Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value climbed 0.65% within the final 24 hours to commerce at $3,865.10 as of 11 p.m. EST on a 52% drop in buying and selling quantity to $16.52 billion.

ETH bought a lift from one other purchase by Tom Lee’s BitMine, which snapped up 7,660 ETH value $29 million from Galaxy Digital on Oct. 31 through its OTC desk. Such massive non-public offers are often executed to keep away from impacting the value.

🔥 NOW: Tom Lee’s Bitmine purchased 7,660 $ETH from Galaxy Digital. pic.twitter.com/Jtcvhbn7bg

— Cointelegraph (@Cointelegraph) November 1, 2025

BitMine’s objective is evident: accumulate as much as 5% of the Ethereum provide as a part of its “Alchemy of 5%” plan. It now holds 3.3 million ETH, or 2.745% of its provide, value $12.8 billion, in response to CoinGecko.

Whereas establishments are busy accumulating, retail merchants appear extra cautious. Knowledge from Kalshi reveals the chances of ETH hitting $5,000 earlier than the 12 months finish have dropped sharply to simply 34%.

Even so, many analysts stay optimistic about Ethereum’s medium-term prospects, given its robust fundamentals and rising curiosity from skilled consumers.

A surge in institutional purchases means much less ETH is accessible on the market on crypto exchanges. As tokens transfer to wallets held by long-term traders, short-term promoting stress drops.

If the pattern continues, provide might tighten even additional, supporting increased costs. Such strikes by BitMine and different massive companies typically result in rallies that entice smaller traders again into the market.

Ethereum Value: On-Chain Indicators Present Accumulation

Blockchain information confirms BitMine acquired ETH from its newest purchase in two batches from Galaxy Digital wallets. Analytics platforms like Arkham and Whale Alert have tracked each the motion and vacation spot of this ETH, verifying the timing and dimension of the transaction. These transfers add to an extended record of institutional buys which have grow to be extra frequent for Ethereum throughout 2025.

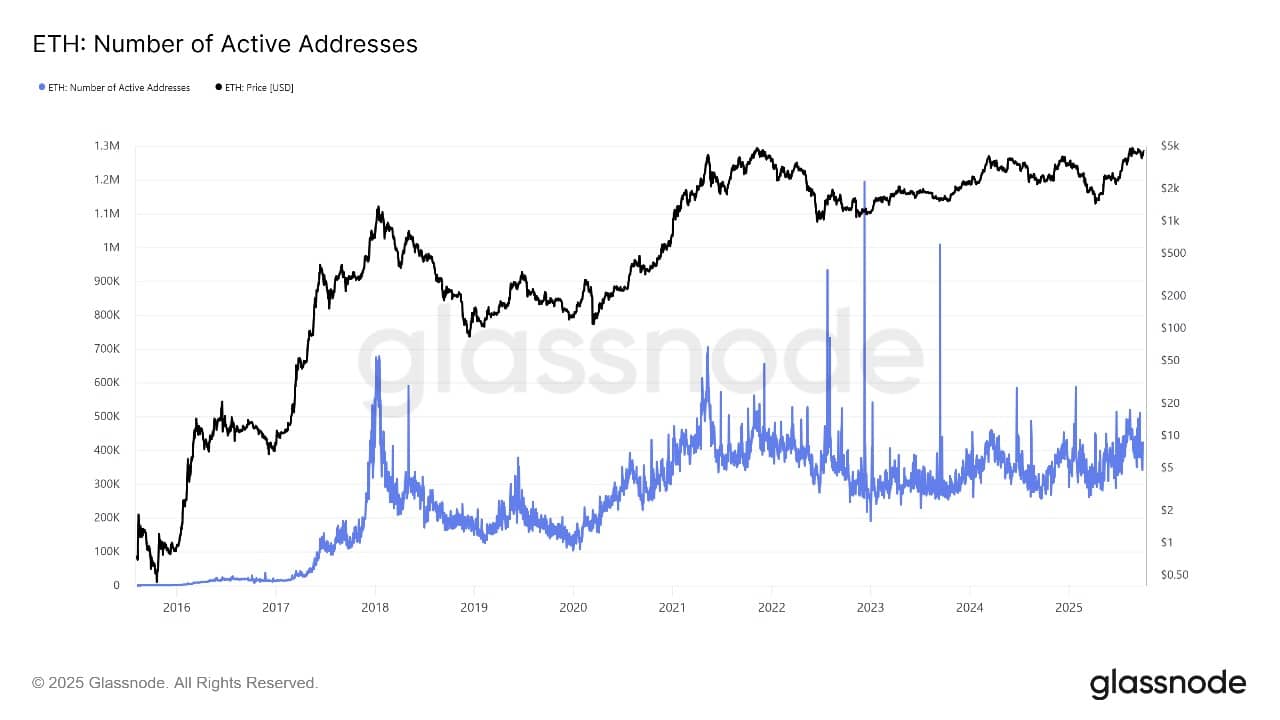

On-chain sentiment is shifting. Lengthy-term holders are transferring cash off exchanges into safe wallets. Addresses holding greater than 1,000 ETH have been rising steadily this quarter. Ethereum staking can be selecting up, with extra tokens locked in validator contracts, signaling a powerful perception within the community’s future.

ETH Energetic Addresses Supply: Glassnode

Market watchers say this mix of much less alternate provide, growing pockets accumulation, and swelling staking balances creates fertile floor for the ETH value to climb. Individuals are exhibiting they need to maintain for the long run, decreasing the dangers of sudden sell-offs.

Technical merchants level out that when establishments paved the way, retail consumers typically observe.

ETH Value Technical Evaluation and Forecast

ETH/USD technical evaluation reveals the ETH value is buying and selling just under the 50-day easy transferring common at $4,164, whereas nonetheless properly above the 200-day common at $3,352, in response to the most recent TradingView chart. The important thing assist now sits between $3,350 and $3,800. That is an space merchants look ahead to recent bounces if the value dips.

Proper now, the market faces robust resistance close to $4,164, the place the 50-day SMA gathers sellers. If the ETH value manages to interrupt above this space, the following goal is the $4,955 excessive marked earlier within the 12 months.

The chart reveals the potential for the ETH value to maneuver increased within the coming weeks if consumers keep lively and break resistance. If not, the coin would possibly fall again to check the $3,352-$3,350 assist area.

ETHUSD Evaluation Supply: Tradingview

Technical indicators are blended however level to a market poised for a transfer. The Relative Power Index (RSI) alerts impartial momentum at 43.90. MACD is barely bullish at 1.87, with histogram bars beginning to tick up.

The ADX indicator reads simply 17.95, exhibiting that the ETH value is consolidating, however any robust push might spark a breakout or breakdown.

The ETH value might see a swing increased in November, with new forecasts inserting common targets round $4,240 and peaks as much as $4,632 if the rally continues. If the value breaks above $4,164, Ethereum might rapidly transfer to check the $4,595 and $4,955 resistance zones.

If sellers pressure a drop, the $3,350–$3,870 space will seemingly entice new consumers searching for discounted entries.

With BitMine and different massive gamers accumulating ETH, upside targets might attain $4,600 or increased this month if institutional shopping for retains up and retail sentiment follows. Nonetheless, merchants ought to watch if the ETH value can break above $4,164 for extra beneficial properties, or if decrease assist holds agency in case of a dip.

In both case, rising institutional demand helps preserve Ethereum’s outlook shiny for each short-term rallies and long-term development.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection