- Dogecoin, Shiba Inu, and Pepe all present declining open curiosity and whale exercise, signaling weak demand.

- DOGE dangers breaking key help at $0.178, SHIB hovers under $0.00001000, and PEPE’s nearing a bearish breakdown.

- Momentum and quantity stay weak, with no sturdy indicators of a rebound but.

The meme coin craze appears to be hitting a wall once more. Dogecoin, Shiba Inu, and Pepe — the holy trinity of speculative tokens — are all flashing pink, and the indicators aren’t trying nice. On-chain knowledge and futures market numbers each present that huge wallets and retail merchants are backing off, including much more stress to the availability facet.

Retail Curiosity Fades Quick

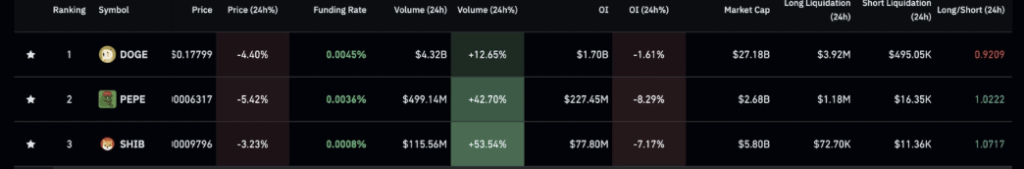

Retail hype round meme cash all the time burns vivid — after which fades simply as shortly. This time, it seems just like the spark’s gone. In accordance with CoinGlass, open curiosity in futures dropped by 2% for DOGE, 7% for SHIB, and 8% for PEPE during the last 24 hours. That places their notional values at $1.7 billion, $77.8 million, and $227.45 million, respectively. The message is straightforward: merchants are decreasing leverage and shutting positions, making an attempt to not get caught in additional draw back volatility.

On the identical time, whale exercise has cooled off too. Santiment knowledge exhibits Dogecoin wallets holding over 100 million tokens haven’t moved a lot since November 1. For SHIB and PEPE, it’s even worse — those self same huge wallets are chopping positions. That sort of regular discount in whale holdings normally factors to rising promote stress.

Dogecoin Checks Key Help

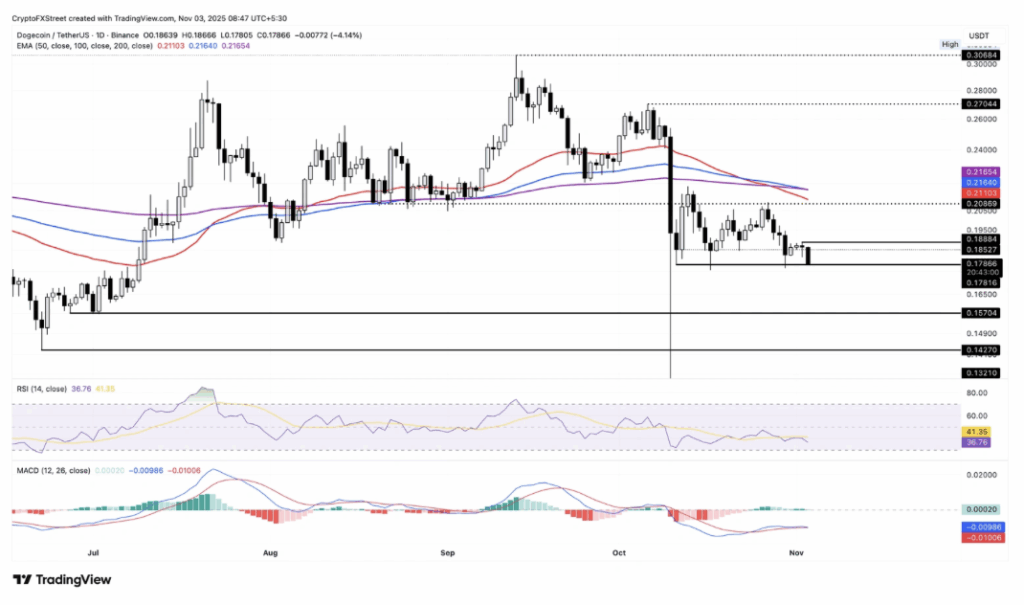

Dogecoin’s down about 4% and buying and selling just below $0.18. The coin’s making an attempt to hold on to its final huge help close to $0.178, which dates again to October 11. If it breaks under that, the subsequent cease might be $0.157, the June 27 low.

The shifting averages don’t look good both — the 50-day EMA just lately crossed under the 200-day, forming a bearish “dying cross,” and now the 100-day seems able to observe. The MACD’s flattening close to its sign line, exhibiting weakening shopping for momentum, whereas the RSI sits round 36, creeping towards the oversold zone.

If DOGE bounces right here, the primary resistance lies close to $0.188, nevertheless it’ll want severe quantity to flip sentiment.

