The bitcoin worth is at a really attention-grabbing level in its present market cycle. With a number of totally different opinions and never a lot motion in worth, it’s onerous to know what’s coming subsequent. However once we have a look at the essential knowledge, issues get lots clearer. These alerts don’t simply inform us what would possibly occur within the fast future, however can make clear what the approaching weeks and months might convey.

The Quick-Time period Holder Realized Value and Bitcoin Value Assist

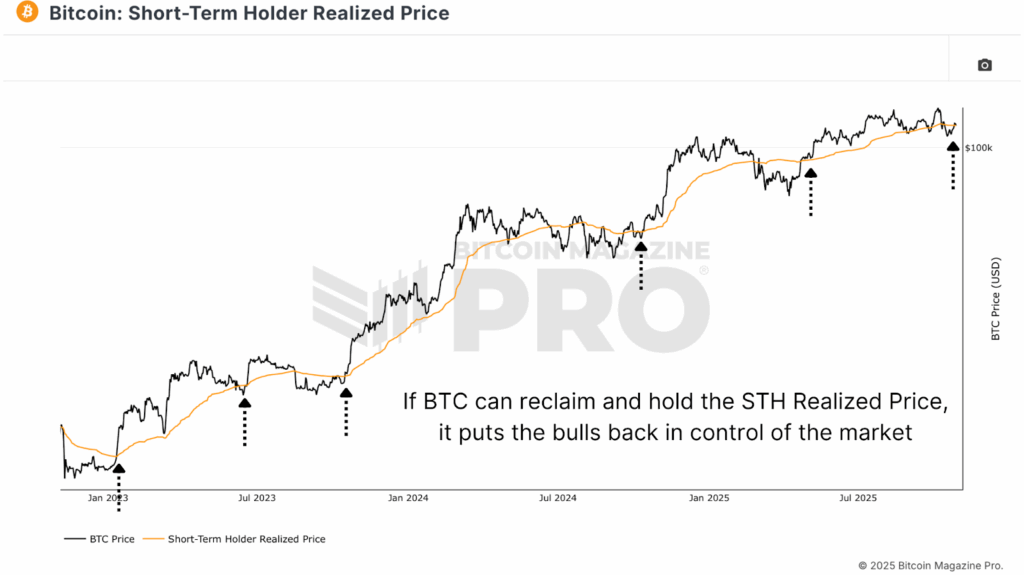

We start with the Quick-Time period Holder Realized Value, successfully the typical value foundation for brand spanking new market contributors. This degree has traditionally acted as a dynamic zone of help and resistance all through every cycle. At current, the STH realized worth sits round $113,000, near the place Bitcoin is presently buying and selling. Regardless of the sharp liquidation occasion earlier this month, the market has rebounded and stabilized round this degree.

When Bitcoin holds above the short-term holder realized worth, it alerts that the typical latest purchaser is both at breakeven or in slight revenue. This typically will increase investor confidence and encourages extra capital rotation into the market. In previous cycles, resembling in 2017, each retest of this line offered a super accumulation alternative earlier than the subsequent leg greater. Sustaining help above this might as soon as once more mark the muse for the subsequent part of the bull cycle.

