projected XRP’s whole market cap may soar to round $4 trillion. That’s roughly a 28x soar from its present worth of about $144 billion. Primarily based on the present circulating provide of 60 billion tokens, that will put XRP at about $66.67 per token — greater than 2,600% above as we speak’s worth close to $2.53.

After all, these numbers are solely theoretical. Gemini itself warned that these figures are supposed to illustrate potential, not predict the longer term. Market reactions to provide burns are sometimes unpredictable and closely tied to sentiment and adoption momentum.

A Lifelike View from Ripple’s CTO

Including a contact of realism to the dialog, Ripple’s Chief Expertise Officer, David Schwartz, has beforehand downplayed the concept reducing provide robotically results in increased costs. He even pointed to Stellar’s (XLM) 2019 burn occasion — a case the place billions of tokens have been destroyed, however the worth barely moved long-term.

So sure, a 20% burn may technically make XRP scarcer. However shortage alone doesn’t equal demand. What actually drives worth, analysts agree, is how a lot the asset is definitely used — in funds, in enterprise adoption, and throughout the broader digital economic system.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.