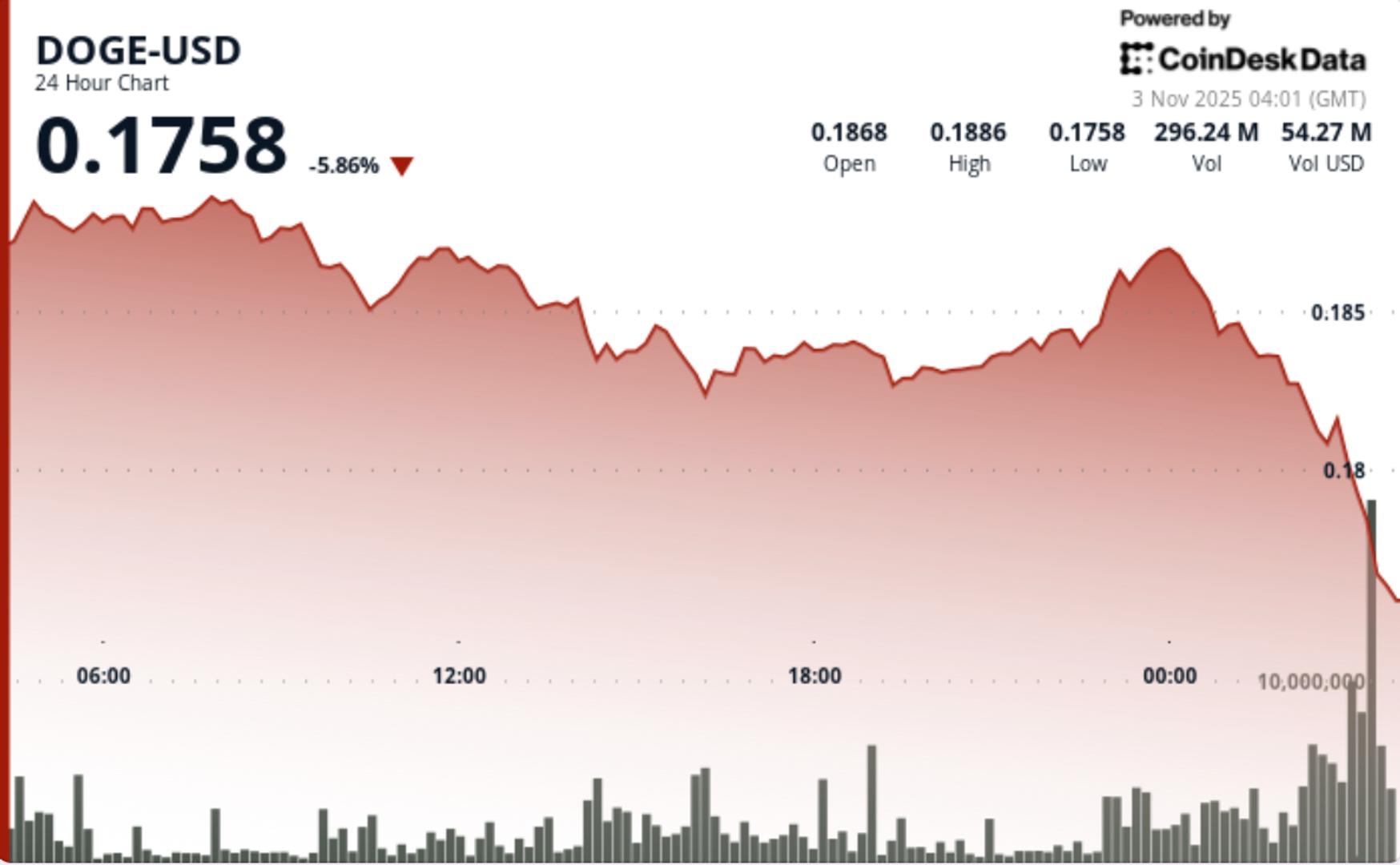

Dogecoin slipped 2.3% to $0.1827 throughout Tuesday’s buying and selling session, breaking decisively beneath key assist at $0.1830 as whale distribution accelerated and long-term holders started exiting positions.

The decline got here amid a deteriorating technical backdrop and elevated promoting exercise throughout massive wallets.

Information Background

DOGE dropped from $0.1870 to $0.1827 throughout the 24-hour window, carving out a $0.0070 vary that marked its third consecutive session of decrease highs.

Worth Motion Abstract

The decline adopted three failed restoration makes an attempt above $0.1860, solidifying resistance at that degree. Heavy distribution continued all through the U.S. buying and selling window as algorithmic exercise amplified promote strain.

Whereas short-term merchants tried to defend $0.1830, long-term pockets information confirmed a pointy behavioral shift — a transparent rotation from accumulation to liquidation.

On-chain metrics confirmed the transfer: 440 million DOGE had been offloaded by mid-tier whales (holding 10M-100M tokens) over a 72-hour interval. The Hodler Internet Place Change metric recorded 22 million DOGE outflows, a 36% reversal from prior accumulation traits and the most important drawdown in practically a month.

Technical Evaluation

Dogecoin’s technical construction has transitioned right into a confirmed bearish pattern following the breach of $0.1830 assist. A “death-cross” sample between the 50-day and 200-day EMAs fashioned in late October, whereas the 100-day EMA is on observe for the same cross — each reinforcing draw back bias.

Value-basis evaluation locations heavy liquidity between $0.177-$0.179, the place roughly 3.78 billion tokens are concentrated. This space now represents the following essential protection zone for bulls.

In the meantime, quantity evaluation highlights sustained institutional exercise: the 274.3M turnover spike and subsequent 15.5M burst throughout the selloff recommend distribution could also be coming into its closing stage earlier than potential base formation.

What Merchants Ought to Watch

DOGE trades in a susceptible place following the breakdown. The $0.1830-$0.1850 band stays the fast pivot zone, whereas failure to defend $0.177 might set off a transfer towards $0.14 — the following significant liquidity pocket.

Analysts warn that solely a sustained reclaim of $0.1860 accompanied by above-average quantity would negate the present bearish setup. Till then, merchants are treating short-term rallies as exit alternatives moderately than pattern reversals.

Whale exercise stays the important thing watchpoint: any sharp decline in large-transaction counts would sign the top of the distribution section and the beginning of potential accumulation close to cost-basis assist.