Understanding The MVRV Ratio and Bitcoin Value Valuation

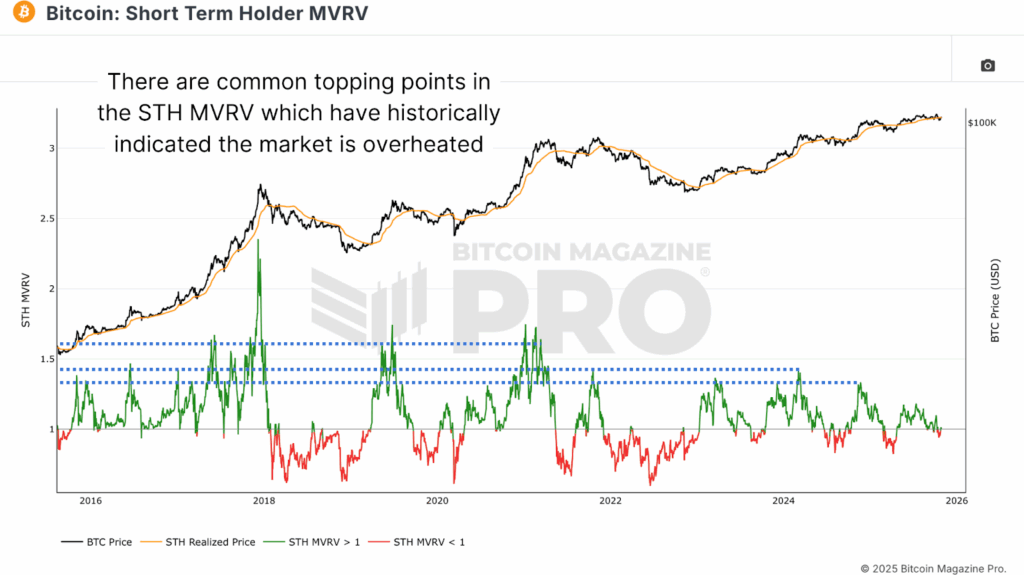

Past the realized worth itself, we flip to the Quick-Time period Holder Market Worth to Realized Worth (MVRV) Ratio, which measures the connection between Bitcoin’s present market worth and its mixture realized worth. This ratio helps establish over- or undervalued situations.

Throughout prior cycles, clear patterns emerge, with Bitcoin constantly discovering help across the 0.66 degree throughout massive down strikes, prime zones for accumulation. On the upside, notable resistance has traditionally appeared round 1.33, 1.43, and 1.64, equivalent to profit-taking factors the place new contributors attain 33%, 43%, or 64% unrealized positive factors, respectively.

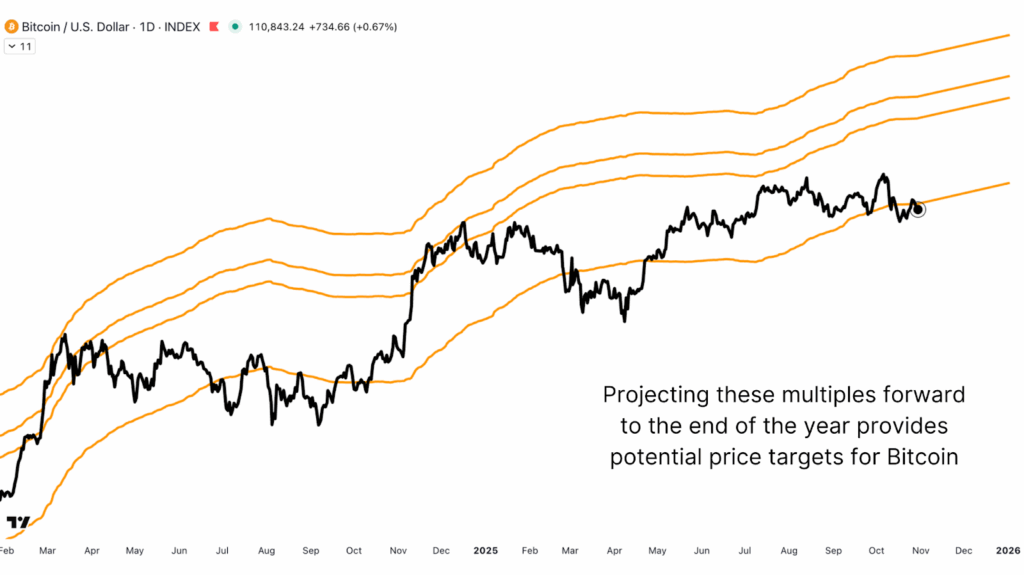

Utilizing these multiples, we will estimate future targets. By multiplying the present STH Realized Value at ~$113,000 by these MVRV thresholds, we will undertaking potential resistance zones for this cycle. The 1.33 zone generates a projected worth of roughly $160,000 for the top of the 12 months. The halfway 1.43 zone equates to a projection of ~$170,000, and the higher zone of 1.64 extrapolates to round $200,00. These ranges align remarkably properly with historic resistance zones, suggesting the $160k–$200k vary might act as a serious worth ceiling if Bitcoin continues to carry above its realized base.

