- Evernorth Holdings accomplished its merger with Armada Acquisition Corp II, debuting on Nasdaq below ticker XRPN and elevating over $1 billion for institutional XRP purchases.

- The corporate now holds 388 million XRP price greater than $1 billion, signaling rising company adoption and balance-sheet integration of XRP.

- Institutional exercise continues to increase, with CME launching XRP choices and a number of XRP ETF filingsadvancing, reinforcing XRP’s bridge position between conventional finance and blockchain.

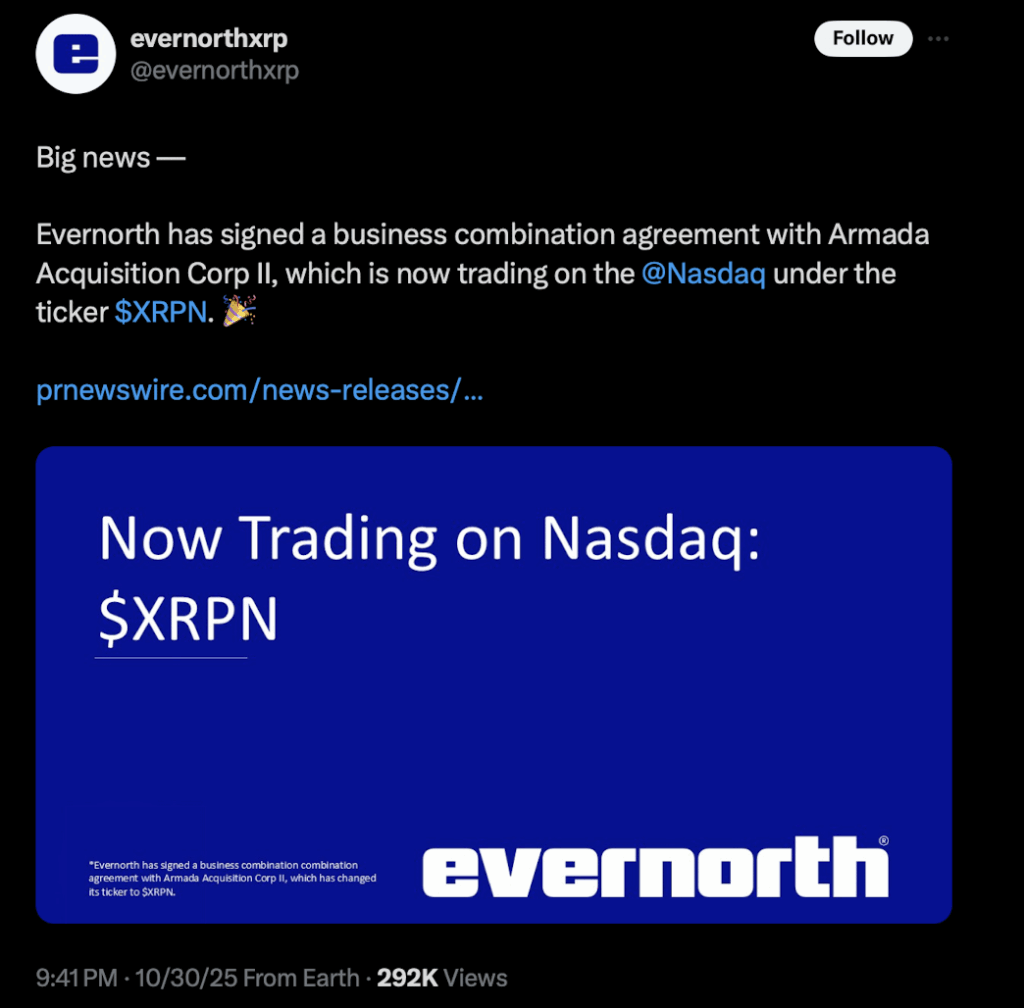

Evernorth Holdings simply pulled off one of many greatest institutional strikes in XRP’s historical past. The corporate finalized its merger with Armada Acquisition Corp II, formally rebranding and itemizing on Nasdaq below the brand new ticker XRPN. Armada’s previous ticker, AACI, is now retired — and associated securities have shifted too, with XRPNU and XRPNW designating the items and warrants.

The transition took impact on October 30, 2025, cementing Evernorth’s position as a key institutional power within the XRP ecosystem. Backed by Arrington XRP Capital, the agency has constructed itself round one core thought: institutional-grade XRP treasury administration. By way of the merger, Evernorth raised greater than $1 billion in gross proceeds, most of which is able to go towards open-market XRP purchases.

Michael Arrington, founding father of Arrington Capital and chairman of Armada, known as the merger “a pure step” within the evolution of XRP-focused monetary infrastructure. “What we’re seeing is an institutional awakening round XRP,” Arrington stated, describing the mission as a part of a broader shift towards blockchain-based liquidity administration.

Institutional Demand for XRP Positive factors Momentum

Following the merger, Evernorth disclosed holdings of over 388 million XRP, valued north of $1 billion — a stash that places it shoulder-to-shoulder with different heavyweight XRP gamers like VivoPower Worldwide and Trident Digital Tech Holdings.

The pattern is evident: corporations are not treating digital property like speculative bets, however as operational instruments. Analysts say these new XRP treasury fashions are altering the sport, letting corporations strengthen stability sheets whereas sustaining liquid, programmable property.

In the meantime, main funding corporations like Grayscale, Bitwise, Franklin Templeton, and 21Shares are updating filings for his or her XRP ETFs. Bitwise CIO Matt Hougan believes the approval of such merchandise may unlock billions in inflows, because of XRP’s loyal retail base and rising company participation.

XRP Futures and ETF Exercise Speed up

The CME Group has expanded its XRP providing with new choices buying and selling on XRP futures, assembly rising institutional urge for food. For the reason that first XRP futures launched final yr, CME has seen greater than 567,000 contracts traded, representing roughly $27 billion in worth.

On the identical time, XRP-linked ETFs are constructing traction. The REX-Osprey XRP ETF has now crossed the $100 million assets-under-management mark, additional signaling that establishments are viewing XRP as greater than only a speculative altcoin.

Collectively, these developments — Evernorth’s Nasdaq debut, CME’s rising futures exercise, and ETF momentum — paint an image of XRP evolving right into a respectable bridge between conventional finance and the blockchain economic system. The narrative is shifting quick, and it seems to be like establishments are lastly leaning in.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.