Shiba Inu Slips Beneath Key Ranges

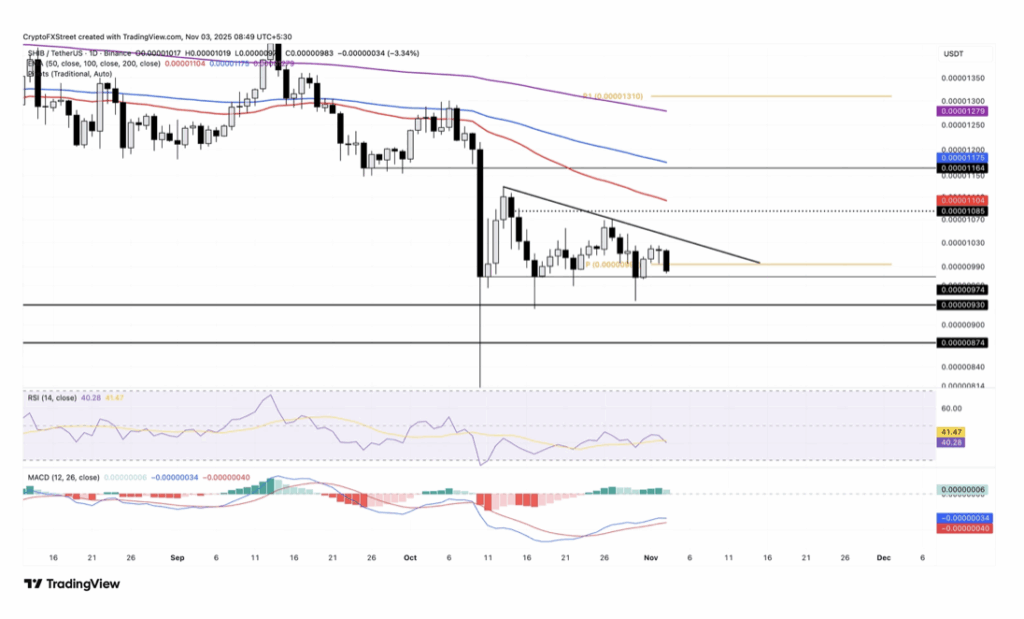

Shiba Inu is slipping under the $0.00001000 mark, and that’s by no means signal. It’s already down 3% this week, and if it loses help at $0.00000974, the subsequent doubtless ranges are $0.00000930 and $0.00000874 — lows from February and January.

The MACD’s inexperienced bars are fading, signaling slowing momentum, and the RSI at 40 suggests sellers are creeping again in. If SHIB someway manages to rebound, the resistance sits at $0.00001000 and $0.00001045, however that’ll be a tricky wall to interrupt.

Pepe Faces One other Breakdown

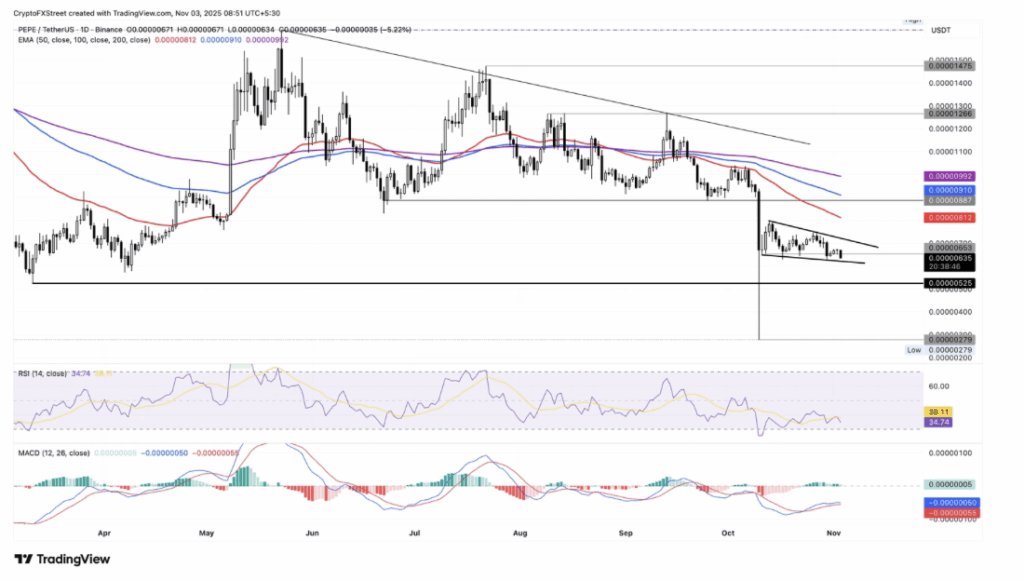

Pepe’s following the identical path. Down about 5% and hovering close to $0.00000620, the meme coin’s testing its native help line drawn from the October 11 and 30 lows. A drop under that would drag all of it the best way to $0.00000525 and even $0.00000279.

The EMAs are all sloping down — 50, 100, 200 — confirming that the broader development’s bearish. The MACD’s about to cross into destructive territory, and the RSI is already deep in oversold ranges at 34. If PEPE will get a rebound, it would take a look at resistance round $0.00000720, however the odds aren’t nice proper now.

The Backside Line

Meme cash are cooling off throughout the board, and each whales and retail merchants are stepping away. The speculative vitality that fueled huge rallies earlier within the 12 months appears to be drying up. Until liquidity or new hype enters the market quickly, the development suggests extra sideways chop — or worse, one other leg down.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.