Lengthy-Time period Holder MVRV and Bitcoin Value Peaks

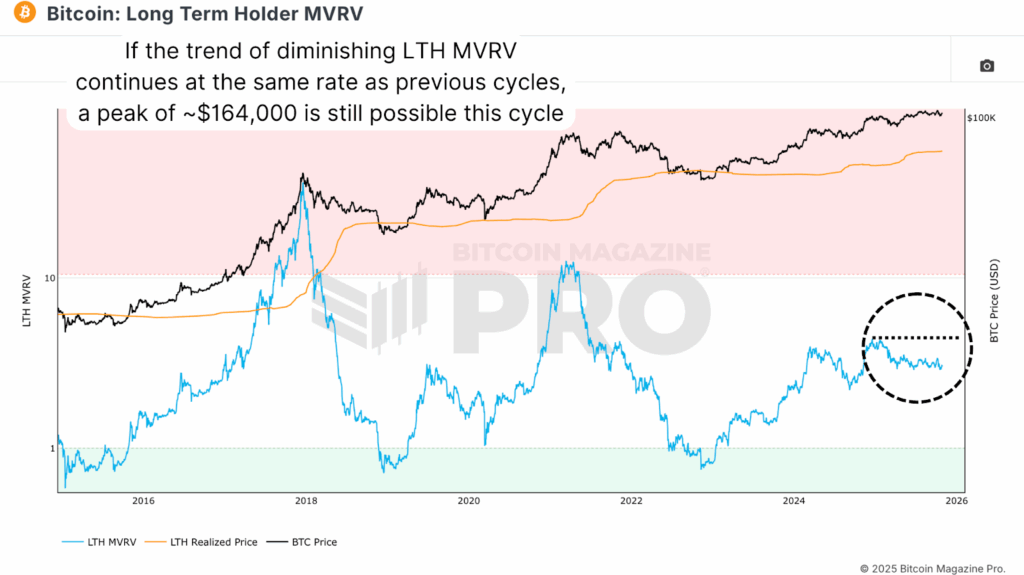

Subsequent, we flip to the Lengthy-Time period Holder MVRV Ratio, which measures unrealized revenue and loss among the many market’s most skilled traders. This cohort’s habits supplies key insights into macrocycle dynamics. Within the 2017 bull run, LTH MVRV peaked at 36.2. Within the 2021 cycle, it peaked at 12.58, roughly a 2.9x discount, demonstrating the diminishing return construction that has outlined Bitcoin’s maturation.

Making use of that very same diminishing issue (÷2.88) suggests a possible peak round 4.37 for this present cycle. Provided that the Lengthy-Time period Holder Realized Value sits close to $37,400, a 4.37x a number of implies a possible goal of roughly $163,000–$165,000, overlapping with the higher targets derived from short-term holder knowledge and ranges we’ve already reached this cycle in LTH MVRV phrases.

The Rolling MVRV Framework and Bitcoin Value Dynamics

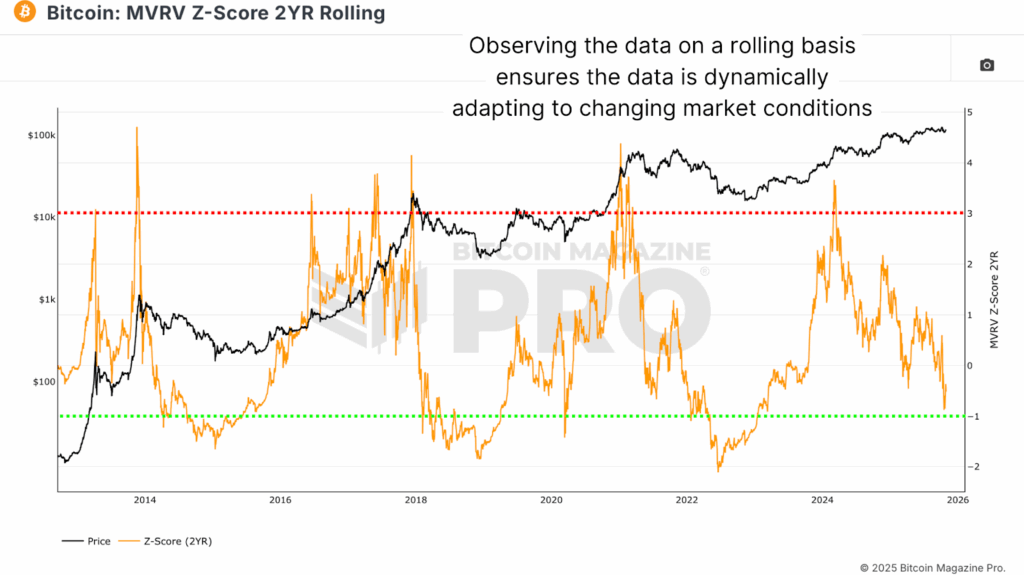

Because the Bitcoin market evolves, conventional MVRV metrics should additionally adapt. One of the efficient approaches is to view these ratios on a rolling foundation, which accounts for dynamic modifications in market situations.

