Bitcoin’s onchain exercise is heating up once more, however analysts warn that the restoration might stall with out renewed demand from exchange-traded funds (ETFs) and Michael Saylor’s MicroStrategy.

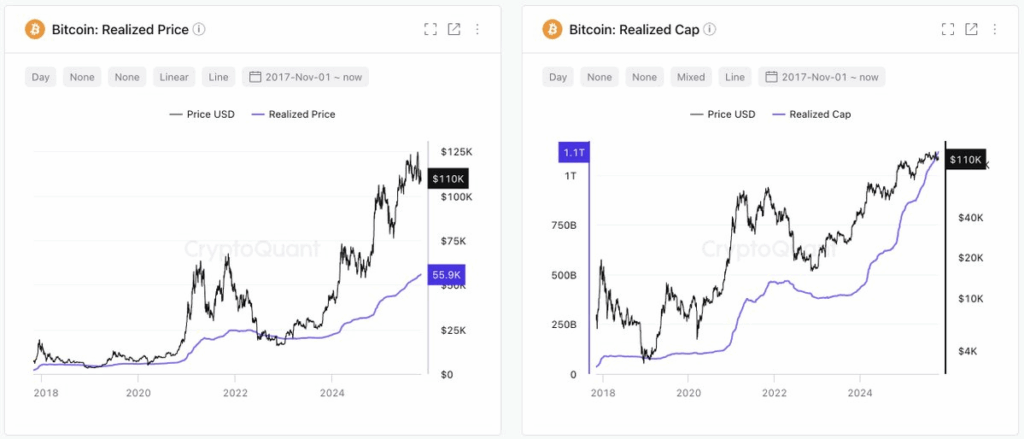

Based on information from CryptoQuant, Bitcoin’s realized cap – a measure of the overall worth of all cash primarily based on the worth at which they final moved – climbed by over $8 billion prior to now week, bringing the overall to greater than $1.1 trillion. The rise indicators an increase in investor participation and renewed capital inflows, whilst broader market sentiment stays cautious after the latest $19 billion crypto sell-off.

Ki Younger Ju, CEO of CryptoQuant, mentioned that whereas institutional channels like ETFs and company treasuries have been the dominant demand drivers, each have slowed their shopping for exercise. “Demand is now pushed principally by ETFs and MicroStrategy, each slowing buys lately. If these two channels recuperate, market momentum seemingly returns,” he wrote on X.

In the meantime, Bitcoin miners proceed to ramp up manufacturing capability, pushing the community’s hash charge greater – a improvement Ju described as a “long-term bullish sign.” Corporations akin to American Bitcoin, which has hyperlinks to the Trump household, have reportedly bought 1000’s of recent ASIC mining machines value over $300 million to develop operations.

Regardless of the $8 billion influx, investor confidence stays subdued. Sentiment indicators nonetheless hover in “Worry” territory, reflecting lingering warning regardless of broader financial developments, together with renewed optimism round U.S.-China commerce relations.

Analysts at Bitfinex say a stronger wave of ETF inflows and potential financial easing by the Federal Reserve may shift the market tone dramatically. Their base state of affairs initiatives Bitcoin may attain as excessive as $140,000 by November if ETF investments complete between $10 billion and $15 billion, alongside two Fed charge cuts and typical This fall seasonal power.

For now, although, Bitcoin’s restoration seems constrained – buoyed by onchain inflows and miner enlargement, however ready for the return of main institutional consumers to reignite its subsequent leg upward.