- 37.5M ADA value $22.8M moved off Coinbase, signaling whale accumulation.

- ADA’s holding regular between $0.60–$0.62, forming a powerful accumulation base.

- Rising futures exercise and deepening change outflows counsel a bullish setup for a transfer towards $0.70–$0.87.

Cardano (ADA) appears to be waking up once more. An enormous $22.8 million switch—roughly 37.5 million ADA—from Coinbase to an unknown pockets has caught the market’s consideration, hinting at one thing larger brewing behind the scenes. Trade knowledge exhibits constant adverse netflows, with the newest determine sitting round -$3.02 million. Which means whales are transferring their holdings off exchanges, a transfer that often screams confidence.

Traditionally, when giant holders begin pulling tokens into chilly storage, it’s as a result of they’re anticipating worth energy forward. These sorts of withdrawals have typically lined up with early levels of bullish reversals. If the development continues, it might tighten sell-side liquidity and set the stage for an upside breakout within the coming weeks.

Cardano’s Value Is Coiling Up

Proper now, ADA’s hovering between $0.60 and $0.62—a good vary that’s beginning to appear to be a powerful accumulation zone. Each dip into this area has been met with fast rebounds, an indication that consumers are quietly defending their floor. The construction means that bulls are absorbing strain and loading up for a transfer above $0.70, which might flip the short-term development again of their favor.

This worth pocket additionally aligns with a key demand zone that triggered ADA’s mid-year rally earlier in 2025. If historical past repeats, it might act as the muse for one more leg upward. For now, it appears like Cardano is stabilizing, gathering power earlier than the following large push.

Trade Outflows Maintain Climbing

On-chain knowledge retains reinforcing the bullish narrative. Trade outflows have intensified once more, hitting -$3.02 million, confirming that enormous holders are nonetheless pulling their ADA out of buying and selling platforms. This exodus reduces the out there provide and, in flip, limits potential promoting strain.

The sample feels acquainted—related waves of outflows earlier this 12 months marked the beginning of sustained recoveries. When liquidity dries up like this, volatility tends to spike upward. In easy phrases, fewer sellers imply sharper strikes when demand kicks again in. That’s why analysts see this as a quiet accumulation section that would quickly shift into full-blown enlargement.

Futures Knowledge Exhibits Aggressive Shopping for

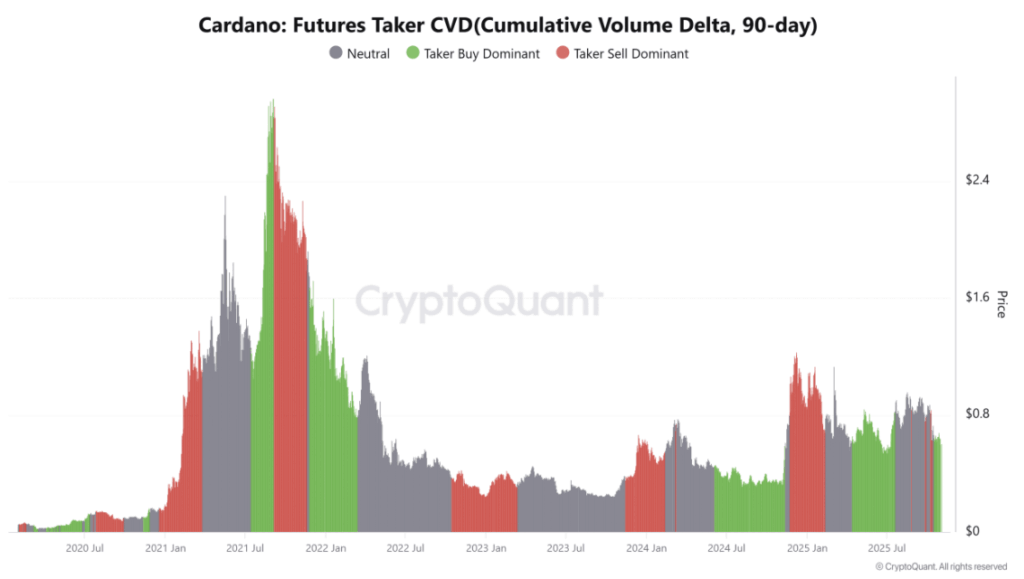

The derivatives market can be flashing inexperienced. Futures knowledge exhibits a 90-day CVD studying that’s Taker Purchase Dominant—mainly, consumers are those pushing quantity proper now. That’s a giant deal as a result of it indicators that merchants aren’t simply sitting again; they’re betting on additional upside.

This aligns completely with what’s taking place on-chain: tightening provide and rising buy-side strain. Collectively, these two indicators typically mark the beginning of a broader uptrend. The alignment between derivatives and spot knowledge exhibits each retail and institutional gamers appear to be positioning for a possible rally.

The Street Forward for ADA

With whales accumulating, change balances shrinking, and futures markets leaning bullish, the items are beginning to line up for ADA. The token appears prefer it’s shifting from accumulation to enlargement, establishing for a retest of the $0.70 zone—and probably $0.87 if momentum builds.

For now, all indicators level to confidence quietly returning to Cardano’s market. If this rhythm retains up, the following breakout may come quicker than most count on.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.