When modeled on a 2-12 months Rolling foundation, the MVRV Z-Rating eliminates a number of the “diminishing peaks” seen in static fashions. Peaks round 3.0 and troughs close to –1.0 have constantly aligned with market tops and bottoms. Intriguingly, present readings are nearer to the purchase zone than the promote zone, implying that Bitcoin remains to be in an accumulation-friendly vary.

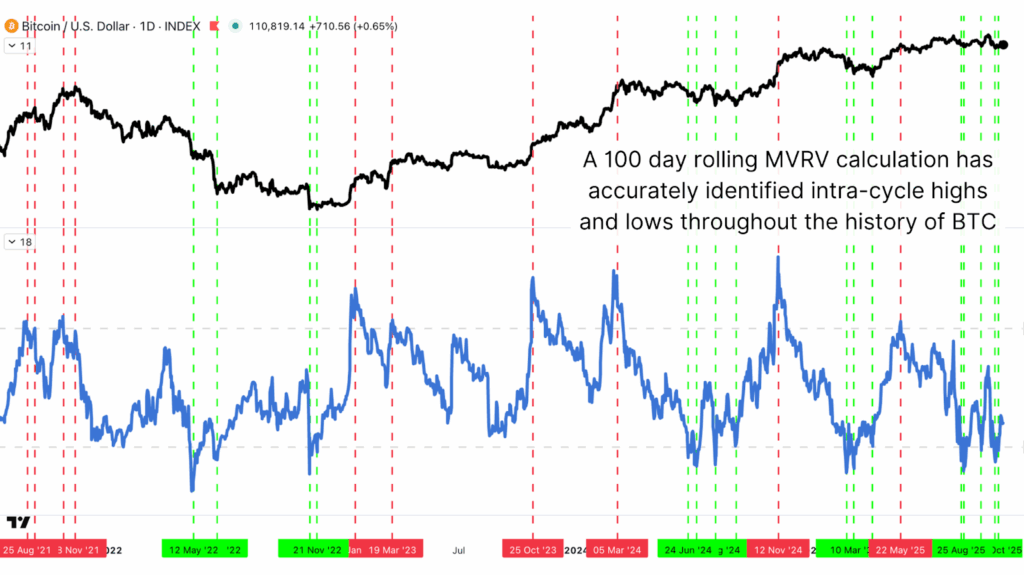

To realize extra granularity, we will additionally assess the MVRV ratio on a 100-day rolling foundation, which captures intra-cycle fluctuations. On this mannequin, spikes above +2 correlate with native tops, whereas dips beneath –2 align with native bottoms and optimum DCA zones. Throughout Bitcoin’s whole historical past, this rolling 100-day MVRV framework has recognized a number of the most correct short-term accumulation and distribution factors, even inside broader cycle tendencies.

Conclusion

At the same time as Bitcoin’s market matures and institutional involvement deepens, these core on-chain valuation frameworks stay among the many strongest instruments for cycle evaluation. The realized worth fashions, notably these tied to particular cohorts, present perception into market conviction, exhibiting when contributors are in revenue and when behavioral shifts are more likely to set off the subsequent transfer. Extra importantly, adapting conventional metrics to rolling frameworks ensures our fashions evolve alongside Bitcoin itself, capturing new investor habits, liquidity cycles, and the rising institutional affect that defines this market’s future.

If Bitcoin can proceed holding above the STH realized worth, the info suggests there’s ample room to the upside, with believable cycle targets within the $160,000–$200,000 area.

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here: Bitcoin: This On-Chain Information Tells Us The place Value Goes Subsequent

For deeper knowledge, charts, {and professional} insights into bitcoin worth tendencies, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.